DEF 14A: Definitive proxy statements

Published on April 21, 2022

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Rule 14a-12 |

ACHIEVE LIFE SCIENCES, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Table of Contents

ACHIEVE LIFE SCIENCES, INC.

1040 West Georgia Street, Suite 1030

Vancouver, British Columbia, Canada V6E 4H1

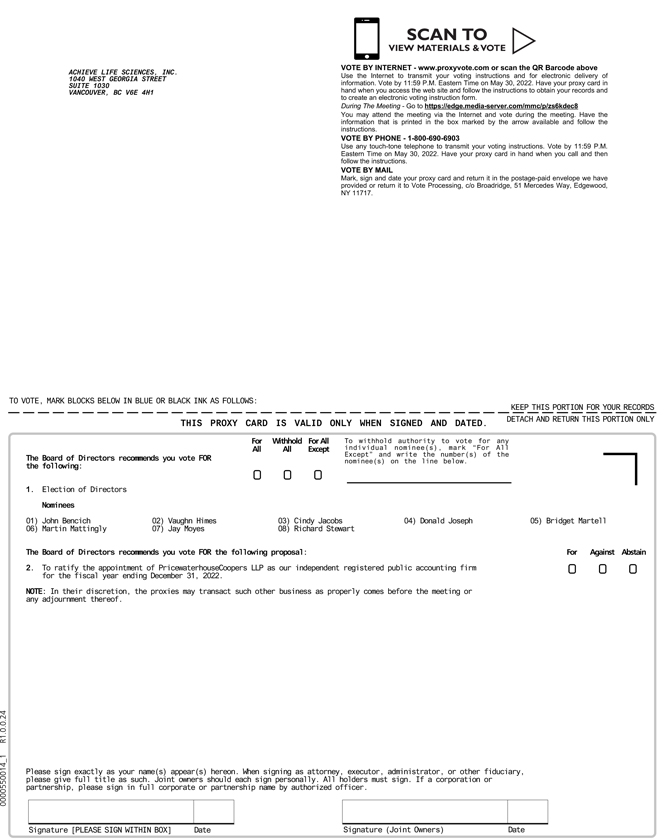

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Achieve Life Sciences, Inc., a Delaware corporation, will be held on May 31, 2022, at 12:00 p.m. Pacific time. You will be able to participate in the 2022 Annual Meeting and vote during the 2022 Annual Meeting via live webcast by visiting https://edge.media-server.com/mmc/p/zs6kdec8 on Tuesday, on May 31, 2022, at 12:00 p.m. Pacific time. Alternatively, you may access the live Annual Meeting by dialing 877-472-9809 (U.S. & Canada) or 629-228-0791 (International). We believe that a virtual stockholder meeting provides greater access to those who may want to attend and provides a safer forum in light of the ongoing COVID-19 pandemic, and therefore we have chosen this over an in-person meeting. Proxy voting can be done in advance of the Annual Meeting. For further instructions on remote voting, please see your Proxy Card enclosed.

The Annual Meeting will be held for the following purposes:

| 1. | To elect eight directors to serve until our next annual meeting of stockholders or until their successors are duly elected and qualified; |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP, or PwC, as our independent registered public accounting firm for the fiscal year ending December 31, 2022; and |

| 3. | To transact such other business as may properly come before the Annual Meeting. |

Only stockholders of record at the close of business on April 1, 2022 are entitled to notice of, and to vote at, the Annual Meeting. For 10 days prior to the Annual Meeting, a complete list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder, for any purpose relating to the Annual Meeting, during ordinary business hours at our principal executive office at the above address.

By Order of the Board of Directors,

John Bencich

Chief Executive Officer

Vancouver, British Columbia, Canada

April 21, 2022

Whether or not you plan to attend the Annual Meeting virtually, we encourage you to vote and submit your proxy by telephone, via the Internet or by mail. For additional instructions on attending virtually, voting by telephone or via the Internet, please refer to the proxy card. To vote and submit your proxy by mail, please complete, sign and date the enclosed proxy card and return it in the enclosed envelope. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from them to vote your shares.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 31, 2022

The Companys Proxy Statement and Annual Report on Form 10-K for the year ended

December 31, 2021 are available at ir.achievelifesciences.com.

