10-K: Annual report pursuant to Section 13 and 15(d)

Published on March 9, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

Or

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 033-80623

OncoGenex Pharmaceuticals, Inc.

(Exact name of the registrant as specified in its charter)

|

Delaware |

|

95-4343413 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

19820 North Creek Parkway, Bothell, Washington 98011

(Address of principal executive offices, including zip code)

(425) 686-1500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Exchange on Which Registered |

|

Common Stock, par value $0.001 per share |

|

The NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

¨ |

|

Smaller reporting company |

|

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.). Yes ¨ No x

As of June 30, 2015, the aggregate market value of the registrant’s Common Stock held by non-affiliates of the registrant was $48,992,133. As of March 9, 2016, 29,812,998 shares of the registrant’s Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement to be filed with the Securities and Exchange Commission not later than April 30, 2016, in connection with the solicitation of proxies for its 2016 Annual Meeting of Stockholders, are incorporated by reference into Items 10, 11, 12, 13 and 14 of Part III hereof.

OncoGenex Pharmaceuticals, Inc.

Table of Contents

|

|

|

|

|

|

|

ITEM 1. |

|

|

3 |

|

|

ITEM 1A. |

|

|

25 |

|

|

ITEM 1B. |

|

|

41 |

|

|

ITEM 2. |

|

|

41 |

|

|

ITEM 3. |

|

|

42 |

|

|

ITEM 4. |

|

|

42 |

|

|

|

|

|

||

|

|

|

|

|

|

|

ITEM 5. |

|

|

43 |

|

|

ITEM 6. |

|

|

44 |

|

|

ITEM 7. |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

45 |

|

ITEM 7A. |

|

|

59 |

|

|

ITEM 8. |

|

|

61 |

|

|

ITEM 9. |

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

|

90 |

|

ITEM 9A. |

|

|

90 |

|

|

ITEM 9B. |

|

|

90 |

|

|

|

|

|

||

|

|

|

|

|

|

|

ITEM 10. |

|

|

91 |

|

|

ITEM 11. |

|

|

91 |

|

|

ITEM 12. |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

|

91 |

|

ITEM 13. |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

|

91 |

|

ITEM 14. |

|

|

91 |

|

|

|

|

|

||

|

|

|

|

|

|

|

ITEM 15. |

|

|

92 |

|

2

References in this Form 10-K to “OncoGenex Pharmaceuticals,” “OncoGenex,” the “Company,” “we,” “us” or “our” refer to OncoGenex Pharmaceuticals, Inc. and its wholly owned subsidiaries. The information in this Annual Report on Form 10-K contains certain forward-looking statements, including statements related to clinical trials, regulatory approvals, markets for our products, new product development, capital requirements and trends in our business that involve risks and uncertainties. Our actual results may differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include those discussed in “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as those discussed elsewhere in this Annual Report on Form 10-K.

OVERVIEW OF OUR BUSINESS

We are an emerging leader in next generation cancer therapeutics. Our mission is to accelerate transformative therapies to improve the lives of people living with cancer and other serious diseases. We have developed a pipeline of late-stage product candidates that are designed to block the production of specific proteins that promote treatment resistance in cancer. We believe our therapies have the potential to redefine treatment outcomes in a variety of cancers. We have three product candidates in our pipeline: custirsen, apatorsen and OGX-225, each of which has a distinct mechanism of action and represents a unique opportunity for cancer drug development. Of the product candidates in our pipeline, custirsen and apatorsen are clinical-stage assets being evaluated in two phase 3 studies and four phase 2 studies, respectively.

Product Candidates Overview and Recent Developments

Our product candidates—custirsen, apatorsen and OGX-225—focus on mechanisms of treatment resistance in cancer patients and are designed to block the production of specific proteins that we believe promote treatment resistance and survival of tumor cells and are over-produced in response to a variety of cancer treatments. Our aim in targeting these particular proteins is to disable the tumor cell’s adaptive defenses, thereby rendering the tumor cells more susceptible to attack with a variety of cancer therapies. We believe this approach will increase survival time and improve the quality of life for cancer patients.

Custirsen

Custirsen is currently being evaluated in two phase 3 trials; one in patients with prostate cancer and one in patients with non-small cell lung cancer, or NSCLC. Custirsen is designed to inhibit the production of clusterin, a protein we believe promotes survival of cancer cells when overexpressed in a variety of tumors. We and collaborating investigators have conducted one phase 3 clinical trial and five phase 2 clinical trials to evaluate the ability of custirsen to enhance the effects of therapy in prostate, non-small cell lung and breast cancers. Results have been presented for each of these trials. Refer to the discussion below under the headings “Our Product Candidates—Custirsen—Current Custirsen Development Activities” and “Our Product Candidates—Custirsen—Summary of Results of Custirsen Clinical Trials” for further details.

3

Ongoing Phase 3 Custirsen Trials:

|

Trial |

|

Cancer Indication |

|

Treatment Combination(1) |

|

Status |

|

|

|

|

|

|

|

|

|

|

|

Metastatic castrate resistant prostate cancer – survival endpoint |

|

Cabazitaxel with and |

|

· Final intent to treat analysis expected in the third quarter of 2016 (2) · Passed final interim futility analysis in December 2015 · Prospectively defined subpopulation did not meet criteria, as reported in December 2015

|

|

|

|

|

|

|

|

|

|

|

|

Advanced non-small cell lung cancer – survival endpoint |

|

Docetaxel with and without |

|

· Final survival analysis expected in the first half of 2017 (2) · Passed final interim futility analysis in July 2015 · Passed first interim futility analysis in August 2014 · Patient enrollment ongoing

|

|

(1) |

In all of our prostate cancer clinical trials and in clinical practice for prostate cancer, docetaxel and cabazitaxel are administered in combination with prednisone. |

|

(2) |

Depending on timing of enrollment and/or event-driven final analyses. |

Apatorsen

Apatorsen is our product candidate designed to inhibit production of heat shock protein 27, or Hsp27, a cell-survival protein expressed in many types of cancers including bladder, non-small cell lung, pancreatic, prostate and breast cancers. Hsp27 expression is stress-induced, including by many anti-cancer therapies. Overexpression of Hsp27 is thought to be an important factor leading to the development of treatment resistance and is associated with metastasis and negative clinical outcomes in patients with various tumor types.

Hsp27 can also function as an immunomodulatory protein by a number of mechanisms that include altering important membrane expressed proteins on monocytes and immature dendritic cells; this alteration results in tumor-associated immune cells that are not functional in identifying and killing cancer cells. The induction of anti-inflammatory cytokines by Hsp27 may also play a role in down-regulating lymphocyte activation leading to additional unresponsive immune cells.

We and collaborating investigators have conducted, or are in the process of conducting, two phase 1 and seven randomized phase 2 clinical trials that have been designed to evaluate the ability of apatorsen to enhance various treatments in patients with bladder, lung, pancreatic and prostate cancers. Final results have been presented for the first completed phase 1 trial evaluating various cancers. Final results have been presented for two trials (phase 1 and phase 2) in bladder cancer and initial results for one phase 2 trial in prostate cancer and one phase 2 trial in pancreatic cancer. Refer to the discussion below under the headings “Our Product Candidates—Apatorsen—Current Apatorsen Development Activities” and “Our Product Candidates—Apatorsen—Summary of Results of Apatorsen Clinical Trials” for further details.

In 2013, we initiated the ORCA (Ongoing Studies Evaluating Treatment Resistance in CAncer) program, which encompasses clinical studies designed to evaluate whether inhibition of Hsp27 can lead to improved prognosis and treatment outcomes for cancer patients. Our goal is to advance cancer treatment by conducting clinical trials for apatorsen across multiple cancer indications including bladder, lung, pancreatic and prostate cancers. We are conducting parallel clinical trials to evaluate apatorsen in several cancer indications and treatment combinations to accelerate the development of apatorsen. As part of this strategy, we are supporting specific investigator-sponsored trials to allow assessment of a broader range of clinical indications for future OncoGenex-sponsored trials and possible market approval. The ORCA trials, with exception of the Pacific™ trial, are designed to provide information that will be useful for designing future phase 3 trials and may be used as supportive studies for registration, if applicable. Due to small sample sizes, data from these trials are not likely to result in statistically significant differences in either progression free survival, or PFS, or survival.

4

Ongoing Apatorsen Trials - The ORCA Program:

|

Trial |

|

Cancer Indication |

|

Treatment Combination |

|

Status |

|

|

|

|

|

|

|

|

|

|

|

Metastatic bladder cancer |

|

Docetaxel with and without |

|

· Final results expected in the second half of 2016 · Patient enrollment completed in September 2015 |

|

|

|

|

|

|

|

|

|

|

|

Advanced non-squamous NSCLC |

|

Carboplatin and pemetrexed |

|

· Survival data expected in the second half of 2016 · Top-line results on PFS reported in January 2016

|

|

|

|

|

|

|

|

|

|

|

|

Advanced squamous NSCLC |

|

Gemcitabine and |

|

· Patient enrollment ongoing

|

|

|

|

|

|

|

|

|

|

|

|

Castrate resistant prostate cancer |

|

Zytiga (abiraterone acetate) |

|

· Patient enrollment completed in March 2016.

|

In addition to the Borealis-1 and Borealis-2 clinical trials in metastatic bladder cancer in the ORCA program, we are evaluating apatorsen for the potential treatment of non-muscle invasive bladder cancer, or NMIBC. We have completed a pre-Investigational New Drug meeting with FDA in preparation for a separate Investigational New Drug, or IND, application to evaluate apatorsen for intravesical administration in combination with Bacillus Calmette-Guerin, or BCG, treatment in patients with NMIBC. FDA had no objection to the study population or classification of subpopulations in the proposed study design and deemed the proposed definitions of primary and secondary endpoints acceptable. Refer to the discussion below under the headings “Our Product Candidates—Apatorsen—Current Apatorsen Development Activities” and “Our Product Candidates—Apatorsen—Summary of Planned Apatorsen Clinical Trials” for further details.

OGX-225

OGX-225 is our product candidate designed to inhibit the production of Insulin Growth Factor Binding Proteins -2 and -5, or IGFBP-2 and IGFBP-5, two proteins that when overexpressed affect the growth of cancer cells. Increased IGFBP-2 and IGFBP-5 production are observed in many human cancers, including prostate, breast, colorectal, non-small cell lung, glioblastoma, acute myeloid leukemia, acute lymphoblastic leukemia, neuroblastoma, and melanoma. The increased production of these proteins is linked to faster rates of cancer progression, treatment resistance, and shorter survival duration in humans.

Preclinical studies with human prostate and breast cancer cells have shown that reducing IGFBP-2 and IGFBP-5 production with OGX-225 sensitized these tumor types to hormone ablation therapy or chemotherapy and induced tumor cell death. We have completed IND enabling toxicology studies for OGX-225.

Financial Overview

In 2015, we recognized $18.2 million in collaboration revenue attributable to a collaboration agreement with Teva. We have devoted substantially all of our resources to the development of our product candidates.

We incurred a loss for the year ended December 31, 2015 of $16.8 million and had an accumulated deficit at December 31, 2015 of $176.8 million and $58.2 million of total assets. We expect to continue to incur additional losses in the future as we continue our research and development activities.

To date, we have funded our operations primarily through private and public placements of equity securities as well as upfront payments and custirsen expense reimbursements received from the collaboration agreement with Teva Pharmaceutical Industries Ltd., or Teva, which was terminated in April 2015. Pursuant to the Termination Agreement, Teva paid to us, as advanced reimbursement

5

for certain continuing research and development activities related to custirsen, an amount equal to $27.0 million less approximately $3.8 million, which reduction represented a hold-back amount of $3.0 million and $0.8 million for certain third-party expenses incurred by Teva between January 1, 2015 and April 24, 2015. We are responsible for all custirsen-related expenses incurred from and after January 1, 2015.

Based on our current expectations, we believe that our cash, cash equivalents, and short-term investments will be sufficient to fund our currently planned operations into the third quarter of 2017. Depending on timing of enrollment or event-driven final analyses, the expected key milestones and activities are as follows:

|

|

• |

|

Custirsen |

|

|

• |

|

Announcing AFFINITY trial results, the phase 3 trial evaluating a survival benefit for custirsen in combination with cabazitaxel as second-line chemotherapy in approximately 630 patients with castrate-resistant prostate cancer. The final analysis for the intent-to-treat population is expected in the third quarter of 2016. |

|

|

• |

|

Announcing ENSPIRIT trial results, the phase 3 trial evaluating a survival benefit for custirsen in combination with docetaxel as second-line chemotherapy in approximately 700 patients with non-small cell lung cancer. The final survival analysis is expected in the first half of 2017. |

|

|

• |

|

Apatorsen |

|

|

• |

|

Announcing Borealis-2 trial results, an investigator-sponsored, randomized phase 2 trial evaluating apatorsen in combination with docetaxel treatment compared to docetaxel treatment alone in patients with advanced or metastatic bladder cancer. Final results are expected in the second half of 2016. |

|

|

• |

|

Announcing Spruce trial results for the overall survival endpoint, the investigator-sponsored, randomized, placebo-controlled phase 2 trial evaluating apatorsen treatment with carboplatin and pemetrexed chemotherapy in patients with previously untreated advanced non-squamous NSCLC. Results are expected in the second half of 2016. |

|

|

• |

|

Preparing an investigational new drug application for FDA submission regarding apatorsen via intravesical administration in combination with Bacillus Calmette-Guerin (BCG) treatment in patients with non-muscle invasive bladder cancer. |

OUR PRODUCT CANDIDATES

We have two clinical-stage product candidates, custirsen in phase 3 and apatorsen in phase 2, and one preclinical-stage product candidate, OGX-225.

Custirsen

Overview of Custirsen

Through our clinical trials, we are treating cancer patients with custirsen with the goal of reducing clusterin production. Clusterin is a protein that is over-produced in several types of cancer and in response to many cancer treatments, including hormone ablation therapy, chemotherapy and radiation therapy. Preclinical and other data suggest that clusterin promotes tumor cell survival. Increased clusterin production has been linked to faster rates of cancer progression, treatment resistance and shorter survival duration. Since increased clusterin production is observed in many human cancers, including prostate, non-small cell lung, breast, ovarian, bladder, renal, pancreatic, colon, anaplastic large cell lymphoma and melanoma, we believe that custirsen may have broad market potential to treat many cancer indications and disease stages.

A broad range of preclinical studies have shown that reducing clusterin production with custirsen: (i) facilitates tumor cell death by sensitizing human prostate, non-small cell lung, breast, ovarian, bladder, renal and melanoma tumor cells to various chemotherapies; and (ii) sensitizes prostate tumor cells to hormone ablation therapy and sensitizes prostate and non-small cell lung tumor cells to radiation therapy. Preclinical studies also indicate that reducing clusterin production with custirsen re-sensitizes docetaxel-resistant prostate tumor cells to docetaxel.

Our phase 1 clinical trials evaluated the safety of custirsen and established a recommended dose of custirsen in combination with docetaxel (assessed two different docetaxel schedules), a gemcitabine and a platinum chemotherapy regimen and hormone ablation therapy. Docetaxel, mitoxantrone, cabazitaxel, gemcitabine and platinums (cisplatin and carboplatin) are all examples of chemotherapy agents. Clinical data from our phase 1 trial in prostate cancer patients demonstrated that weekly intravenous administration of custirsen resulted in drug distribution to prostate cancer tissue and over 92% inhibition of its target, clusterin mRNA, in prostate tumor cells in these patients at the 640mg dose, which was the highest dose evaluated in this clinical trial. This dose was determined by the clinical investigators to be well tolerated and therefore was established as the recommended dose.