Table of Contents

Table of Contents

ACHIEVE LIFE SCIENCES, INC.

1040 West Georgia Street, Suite 1030

Vancouver, British Columbia, Canada V6E 4H1

PROXY STATEMENT FOR

2022 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement for the Annual Meeting, or Proxy Statement, is furnished in connection with the solicitation of proxies on behalf of the board of directors, or Board of Directors or Board, of Achieve Life Sciences, Inc. (Achieve), a Delaware corporation, or the Company, for use at the Annual Meeting of Stockholders, or the Annual Meeting, to be held on May 31, 2022, at 12:00 p.m. Pacific time for the purposes set forth in this Proxy Statement and in the accompanying Notice of Annual Meeting.

We believe that a virtual stockholder meeting provides greater access to those who may want to attend and provides a safer forum in light of the ongoing COVID-19 pandemic, and therefore we have chosen this over an in-person meeting. You will not be able to attend the Annual Meeting in person.

This Proxy Statement and accompanying proxy card will first be mailed on or about April 21, 2022 to all stockholders entitled to vote at the Annual Meeting.

Voting Rights

Only stockholders of record at the close of business on April 1, 2022, the record date, are entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement of the Annual Meeting. At the close of business on April 1, 2022, we had 9,475,077 shares of common stock outstanding.

Each stockholder of record is entitled to one vote for each share of common stock held on the record date on all matters. Dissenters rights are not applicable to any of the matters being voted on.

Participating in the Annual Meeting

We will be hosting the Annual Meeting live via Internet webcast. A summary of the information you need to participate in the Annual Meeting online is provided below:

| | Any stockholder may listen to the Annual Meeting via webcast at https://edge.media-server.com/mmc/p/zs6kdec8. Alternatively, you may access the live Annual Meeting by dialing 877-472-9809 (U.S. & Canada) or 629-228-0791 (International). The webcast will begin at 12:00 p.m. Pacific time on May 31, 2022. |

Board Recommendation

Our Board of Directors recommends that you vote:

| | FOR each of the nominees for the Board of Directors, who are, John Bencich, Vaughn Himes, Cindy Jacobs, Donald Joseph, Bridget Martell, Martin Mattingly, Jay Moyes, and Richard Stewart; and |

| | FOR the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. |

1

Table of Contents

Voting of Proxies

All shares represented by a valid proxy received prior to the Annual Meeting will be voted, and, if you provide specific instructions, your shares will be voted as you instruct. If you sign your proxy card with no further instructions and do not hold your shares beneficially through a broker, bank or other nominee, your shares will be voted FOR each of the nominees for the Board of Directors, FOR the ratification of PwC as our independent registered public accounting firm for the fiscal year ending December 31, 2022, and in the discretion of the proxy holders with respect to any other matters that properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting.

How to Vote Your Shares

YOUR VOTE IS IMPORTANT. Your shares can be voted at the Annual Meeting only if you are represented by proxy, please take the time to vote your proxy.

Stockholders of record, or registered stockholders, can vote by proxy in the following three ways:

| By Telephone: |

Call the toll-free number indicated on the enclosed proxy card and follow the recorded instructions. | |

| Via the Internet: |

Go to the website indicated on the enclosed proxy card and follow the instructions provided. | |

| By Mail: |

Mark your vote, date, sign and return the enclosed proxy card in the postage-paid return envelope provided. | |

If your shares are held beneficially in street name through a nominee such as a financial institution, brokerage firm, or other holder of record, your vote is controlled by that institution, firm or holder. Your vote by proxy may also be cast by telephone or via the Internet, as well as by mail, if your financial institution or brokerage firm offers such voting alternatives. Please follow the specific instructions provided by your nominee on your voting instruction card.