6

We have conducted five phase 2 clinical trials and one phase 3 trial to evaluate the ability of custirsen to enhance the effects of therapy in patients with prostate, non-small cell lung and breast cancer. Data from each of the trials demonstrates that adding custirsen to therapy shows potential benefits, including:

|

|

· |

longer survival duration for patients with worse poor prognostic factors when custirsen was added to first-line docetaxel compared to first-line docetaxel alone in patients with metastatic CRPC (randomized phase 3 trial); |

|

|

· |

longer survival duration when custirsen was added to first-line docetaxel compared to first-line docetaxel alone in patients with CRPC (randomized phase 2 trial); |

|

|

· |

longer survival duration when custirsen was added to either mitoxantrone or docetaxel as second-line chemotherapy compared to survival duration observed in two prior published trials of CRPC patients receiving second-line chemotherapy and comparable survival compared to results observed with cabazitaxel; |

|

|

· |

decreased on-treatment serum clusterin levels compared to baseline levels of the patient population; analysis of study data found that lower serum clusterin levels during treatment were predictive of survival; |

|

|

· |

increased frequency of pain palliation when compared to results with either mitoxantrone or cabazitaxel second-line chemotherapy in the phase 3 TROPIC trial, and increased frequency and duration of pain palliation when custirsen was added to either mitoxantrone or docetaxel as second-line chemotherapy when compared to the frequency and duration of pain palliation observed in the TAX 327 Study for first-line chemotherapy alone in patients with CRPC; and |

|

|

· |

longer survival duration when custirsen was added to gemcitabine and a platinum-containing chemotherapy compared to the survival duration reported in prior published results from randomized clinical trials in NSCLC patients receiving gemcitabine and a platinum-containing chemotherapy. |

Refer to the discussion below under the heading “Summary of Results of Custirsen Clinical Trials” for further details including safety summary.

The U.S. Adopted Name for the custirsen drug product is custirsen sodium, which is the generic name.

Current Custirsen Development Activities

The following clinical trials are currently ongoing:

|

|

· |

The AFFINITY Trial: The phase 3 clinical trial to evaluate a survival benefit for custirsen in combination with cabazitaxel treatment as second-line chemotherapy in patients with CRPC. AFFINITY was initiated in August 2012 and completed enrollment of approximately 630 patients in September 2014. In January 2015, an interim futility analysis was completed and per recommendation of an Independent Data Monitoring Committee, or IDMC, the trial continued as planned. |

Exploratory analyses from the phase 3 SYNERGY trial showed a significant survival benefit in men who received custirsen and who were at increased risk for poor outcomes. Men with an increased risk for poor outcomes are identified as having two or more of five common features: poor performance status, elevated prostate specific antigen, or PSA, elevated lactate dehydrogenase, or LDH, decreased hemoglobin, and the presence of liver metastasis.

Based on these findings, we sought advice from regulatory authorities to amend the AFFINITY trial to include these learnings and to adjust the statistical analysis plan accordingly. Both the FDA and European Medicines Agency, or EMA, were supportive of the proposed amendment to the AFFINITY protocol and statistical analysis plan. The following protocol amendment was submitted in all participating countries where the trial is being conducted:

|

|

o |

The inclusion of a co-primary survival objective for evaluating survival benefit in a subpopulation of men who were at increased risk for poor outcomes as well as for all men enrolled into the study, known as the intent-to-treat (ITT) population. |

|

|

o |

A revised statistical analysis plan including the hypothesized hazard ratio, or HR, for the subpopulation who were at an increased risk for poor outcomes specified to be 0.69 with the critical HR ≤ 0.778. The hypothesized HR for the ITT population, remains unchanged as 0.75 with the critical HR ≤ 0.820. |

|

|

o |

The revised statistical analysis plan included an interim analysis for the ITT population at the same time as the final analysis for the subpopulation. This interim analysis had both futility and early efficacy criteria defined for the ITT population. |

The co-primary survival analysis for the poor prognostic subpopulation and the interim analysis for the ITT population in the AFFINITY trial were completed in December 2015. The co-primary survival results for the subpopulation of men who had multiple poor prognostic risk factors revealed that the combination of custirsen and cabazitaxel did not meet the rigorous criteria required to demonstrate an improvement in overall survival (hypothesized hazard ratio < 0.69, one-sided

7

p value < 0.015). Based on the interim analysis for the ITT population, the IDMC recommended that the trial continue as planned. Both the IDMC and we remain blinded to all analyses and final results are expected in the third quarter of 2016, depending on timing of the event-driven final ITT analysis.

|

|

· |

The ENSPIRIT Trial: The phase 3 clinical trial to evaluate a survival benefit for custirsen in combination with docetaxel treatment as second-line chemotherapy in patients with NSCLC. This trial was initiated in September 2012. |

The first interim futility analysis was completed in August 2014. A protocol amendment was submitted and approved by all regulatory agencies in participating countries, to amend the statistical design and analysis plan of the ENSPIRIT trial including the following:

|

|

o |

A revised statistical analysis plan including the hypothesized HR, to be 0.75 with the critical HR of ≤ 0.84, reducing the required sample size from 1,100 to 700 patients. This change maintained 90% power while assessing for a more clinically relevant survival benefit when adding custirsen to second-line docetaxel. |

|

|

o |

A revision to the final interim futility analysis with more rigorous criteria in order to continue the trial due to lack of futility. This was successfully completed in July 2015, and the trial continued as planned. |

|

|

o |

The inclusion of an additional objective to analyze survival outcome based on NSCLC histology as part of the other non-primary analyses. |

We believe these amendments, specifically the revised statistical thresholds, are more appropriately aligned to the interests of both treating clinicians and their patients. Based on current ENSPIRIT enrollment projections and the changes outlined in the protocol amendment, we believe final survival results could be available in the first half of 2017, depending on completion of enrollment and timing of the event-driven final analysis.

Custirsen has received Fast Track designation from the U.S. Food and Drug Administration, or FDA, for second-line treatment of metastatic CRPC when combined with cabazitaxel and prednisone and for the second-line treatment of advanced NSCLC when combined with docetaxel in patients with disease progression following treatment with a first-line, platinum-based chemotherapy doublet regimen.

Summary of Results of Custirsen Clinical Trials

One phase 3 and five phase 2 clinical trials have been conducted to evaluate the ability of custirsen to enhance the effects of therapy in patients with prostate, non-small cell lung and breast cancer. The following is a summary of the completed clinical trials evaluating custirsen in combination with chemotherapy.

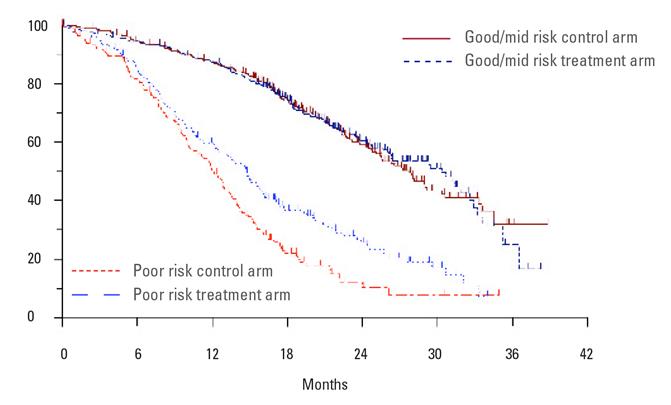

Summary of Final Results of the SYNERGY Phase 3 Clinical Trial in Patients with metastatic CRPC

The trial enrolled 1,022 men at 124 sites across the United States and Europe between 2010 and 2012. Patients were randomized to receive either 640 mg of custirsen per week by intravenous infusion in combination with docetaxel or docetaxel alone, which remains the standard of care for first-line chemotherapy treatment in patients with metastatic CRPC. Top-line results were reported in April 2014 indicating that the addition of custirsen to first-line docetaxel chemotherapy did not meet the primary endpoint of a statistically significant improvement in overall survival in men with metastatic CRPC, compared to docetaxel alone (median survival 23.4 months vs 22.2 months, respectively; hazard ratio 0.93 and one-sided p value 0.207). However, subsequent exploratory analyses showed improved overall survival for men who had the worst poor prognostic scores and received custirsen. Prognostic scoring for each patient allowed classification into good, mid and poor prognostic subgroups. The figure below shows the survival difference for docetaxel plus custirsen treatment compared to docetaxel alone for the poor prognostic subgroup. For the good and mid prognostic subgroups combined, there was no survival difference for docetaxel plus custirsen treatment compared to docetaxel alone (also shown in the figure below).

In summary, exploratory analyses indicated a survival benefit in patients who had the worst prognostic scores based on a number of poor prognosis factors when treated with custirsen in combination with docetaxel compared to docetaxel alone:

|

|

· |

the exploratory multivariate analysis indicated that the significant predictors of overall survival in this study were low performance status, presence of liver metastases, opioid usage for prostate cancer pain, anemia, high levels of PSA in the blood as well as high blood levels of LDH and alkaline phosphatase, also known to be common poor prognostic laboratory indicators, and |

|

|

· |

the unadjusted hazard ratio, a measure used to compare the death rates between groups, showed a 27% lower rate of death for patients who were at increased risk for poor outcomes and received custirsen. |

8

As part of our phase 1, 2 and 3 clinical trials, custirsen has been administered to more than 1,300 patients with multiple types of cancer. Some of the patients experienced a variety of adverse events, the majority of which are associated with other treatments in the protocol and with the disease. The majority of adverse events were mild and the most common adverse events associated with custirsen consisted of flu-like symptoms. The most common moderate and severe adverse events occurring in more than 3% of patients who received custirsen and docetaxel in the completed phase 3 SYNERGY trial were fatigue, fever and neutropenia, weakness, diarrhea, pulmonary embolism (a blood clot that blocks an artery in the lungs), and pneumonia. These events also occurred in patients who received docetaxel alone in the completed phase 3 SYNERGY trial.

Summary of Final Results of Phase 2 Clinical Trial in Patients with CRPC Receiving Custirsen and Docetaxel as First-Line Chemotherapy

Final results of a randomized phase 2 trial evaluating the benefit of combining custirsen with first-line docetaxel in patients with CRPC were published in the September 20, 2010 issue of the Journal of Clinical Oncology, or JCO.

The trial enrolled 82 patients at 12 sites in Canada and the United States from September 2005 to December 2006. Patients were randomized to one of two treatment arms to receive either 640 mg of custirsen per week by intravenous infusion in combination with docetaxel or docetaxel alone. Analyses indicated a survival benefit in patients treated with custirsen in combination with docetaxel compared to docetaxel alone:

|

|

· |

median overall survival among patients treated with custirsen plus docetaxel was 23.8 months compared to 16.9 months for patients treated with docetaxel alone, indicating a 6.9 month survival advantage in the custirsen arm; |

|

|

· |

the unadjusted hazard ratio, a measure used to compare the death rates between treatment groups, was 0.61, representing a 39% lower rate of death for patients receiving custirsen; and |

|

|

· |

a prospectively defined multivariate analysis indicated that the significant predictors of overall survival in this study were treatment arm, performance status and presence of metastases other than in bone or lymph nodes. In the multivariate analysis, patients treated with custirsen had a rate of death 51% lower than patients treated with docetaxel alone (HR=0.49; p=0.012). |

9

Study investigators concluded that custirsen treatment was well tolerated in combination with docetaxel. Patients receiving custirsen had an increased incidence of mild fever, chills and elevated creatinine levels (a laboratory measure for reduced kidney function) and a moderate to significant decrease in circulating lymphocytes in the blood (another laboratory measure) without any increase in infection rate compared to patients receiving docetaxel alone. Lymphocytes are a type of white blood cell involved in the body’s defense against infections. Based on final results of this randomized phase 2 trial, the phase 3 SYNERGY trial was designed to evaluate the overall survival benefit of custirsen in patients treated with first-line chemotherapy.

Summary of Results of Phase 2 Clinical Trial in Patients Receiving Custirsen and Docetaxel as Second-Line Chemotherapy

Data from a phase 2 clinical study of custirsen in combination with docetaxel retreatment or mitoxantrone as second-line chemotherapy in patients with metastatic CRPC were published in the September 1, 2011 issue of Clinical Cancer Research, or CCR. In this phase 2 trial, patients who were previously treated with a first-line, docetaxel-based chemotherapy regimen and progressed on or within six months of discontinuation of docetaxel treatment were randomized to receive custirsen plus either docetaxel retreatment or mitoxantrone. Initially, 42 patients were randomized, received at least one cycle of custirsen and chemotherapy and were included in the analysis: 20 patients received docetaxel retreatment plus custirsen and 22 patients received mitoxantrone plus custirsen. The protocol was amended to allow additional patients to be enrolled in the docetaxel retreatment arm and 25 additional patients were enrolled.

Data from the clinical trial are summarized as follows:

|

|

· |

The median overall survival duration for the custirsen plus mitoxantrone arm was 11.5 months (95% C.I.: 6.1-15.2 months). For the custirsen plus docetaxel retreatment arm, the median overall survival was 15.8 months (95% C.I.:9.9-23.3 months) for the 20 randomized patients and 12.8 months (95% C.I.:9.9-17.0 months) for the combined patient population (n=45) that included 25 additional patients with high serum clusterin levels at enrollment beyond the 20 randomized patients. |

|

|

· |

Analyses presented in the CCR manuscript demonstrated that treatment with custirsen in combination with chemotherapy significantly lowered serum clusterin levels as compared to baseline levels, and that average serum clusterin levels during treatment were predictive of survival, with low serum clusterin levels correlating to longer survival. |

|

|

· |

Pain responses were observed in 62% of evaluable patients, with 88% of these patients having a durable response of three months or more. |

Summary of Results of Phase 2 Clinical Trial in Patients with NSCLC Receiving Custirsen and Gemcitabine/Platinum as First-Line Chemotherapy

Data from a phase 2 clinical study of custirsen in patients with advanced NSCLC was published in the January 2012 issue of Journal of Thoracic Oncology, or JTO. This study evaluated custirsen in combination with gemcitabine and a platinum chemotherapy (cisplatin or carboplatin) as first-line chemotherapy in 81 patients with advanced NSCLC. Eighty-one percent of the patients had stage IV disease at enrollment, and 16% had squamous cell carcinoma.

Data from the clinical trial are summarized as follows:

|

|

· |

the median overall survival was 14.1 months; |

|

|

· |

54% of patients survived at least one year; |

|

|

· |

30% of patients survived at least two years; |

|

|

· |

disease control was achieved in 69% of patients; and |

|

|

· |

analyses showed that treatment with custirsen in combination with gemcitabine and a platinum chemotherapy significantly lowered serum clusterin levels as compared to baseline levels, and that average serum clusterin levels during treatment were predictive of survival, with low serum clusterin levels correlating to longer survival. |

Summary of Preliminary Results of Phase 2 Clinical Trial in Patients with Advanced Breast Cancer Receiving Custirsen and Docetaxel as First- or Second-Line Chemotherapy

In January 2009, results of a phase 2 clinical trial in 15 patients with advanced breast cancer were published in the scientific journal CCR; this study evaluated custirsen in combination with docetaxel as first-line or second-line chemotherapy. The authors concluded that the combination of custirsen and docetaxel at 75 mg/m2 was well tolerated, and some clinical activity was seen in the patients with metastatic breast cancer.

10

Summary of Preliminary Results of Phase 2 Clinical Trial in Patients with CRPC Receiving Custirsen and Hormone Ablation Therapy

This trial was an investigator-sponsored trial that evaluated weekly custirsen with androgen withdrawal therapy for a three-month duration in patients with high-risk, localized prostate carcinoma prior to radical prostatectomy. Results of the trial indicated that custirsen was detectable in prostate tissue for 14 days after the last administration, that clusterin expression was decreased in cells from lymph nodes as well as from prostate specimens, and that patients who received custirsen plus androgen withdrawal therapy had higher levels of apoptosis (cell death) compared with patients who never received androgen withdrawal therapy or who received only androgen withdrawal therapy.