Please note, that if your shares are held beneficially through a bank, broker or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from the record holder. Should you wish to listen to the Annual Meeting, you can join at https://edge.media-server.com/mmc/p/zs6kdec8. Alternatively, you may access the live Annual Meeting by dialing 877-472-9809 (U.S. & Canada) or 629-228-0791 (International).

Revocability of Proxies

You may revoke or change any previously delivered proxy (including a proxy sent to you by someone other than us) at any time before the Annual Meeting by:

| | delivering a written notice of revocation to our Secretary at our principal executive office at 1040 West Georgia Street, Suite 1030, Vancouver, British Columbia, Canada V6E 4H1; or |

| | delivering a valid proxy bearing a later date or submitting a new later dated proxy. |

If you hold shares in street name through a broker, bank or other nominee, you must contact that bank, broker or other nominee to revoke any prior voting instructions.

If you receive a proxy from someone other than us, see Stockholder Nominations below.

2

Table of Contents

Quorum

The presence, virtually or by proxy, of at least a majority of the shares of common stock outstanding on the record date will constitute a quorum. Both abstentions and broker non-votes are counted for the purpose of determining the presence of a quorum.

Votes Required to Approve Matters Presented at the Annual Meeting

Our directors are elected by a plurality of the votes properly cast at the Annual Meeting. Approval of Proposal Two requires a majority of the votes properly cast at the Annual Meeting.

Broker Non-Votes

For banks, brokers or other nominee accounts, they are entitled to vote shares held for a beneficial owner on routine matters without instructions from the beneficial owner of those shares. For non-routine matters, the beneficial owner of such shares is required to provide instructions to the bank, broker or other nominee in order for them to be entitled to vote the shares held for the beneficial owner. Proposal One (election of our directors), will be treated as non-routine matter. If you hold your shares in street name and you do not instruct your bank, broker or other nominee how to vote in the election of directors, no votes will be cast on your behalf with respect to this proposal. The approval of Proposal Two (the ratification of the selection of PwC as our independent public accounting firm), will be treated as a routine matter, and, therefore, no broker non-votes are expected to exist with respect to this proposal.

If you hold your shares in street name, it is critical that you cast your vote if you want it to count on all matters to be decided at the Annual Meeting.

Impact on the Vote of Broker Non-Votes and Abstentions

As noted above, broker non-votes are counted for purposes of determining whether or not a quorum exists for the transaction of business at the Annual Meeting. Broker non-votes, as well as abstentions from voting, will not, however, be treated as votes cast and, therefore, will have no effect on the outcome of Proposal One (election of our directors) and Proposal Two (the ratification of the selection of PwC as our independent public accounting firm). As stated above, Proposal Two will be treated as a routine matter, which means that brokers will be able to use their discretion to vote on behalf of the beneficial owner absent instructions from such owners; therefore, no broker non-votes are expected to exist with respect to this proposal.

Solicitation of Proxies

We will bear the cost of soliciting proxies, including preparing, assembling, printing and mailing this Proxy Statement, the proxy card and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of common stock beneficially owned by others to forward to such beneficial owners. We may reimburse persons representing beneficial owners of common stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram, via the Internet or by personal solicitation by our directors, officers or other regular employees. No additional compensation will be paid to these individuals for such services.

Availability of Proxy Statement and Annual Report on Form 10-K

Our Proxy Statement and Annual Report on Form 10-K for the fiscal year ended December 31, 2021 are available at www.sec.gov and on our website at ir.achievelifesciences.com. We have provided to each stockholder of record as of April 1, 2022, a copy of our consolidated financial statements and related information, which are included in our Annual Report on Form 10-K for fiscal year 2021. We will mail without

3

Table of Contents

charge, upon written request, a copy of our Annual Report on Form 10-K for fiscal year 2021, including the consolidated financial statements, schedules and list of exhibits, and any particular exhibit specifically requested. Requests should be sent to: Achieve Life Sciences, Inc., 1040 West Georgia Street, Suite 1030, Vancouver, British Columbia, Canada V6E 4H1, Attention: Investor Relations.