Summary of Results of Phase 3 Clinical Trial in Patients with CRPC Receiving a Taxane and Custirsen/Placebo Following Prior Docetaxel; Discontinued due to enrollment

Results of a randomized phase 3 trial evaluating the pain palliation benefit of custirsen in combination with taxane chemotherapy (docetaxel retreatment or cabazitaxel) in patients with CRPC following prior docetaxel were presented at the ASCO GU Symposium in January 2014. In this double-blind, placebo-controlled trial, called the SATURN trial, durable pain palliation for ³12 weeks duration was the primary endpoint.

The trial was stopped after 20 months, during which 14 subjects were randomized. Restrictive protocol-specified criteria of stable baseline pain and consistent analgesic use prevented the ability to complete trial enrollment.

Data from the clinical trial are summarized as follows:

|

|

· |

durable pain palliation of ³12 weeks duration was achieved in 3/14 subjects: n=1/7 (14%, taxane + placebo arm) and n=2/7 (29%, taxane + custirsen arm); |

|

|

· |

custirsen was generally well tolerated when administered in combination with a taxane (docetaxel or cabazitaxel) and prednisone; and |

|

|

· |

median (95% CI) overall survival by Kaplan-Meier analyses was 7.8 months (3.2, 11.5) (taxane + placebo) and 11.8 months (9.8, 15.7) (taxane + custirsen). |

Summary of Custirsen Development Program

Ongoing Phase 3 Custirsen Trials:

|

Cancer Indication and Trial |

|

Treatment Combination(1) |

|

Status |

|

Metastatic castrate resistant prostate cancer – survival endpoint (AFFINITY) |

|

Cabazitaxel with and without custirsen (~630 patients); second-line chemotherapy |

|

· Final intent to treat analysis expected in the third quarter of 2016 (2) · Passed final interim futility analysis in December 2015 · Prospectively defined subpopulation did not meet criteria, as reported in December 2015

|

|

|

|

|

|

|

|

Advanced non-small cell lung cancer – survival endpoint (ENSPIRIT) |

|

Docetaxel with and without custirsen (~700 patients); second-line chemotherapy |

|

· Final survival analysis expected in the first half of 2017 (2) · Passed final interim futility analysis in July 2015 · Passed first interim futility analysis in August 2014 · Patient enrollment ongoing |

11

Completed Custirsen Trials:

|

Cancer Indication |

|

Treatment Combination(1) |

|

Status |

|

Metastatic castrate resistant prostate cancer (SYNERGY) |

|

Docetaxel with and without |

|

· Completed; top-line data reported in April 2014; manuscript in preparation

|

|

|

|

|

|

|

|

Metastatic castrate resistant prostate cancer (SATURN) |

|

Taxane chemotherapy (docetaxel retreatment or cabazitaxel) with and without custirsen; second-line chemotherapy |

|

· Results presented at the ASCO GU Symposium in January 2014 · 14 patients enrolled in phase 3 · Phase 3 discontinued: Restrictive protocol-specified criteria of stable baseline pain and consistent analgesic use prevented the ability to complete trial enrollment. |

|

|

|

|

|

|

|

Metastatic castrate resistant prostate cancer |

|

Docetaxel with and without custirsen; first-line chemotherapy |

|

· Data published in JCO, September 2010 · Phase 2 completed |

|

|

|

|

|

|

|

Metastatic castrate resistant prostate cancer |

|

Docetaxel or mitoxantrone with and without custirsen; second-line chemotherapy |

|

· Data published in CCR, September 2011 · Phase 2 completed |

|

|

|

|

|

|

|

Advanced non-small cell lung cancer |

|

Gemcitabine and cisplatin or carboplatin with and without custirsen; first-line chemotherapy |

|

· Data published in JTO, January 2012 · Phase 2 completed |

|

|

|

|

|

|

|

Localized prostate cancer |

|

Custirsen with hormone ablation therapy |

|

· Results presented at ASCO 2008 Genitourinary Cancers Symposium · Phase 2 completed |

|

|

|

|

|

|

|

Advanced breast cancer |

|

Custirsen with docetaxel |

|

· Data published in CCR, January 2009 · Phase 2 completed |

|

|

|

|

|

|

|

Localized prostate cancer |

|

Custirsen with hormone ablation therapy |

|

· Data published in Journal of National Cancer Institute, September 2005 · Phase 1 completed |

|

|

|

|

|

|

|

Solid tumors (prostate, breast, NSCLC, ovarian, renal, bladder, peritoneum) |

|

Custirsen with docetaxel |

|

· Data published in CCR, February 2008 · Phase 1 completed |

|

(1) |

In all of our prostate cancer clinical trials and in clinical practice for prostate cancer, docetaxel and cabazitaxel are administered in combination with prednisone. |

|

(2) |

Depending on timing of enrollment and/or event-driven final analyses. |

Apatorsen

Overview of Apatorsen

Apatorsen is our product candidate that is designed to inhibit production of Hsp27, a cell-survival protein expressed in many types of cancers including bladder, prostate, breast, pancreatic and non-small cell lung cancer. Hsp27 expression is stress-induced, including by many anti-cancer therapies. Overexpression of Hsp27 is thought to be an important factor leading to the development of treatment resistance and is associated with metastasis and negative clinical outcomes in patients with various tumor types.

A number of preclinical studies have shown that reducing Hsp27 production induces tumor cell death in prostate, non-small cell lung, bladder and pancreatic cancer cells. The studies also suggest that reducing Hsp27 production sensitizes prostate tumor cells to hormone ablation therapy. These preclinical studies have also shown that inhibiting the production of Hsp27 in human prostate, bladder, lung, breast, ovarian and pancreatic tumor cells sensitizes the cells to chemotherapy.

Hsp27 has been reported by others to function as an immunomodulatory protein by a number of mechanisms that include altering important membrane expressed proteins on monocytes and immature dendritic cells; this alteration results in tumor-associated immune cells that are not functional in identifying and killing cancer cells. The induction of anti-inflammatory cytokines by Hsp27 may also play a role in down-regulating lymphocyte activation leading to additional unresponsive immune cells.

12

In 2013, we initiated the ORCA (Ongoing Studies Evaluating Treatment Resistance in CAncer) program which encompasses clinical studies designed to evaluate whether inhibition of Hsp27 can lead to improved prognosis and treatment outcomes for cancer patients. Our goal is to advance cancer treatment by conducting clinical trials for apatorsen across multiple cancer indications including bladder, lung, pancreatic and prostate cancers. We are conducting parallel clinical trials to evaluate apatorsen in several cancer indications and treatment combinations to accelerate the development of apatorsen. As part of this strategy, we are supporting specific investigator-sponsored trials to allow assessment of a broader range of clinical indications for future OncoGenex-sponsored trials and possible market approval. The ORCA trials, with exception of the Pacific™ trial, are designed to provide information that will be useful for designing future phase 3 trials and may be used as supportive studies for registration, if applicable. Due to small sample sizes, data from these trials are not likely to result in statistically significant differences in either PFS or survival.

Ongoing Trials

|

|

· |

The Borealis-2™ Trial: The investigator-sponsored, randomized phase 2 trial evaluating apatorsen in combination with docetaxel treatment compared to docetaxel treatment alone in patients with advanced or metastatic bladder cancer who have disease progression following first-line platinum-based chemotherapy. Patients may also continue weekly apatorsen infusions as maintenance treatment until disease progression or unacceptable toxicity if they complete all 10 cycles of docetaxel, or are discontinued from docetaxel due to docetaxel toxicity. This trial was initiated in April 2013 and patient enrollment was completed in September 2015. The trial randomized approximately 200 patients and results are expected in the second half of 2016. |

|

|

· |

The Spruce™ Trial: The investigator-sponsored, randomized, placebo-controlled phase 2 trial evaluating apatorsen plus carboplatin and pemetrexed therapy compared to carboplatin and pemetrexed therapy in patients with previously untreated advanced non-squamous NSCLC. Patients continued weekly apatorsen or placebo infusions as maintenance treatment until disease progression if they completed a minimum of 3 cycles of chemotherapy treatment. The aim of the trial is to determine if adding apatorsen to carboplatin and pemetrexed therapy can extend PFS outcome. Additional analyses are expected to include tumor response rates, overall survival, safety, tolerability and the effect of therapy on Hsp27 levels. Patients who are at increased risk for poor outcomes will also be prospectively evaluated. This trial was initiated in August 2013 and patient enrollment was completed in February 2015. The trial randomized approximately 155 patients. Primary endpoint data for PFS was reported in January 2016 and did not reach the statistical significance required to demonstrate a benefit. A potential PFS benefit was observed in patients with high baseline serum Hsp27 status when treated with apatorsen. The study is ongoing and overall survival results are expected in the second half of 2016. |

|

|

· |

The Spruce-2™ Trial (formerly referred to as the Cedar Trial): The investigator-sponsored, randomized phase 2 trial evaluating apatorsen plus gemcitabine and carboplatin therapy or gemcitabine and carboplatin therapy alone in patients with previously untreated advanced squamous NSCLC. Patients also continue weekly apatorsen infusions as maintenance treatment after chemotherapy until disease progression. The aim of the trial is to determine if adding apatorsen to gemcitabine and carboplatin therapy can extend PFS outcome. Additional analyses will include tumor response rates, overall survival, safety, and health-related quality of life. Additional analyses are expected to determine the effect of therapy on Hsp27 levels, explore potential biomarkers that may help predict response to treatment and survival outcomes in patients who were at increased risk for poor outcomes. The trial was initiated in July 2014 and is enrolling patients. The trial is expected to randomize approximately 140 patients. |

|

|

· |

The Pacific™ Trial: The investigator-sponsored, randomized phase 2 trial evaluating apatorsen in men with CRPC who are experiencing a rising PSA while receiving Zytiga® (abiraterone acetate). The aim of the trial is to determine if adding apatorsen to Zytiga treatment can reverse or delay treatment resistance by evaluating the PFS rate at a milestone Day 60 assessment. Other secondary endpoints such as PSA and objective responses, time to disease progression, CTCs and Hsp27 levels are expected to be evaluated. The trial completed enrollment of 72 patients in March 2016. |

13

Summary of Planned Apatorsen Clinical Trials

In addition to the Borealis-1 and Borealis-2 clinical trials in metastatic bladder cancer in the ORCA program, we are evaluating apatorsen for the potential treatment of NMIBC. We have completed a pre-IND meeting with FDA in preparation for a separate IND application to evaluate apatorsen for intravesical administration in combination with Bacillus Calmette-Guerin, or BCG, treatment in patients with NMIBC. FDA had no objection to the study population or classification of subpopulations in the proposed study design and deemed the proposed definitions of primary and secondary endpoints acceptable.

Summary of Completed Results of Apatorsen Clinical Trials

Preliminary or final results have been presented for a phase 1 clinical trial in patients with solid tumors, a phase 1 clinical trial in patients with superficial or muscle-invasive bladder cancer, a randomized phase 2 trial in metastatic CRPC, a randomized phase 2 in metastatic bladder cancer and a randomized phase 2 trial in metastatic pancreatic cancer. The following is a summary of the preliminary or final results from these trials.

Summary of Preliminary Results of Apatorsen Randomized Phase 2 Clinical Trial in Patients with Untreated Metastatic Pancreatic Cancer

Rainier enrolled and treated 130 patients with previously untreated metastatic pancreatic cancer. Patients were randomized to receive apatorsen in combination with ABRAXANE® (paclitaxel protein-bound particles for injectable suspension) (albumin-bound) and gemcitabine compared to ABRAXANE and gemcitabine alone. Patients were to receive up to six cycles of weekly intravenous therapy. The addition of apatorsen to ABRAXANE and gemcitabine did not demonstrate an overall survival benefit in the study when compared to ABRAXANE and gemcitabine alone. A potential benefit was observed in a subgroup of patients with high baseline serum Hsp27 status (14% of total) when treated with apatorsen (PFS HR= 0.40; 95% CI 0.19-0.86 and survival HR= 0.57; 95% CI 0.26-1.25). Overall, higher baseline Hsp27 status correlated with worse survival outcome. The study was sponsored and conducted by Sarah Cannon Research Institute, or SCRI, and further results were presented at the Gastrointestinal, or GI, Cancers Symposium meeting in January 2016. The study investigators concluded that these promising results in pancreatic cancer patients with high baseline Hsp27 status warrant further study of apatorsen in this population. We do not intend to pursue additional trials in pancreatic cancer at this time.

Summary of Preliminary Results of Apatorsen Randomized Phase 2 Clinical Trial in Patients with Metastatic Bladder Cancer

Borealis-1 enrolled and treated 179 patients with documented metastatic or locally inoperable transitional cell carcinoma, or TCC, of the urinary tract who had not previously received chemotherapy for metastatic disease and were not candidates for potentially curative surgery or radiotherapy. Patients were randomized to receive standard chemotherapy (gemcitabine/cisplatin) in combination with apatorsen at two dose levels (600 mg and 1000 mg) or gemcitabine/cisplatin plus placebo. Patients received up to six cycles of weekly intravenous therapy. Patients received weekly apatorsen or placebo maintenance therapy until disease progression or other reason for withdrawal from protocol treatment if they had completed a minimum of four cycles of chemotherapy. The primary endpoint of the trial was overall survival. Secondary endpoints included PFS, disease response and safety assessments for the two doses of apatorsen.

In December 2014, we announced overall trial results indicated that the addition of 600mg apatorsen to standard of care chemotherapy showed a 14% reduction in risk of death (overall survival hazard ratio (HR) = 0.86) and a 17% reduction in progressive disease and death (PFS HR = 0.83) when compared to chemotherapy alone. Subsequent exploratory analyses showed improved overall survival for those patients who received 600mg apatorsen and had poor prognosis over various prognostic factors such as performance status. Over one-third of the patients in the trial had lower performance status, as defined by a Karnofsky score of 80% or less. These patients derived the greatest benefit from 600mg apatorsen in combination with chemotherapy, resulting in a 50% reduction in risk of death (overall survival HR = 0.50) compared to chemotherapy alone. Less benefit was observed in the 1000mg apatorsen arm due to increased adverse events leading to a higher rate of discontinuation of both apatorsen and chemotherapy. Apatorsen 600mg was well tolerated in combination with chemotherapy. These data were presented at the 2015 ASCO Annual Meeting. We believe these results provide future direction for defining the patient population for a subsequent phase 3 trial.

Summary of Preliminary Results of Apatorsen Randomized Phase 2 Clinical Trial in Patients with CRPC

This randomized, controlled phase 2 trial completed enrollment of 74 patients who had minimally symptomatic or asymptomatic advanced prostate cancer and who have not yet received chemotherapy. The trial was designed to determine the potential benefit of apatorsen by assessing the number of patients without disease progression at 12 weeks post-study treatment with or without apatorsen. Preliminary study results presented at ESMO in September 2012 showed a higher number of patients without disease progression at 12 weeks and greater declines in PSA and CTCs in patients receiving apatorsen plus prednisone treatment compared to those receiving prednisone alone. A manuscript with final results is in development.

14

Apatorsen infusion reactions occurred and were primarily grade 1 or 2 chills, diarrhea, fatigue, nausea, flushing, pyrexia and vomiting. Other adverse events in two or more patients receiving apatorsen were dizziness, hot flashes, muscular weakness, and hypertension. Grade 3-4 laboratory treatment-emergent adverse events in two or more patients receiving apatorsen included lymphopenia (12%), hyperglycemia (12%), and elevated creatinine (6%).