4

Table of Contents

General

Directors are elected at each annual stockholders meeting to hold office until the next annual meeting or until their successors are elected and have qualified. Currently, there are seven members of the Board of Directors. The following table sets forth information with respect to the directors nominated for election at the annual stockholders meeting. The ages of such persons are shown as of April 1, 2022.

| Name |

Age | Position |

Director Since | |||

| John Bencich |

44 | Director and Chief Executive Officer | 2020 | |||

| Richard Stewart |

63 | Director, Executive Chairman and Chairman of the Board | 2017 | |||

| Cindy Jacobs |

64 | Director, President and Chief Medical Officer | 2021 | |||

| Donald Joseph |

68 | Director, Chairperson of the Nominating and Governance Committee and Member of the Audit Committee and Compensation Committee | 2017 | |||

| Martin Mattingly |

65 | Director, Chairperson of the Compensation Committee and Member of the Audit Committee and Nominating and Governance Committee | 2010 | |||

| Jay Moyes |

68 | Director, Chairperson of the Audit Committee and Member of the Nominating and Governance Committee | 2017 | |||

| Bridget Martell |

56 | Director, Member of the Audit Committee, Compensation Committee and Nominating and Governance Committee | 2021 | |||

| Vaughn Himes |

61 | Director | 2022 | |||

The Board of Directors held a total of six meetings during fiscal year 2021. During fiscal year 2021, each of our directors attended at least 75% of the aggregate of: (i) the total number of meetings of the Board of Directors held during the period he or she was a director; and (ii) the total number of meetings held by all committees on which the director served during the period he or she was a member.

Although we do not have a formal policy regarding attendance by directors at annual meetings of stockholders, we encourage directors to attend and, historically, most have done so. All of our directors then in office were in attendance at the 2021 annual meeting.

Pursuant to our Corporate Governance Guidelines, the Board of Directors is required to hold at least four regularly scheduled meetings each year. At least one of these meetings must include budgeting and long-term strategic planning. Each director is expected to attend no fewer than 75% of the total of all meetings of the Board of Directors and meetings of the committees on which he or she serves.

Set forth below are the names of, and information concerning, our current directors.

John Bencich has served as our Chief Executive Officer and member of the Board of Directors since September 2020. Previously, Mr. Bencich served as our Vice President and Chief Financial Officer from August 2014 to September 2020, and as our Executive Vice President and Chief Operating Officer from August 2017 to August 2014. Mr. Bencich joined us from Integrated Diagnostics, Inc., a molecular diagnostics company, where he

5

Table of Contents

served as Chief Financial Officer from September 2012 to August 2014. Prior to joining Integrated Diagnostics, he served as Chief Financial Officer of Allozyne, Inc. since July 2011. He served as the Vice President, Chief Financial Officer and Treasurer of Trubion Pharmaceuticals, Inc., a publicly traded biotechnology company, from November 2009 until its acquisition by Emergent BioSolutions Inc. in October 2010. Mr. Bencich served as Trubions Senior Director of Finance and Accounting from May 2007 through November 2009. Earlier in his career, Mr. Bencich held roles at Onyx Software Corporation, a publicly traded software company, and Ernst & Young LLP an international professional services firm. Mr. Bencich received a B.A. in Accountancy from the University of San Diego and an M.B.A. from Seattle University. Mr. Bencich received his Certified Public Accountant Certification from the State of Washington and held an active license for 17 years. The determination was made that Mr. Bencich should serve on our Board of Directors based on our belief that the Board of Directors have the benefit of managements perspective and, in particular, that of the Chief Executive Officer, as well as Mr. Bencichs extensive financial experience.