Summary of Preliminary Results of Apatorsen Phase 1 Clinical Trial in Patients with Superficial Bladder Cancer

This investigator-sponsored phase 1 trial was designed to determine the effects of apatorsen on Hsp27 expression and tumor response rates when administered into the bladder using intravesical instillation. In addition, the trial measured the direct effect of delivering apatorsen by intravesical instillation on expression of Hsp27 in bladder tumor cells. This clinical trial was primarily funded by the National Cancer Institute of Canada.

Preliminary results from this trial were presented at the ASCO 2012 Genitourinary Cancers Symposium in February 2012 and demonstrated a trend towards decreased levels of Hsp27 and increased tumor cell death rates after intravesical treatment with apatorsen. In the apatorsen treated patients who experienced a complete pathologic response, the absence of residual disease made it difficult to fully assess the effect of apatorsen on Hsp27 expression. Therefore, the analysis was based mainly on the remaining patients who had evaluable tumor tissue. Results showed that eight of 24 patients (33%) had no pathologic evidence of disease. A manuscript with final results is in development.

Summary of Results of Apatorsen Phase 1 Clinical Trial in Patients with Solid Tumors

Apatorsen has been evaluated in a phase 1 trial in patients with breast, prostate, ovarian, or NSCLC who have failed potentially curative treatments or for whom a curative treatment does not exist. Final results of this phase 1 trial were presented in an oral presentation at the ASCO 2010 annual meeting. The phase 1 trial evaluated 42 patients treated with apatorsen as a single agent and 22 patients treated with apatorsen in combination with docetaxel who had failed up to six prior chemotherapy treatments. Apatorsen as a single agent administered weekly was evaluated at doses from 200 mg up to 1000 mg in five cohorts of approximately six patients per cohort. Two further cohorts evaluated apatorsen at the 800 and 1000 mg doses combined with docetaxel. Patients could receive up to 10 21-day cycles.

Most adverse events were mild (grade 1 or 2) and mainly occurred during the three “loading doses” given over nine days prior to weekly dosing. The most frequently reported adverse events in the apatorsen monotherapy arms were infusion-related reactions and chills. The most frequently reported adverse events in the apatorsen plus docetaxel arms were infusion-related reactions, chills, fatigue, diarrhea, pruritus (itching), nausea and back pain. The incidence of laboratory toxicity was determined based on laboratory data. The majority of laboratory toxicities were Grade 1 or Grade 2. Serious adverse events were reported for approximately half the patients. The most common events were disease progression and dyspnea (shortness of breath), reported for five subjects each, and febrile neutropenia, reported for four subjects. Increased blood creatinine (a test of kidney function) and hydronephrosis (obstruction of the urine flow from the kidney due to tumor blockage) were reported for two subjects each. All remaining serious adverse events were reported for one subject each.

Thirty patients had baseline and at least one post-baseline assessment of measurable disease. A total of eight of 30 patients (27%) had a decrease in measurable disease from baseline of at least 15%. For patients treated with monotherapy, three patients had tumor reductions and for patients treated with combined therapy with docetaxel, five patients had tumor reductions.

Thirty-three of 36 patients with prostate cancer had at least one post-baseline PSA. Three of 21 in the monotherapy cohorts had reductions in PSA greater than or equal to 30% as did six of 12 in the combination therapy cohorts. Six of seven patients with ovarian cancer had both baseline and post-baseline CA-125 (an ovarian tumor marker) measurements. All were treated with monotherapy. Three patients had a reduction of CA-125.

Decreases in both total CTCs and Hsp27+CTCs were observed. Hsp27+CTCs were decreased in 71% of evaluable patients.

In approximately 35% of patients, serum Hsp27 protein levels were decreased by 30% or greater over a time period of at least six weeks.

15

Summary of Apatorsen Development Program

Ongoing Apatorsen Trials:

|

Cancer Indication and Trial |

|

Treatment Combination |

|

Status |

|

Metastatic bladder cancer (Borealis-2) |

|

Docetaxel with and without apatorsen (~ 200 patients); second-line chemotherapy |

|

· Final results expected in the second half of 2016 · Patient enrollment completed in September 2015 |

|

|

|

|

|

|

|

Advanced non-squamous NSCLC (Spruce) |

|

Carboplatin and pemetrexed with and without apatorsen (~155 patients) |

|

· Survival data expected in the second half of 2016 |

|

|

|

|

|

· Top-line data on PFS reported in January 2016 |

|

|

|

|

|

|

|

Advanced squamous NSCLC (Spruce-2) |

|

Gemcitabine and carboplatin with and without apatorsen (~ 140 patients) |

|

· Patient enrollment ongoing |

|

|

|

|

|

|

|

Castrate resistant prostate cancer (Pacific) |

|

Zytiga (abiraterone acetate) with and without apatorsen (~72 patients) |

|

· Patient enrollment completed in March 2016. |

Completed Apatorsen Trials:

|

Cancer Indication |

|

Treatment Combination |

|

Status |

|

Metastatic pancreatic cancer (Rainier) |

|

Abraxane and gemcitabine with and without apatorsen (~ 130 patients) |

|

· Final data presented at 2016 GI ASCO · Top-line data reported in September 2015 · Phase 2 completed |

|

|

|

|

|

|

|

Metastatic bladder cancer (Borealis-1) |

|

Gemcitabine and cisplatin with and without apatorsen (~ 180 patients); first-line chemotherapy |

|

· Final data presented at 2015 ASCO Annual Meeting · Top-line data reported in December 2014 · Phase 2 completed |

|

|

|

|

|

|

|

Solid tumors |

|

Apatorsen with and without chemotherapy |

|

· Final data presented at 2010 ASCO Annual Meeting, manuscript accepted for publication · Phase 1 completed |

|

|

|

|

|

|

|

Superficial and muscle invasive bladder Cancer (BL-01) |

|

Apatorsen as monotherapy (24 patients) |

|

· Preliminary data presented at 2012 ASCO Genitourinary Cancers Symposium, manuscript in preparation · Phase 1 completed |

|

|

|

|

|

|

|

Castrate resistant prostate cancer (PR-01) |

|

Prednisone with and without apatorsen (74 patients) |

|

· Preliminary data presented at 2012 ESMO Annual Meeting, manuscript in preparation · Phase 2 completed |

OGX-225

Overview of OGX-225

OGX-225 is our product candidate designed to inhibit the production of Insulin Growth Factor Binding Proteins -2 and -5, or IGFBP-2, IGFBP-5, two proteins that when overexpressed affect the growth of cancer cells. Increased IGFBP-2 and IGFBP-5 production are observed in many human cancers, including prostate, breast, colorectal, non-small cell lung, glioblastoma, acute myeloid leukemia, acute lymphoblastic leukemia, neuroblastoma, and melanoma. The increased production of these proteins is linked to faster rates of cancer progression, treatment resistance, and shorter survival duration in humans.

16

Preclinical studies with human prostate and breast cancer cells have shown that reducing IGFBP-2 and IGFBP-5 production with OGX-225 sensitized these tumor types to hormone ablation therapy or chemotherapy and induced tumor cell death. We have completed IND enabling toxicology studies for OGX-225.

Summary of OGX-225 Development Program

OGX-225 Preclinical Studies:

|

Cancer Indication |

|

Treatment Combination |

|

Status |

|

Solid tumors |

|

OGX-225 with and without chemotherapy |

|

· Toxicology studies for initial IND completed · Preclinical proof-of-concept studies completed |

Second-Generation Antisense Technology

Custirsen, apatorsen and OGX-225 are based on second-generation antisense drug chemistry and belong to the drug class known as antisense therapeutics. On a product-by-product basis, we have collaborated with Ionis Pharmaceuticals, Inc. (formerly Isis Pharmaceuticals, Inc.), or Ionis, and selectively licensed technology from Ionis to combine Ionis’ second-generation antisense chemistry with our proprietary gene target sequences to create inhibitors that are designed to down-regulate certain proteins associated with cancer resistance. In contrast to first-generation antisense chemistry, second-generation antisense chemistry has improved target binding affinity, increased resistance to degradation, and improved tissue distribution. These improvements result in slower clearance of the therapies from the body, which allow for less frequent dosing and thereby make treatment easier on patients at a lower associated cost. For example, clinical data from our phase 1 clinical trial evaluating custirsen in combination with neoadjuvant hormone therapy in prostate cancer patients demonstrated that weekly intravenous administration of custirsen resulted in drug distribution to prostate cancer tissue and over 92% inhibition of its target, clusterin mRNA, in prostate tumor cells in these patients. These data demonstrate that, following systemic administration, custirsen entered tumor cells and effectively inhibited clusterin production.

OVERVIEW OF MARKET AND TREATMENT

In North America, cancer has recently surpassed heart disease as the leading cause of death in the United States. The American Cancer Society estimates that approximately 1.7 million new cancer cases are expected to be diagnosed in 2016. Cancer is the second most common cause of death in the United States, accounting for nearly 1 of every 4 deaths. Approximately 600,000 Americans are expected to die of cancer in 2016.

Typically, cancer treatments are given sequentially and can include hormone therapy, surgery, radiation therapy, immunotherapy and chemotherapy. Although a particular therapy may initially be effective, tumor cells often react to therapeutic treatment by increasing the production of proteins that afford them a survival advantage, enabling them to become resistant to therapy, multiply, and spread to additional organs. As a result, many patients progress through multiple different therapies and ultimately die from the disease.

OUR STRATEGY

Our objective is to develop and commercialize new cancer therapies that address resistance to therapies in cancer patients. Key elements of our strategy include:

|

|

· |

gaining market approval for custirsen by conducting registration trials that demonstrate efficacy and safety, in both prostate and lung cancer; |

|

|

· |

advancing apatorsen by conducting clinical trials across multiple cancer indications for apatorsen, including bladder, lung and prostate cancers. We are conducting parallel clinical trials to evaluate apatorsen in several cancer indications and treatment combinations to accelerate the development of apatorsen. We are supporting specific investigator-sponsored trials to allow assessment of a broader range of clinical indications for future OncoGenex-sponsored trials and possible market approval; |

17

|

|

· |

developing and commercializing new cancer therapies, including OGX-225, to inhibit treatment resistance in cancer patients. We plan to leverage our expertise in development to bring new products to market as soon as possible. We intend to maintain and develop our relationship with the Vancouver Prostate Centre and develop relationships with other research institutions in order to identify additional product candidates; and |

|

|

· |

optimizing the development of our product candidates through use of outsourcing and internal expertise. In order to increase efficiency and lower our overhead, we outsource, and plan to continue to outsource, preclinical and manufacturing activities. We have chosen to establish critical product development functions in-house, including clinical trial management and regulatory affairs. |

LICENSE AND COLLABORATION AGREEMENTS

Ionis Pharmaceuticals, Inc.

Custirsen

In November 2001, OncoGenex Technologies entered into an agreement with Ionis to jointly develop and commercialize custirsen. This strategic relationship provided us with access to Ionis’ proprietary position in second-generation antisense chemistry for use in custirsen, and Ionis’ expertise in developing antisense therapeutics, including its manufacturing expertise, and allowed us to develop custirsen cost efficiently. Under this agreement, we paid 65%, and Ionis paid 35%, of the costs resulting from the development and commercialization of custirsen. In July 2008, we and Ionis amended this agreement to provide that we are solely responsible for the costs and development of custirsen, and, in turn, we incurred certain financial obligations to Ionis, primarily related to sharing revenue received by us from a third party as a result of a licensing transaction.

Under the amended agreement, Ionis assigned to OncoGenex Technologies its rights in the patents claiming the composition and therapeutic methods of using custirsen, and granted OncoGenex Technologies a worldwide, nonexclusive license to their know-how and patents covering our core antisense technology and manufacturing technology solely for use with custirsen. The key product related patent that Ionis assigned to OncoGenex Technologies was U.S. Patent number 6,900,187 having an expiration date of at least 2021, and the key core antisense technology patents Ionis licensed OncoGenex Technologies are U.S. Patent number 7,919,472 having an expiration date of 2026 and its foreign equivalents pending in Australia, Canada, the European Patent Convention and Japan. In addition, Ionis agreed that so long as OncoGenex Technologies or its commercialization partner is using commercially reasonable efforts to develop and commercialize custirsen, Ionis will not research, develop or commercialize an antisense compound designed to modulate clusterin. The amended agreement will continue until OncoGenex Technologies or its commercialization partner is no longer developing or commercializing custirsen or until Ionis terminates the agreement for an uncured failure by OncoGenex Technologies to make a payment required under the agreement.

Licensing revenue that is based on a percentage of net sales of a licensor is defined as Royalty Revenue, while other licensing revenue, with the exception of fair market value of equity and reimbursement of research and development expenses, is defined as Non-Royalty Revenue. We will pay Ionis royalties comprised of a base percentage of net sales of custirsen and a percentage of Royalty Revenue we receive in excess of a certain threshold up to a certain cap. The amount of the royalties payable to Ionis depends on whether Ionis owes royalty payments to third parties pursuant to its license agreements with such parties. Our total royalty obligations to Ionis will depend on net sales of custirsen during the period and if Ionis owes royalty payments to third parties. In addition, we are required to pay Ionis 20% of all Non-Royalty Revenue we receive.

In May and November 2015, we received communications from Ionis requesting payment of 30% of the $23.2 million paid by Teva under the Termination Agreement, as well as 30% of any amounts paid by Teva upon release of the $3.0 million holdback amount. In January 2016, Ionis filed a lawsuit and claims that OncoGenex Technologies is in breach of the license agreement for failing to pay Ionis a share of the advance reimbursement payment from Teva and other non-monetary consideration received from Teva in connection with the termination of the Collaboration Agreement. Ionis seeks damages in the amount of at least $10 million and a declaratory judgment that, based on OncoGenex Technologies’ alleged breach, Ionis has the right to terminate the license agreement. We do not believe that any payments are due to Ionis. Under the Ionis license agreement, no payment is due to Ionis on any consideration that we receive for the reimbursement for research and development activities. The amounts paid or payable by Teva under the Termination Agreement constitute an advanced reimbursement for certain continuing research and development activities related to custirsen and certain other antisense inhibitors of clusterin, and therefore, no payments are owed to Ionis. We intend to vigorously defend the lawsuit and, based on our preliminary review, we believe we have valid defenses.

We paid Ionis $10 million in January 2010 as Ionis’ share of Non-Royalty Revenue received by us in December 2009 in connection with our collaboration agreement with Teva. We did not make any further payments to Ionis in 2015 under the terms of the agreement with Ionis.

18

Neither we nor Ionis can pursue the development or commercialization of any antisense compound for clusterin outside of the agreement with Ionis. This arrangement will continue until custirsen is no longer being developed or commercialized or until the agreement with Ionis is earlier terminated due to an uncured material breach.

To facilitate the execution and performance of the collaboration agreement with Teva, we and Ionis agreed to further amend our agreement, which amendment provided that, among other things, if we are the subject of a change of control with a third party, where the surviving entity immediately following such change of control has the right to develop and sell the product, then (i) a milestone payment of $20 million will be due and payable to Ionis 21 days following the first commercial sale of the product in the United States and (ii) unless such surviving entity had previously sublicensed the product and a royalty rate payable to Ionis by us has been established, the applicable royalty rate payable to Ionis will thereafter be the maximum amount payable under our agreement with Ionis. Any non-royalty milestone amounts previously paid will be credited towards the $20 million milestone if not already paid. As a result of the $10 million milestone payment paid to Ionis in relation to the collaboration agreement with Teva, the remaining amount owing in the event of change of control discussed above is a maximum of $10 million.

OncoGenex Technologies has agreed to indemnify Ionis and persons affiliated with Ionis against liabilities resulting from the development, manufacture, use, handling, storage, sale or other commercialization or disposition of custirsen caused by OncoGenex Technologies’ or its licensees’ or sublicensees’ gross negligence or willful misconduct, or caused by OncoGenex Technologies’ material breach of our agreement with Ionis.

Apatorsen