Richard Stewart has served as our Executive Chairman since September 2020, and as our Chairman of the Board and a director since the consummation of the merger between OncoGenex Pharmaceuticals, Inc. and Achieve in August 2017 (the Merger). Previously, Mr. Stewart served as Chief Executive Officer from the Merger to September 2020, and was Chairman and a director of Achieve, from its founding in May 2015, through the Merger. Mr. Stewart is also a founder and has served as a director of Ricanto Limited, a pharmaceutical asset optimization company, since 2009. Mr. Stewart has been Chairman and Chief Executive Officer of Renown Pharma Limited, a central nervous system company focused on Parkinsons disease, since 2016. Prior to Achieve, Mr. Stewart was Chairman and Chief Executive Officer of Huxley Pharmaceuticals, Inc., a single purpose central nervous system company, during 2009, prior to Huxley Pharmaceuticals, Inc.s acquisition by BioMarin Pharmaceutical Inc. Mr. Stewart was Chief Executive Officer of Brabant Pharma Limited, a single purpose central nervous system company, from 2013 to 2014 prior to its acquisition by Zogenix Inc. He was a co-founder and Chief Executive Officer of Amarin Corporation plc, a central nervous system company focused on Parkinsons disease and Huntingtons disease, from 2000 to 2007. Mr. Stewart was a co-founder and Chief Financial Officer, and later Chief Business Officer, of SkyePharma plc, a drug delivery company specializing in controlled release formulations, and held such positions from 1995 to 1998. Mr. Stewart holds a Bachelor of Science degree in Business Administration from the University of Bath. The determination was made that Mr. Stewart should serve on our Board of Directors due to his prior service on boards of directors, and extensive experience and innovations in the field of biotechnology. In addition, Mr. Stewarts accomplishments provide the Board of Directors with in-depth product and field knowledge.

Cindy Jacobs, Ph.D., M.D., has served as our President since September 2020 and our Chief Medical Officer since August 2008, and a member of the Board of Directors since March 2021. Previously, Dr. Jacobs served as Executive Vice President and Chief Medical Officer of OncoGenex Pharmaceuticals, Inc. from September 2005 to August 2008. Dr. Jacobs is also the founder of Eagles Ridge Executive Consulting LLC., an executive consulting business operating since July 2020. From 1999 to July 2005, Dr. Jacobs served as Chief Medical Officer and Senior Vice President, Clinical Development of Corixa Corporation. Prior to 1999, Dr. Jacobs held Vice President, Clinical Research positions at two other biopharmaceutical companies. Dr. Jacobs currently serves on the Board of Directors of Pacylex Pharmaceuticals Inc. since October 2020 and HiberCell Inc. since September 2021 and previously served on the Board of Directors of Renown Pharmaceuticals Private Limited from January 2018 to October 2021. Dr. Jacobs received her Ph.D. degree in Veterinary Pathology/Microbiology from Washington State University and an M.D. degree from the University of Washington Medical School. The determination was made that Dr. Jacobs should serve on our Board of Directors based on our belief that the Board of Directors have the benefit of managements perspective and, in particular, that of the President and Chief Medical Officer, as well as Dr. Jacobs extensive clinical and regulatory experience and experience serving on the boards of directors of various companies.

Donald Joseph has served as a director since August 2017. He currently serves as Chief Legal Officer and Secretary of Acer Therapeutics Inc., a publicly traded pharmaceutical company, since April 2018. He previously served as an advisor and consultant to biopharmaceutical and global health organizations. He has over twenty

6

Table of Contents

years of biopharmaceutical industry experience, including senior management positions in global health non-profit organizations. Mr. Joseph served as the Chief Legal Officer and Board Secretary of Humanigen, Inc. (previously known as KaloBios Pharmaceuticals, Inc.), a publicly traded company, from June 2013 to November 2015. Prior to Humanigen/KaloBios, he was Chief Executive Officer of BIO Ventures for Global Health, or BVGH, from February to November 2012 and Chief Operating Officer from April 2010 to January 2012. He is a former Chairman and Secretary and director of BVGH. He previously served as general counsel, corporate secretary, and in other senior management roles at publicly held biopharmaceutical companies, including Abgenix and Renovis. Before entering the life sciences industry, Mr. Joseph practiced business law for a number of years in major firms, including as an international partner at Baker & McKenzie, one of the worlds largest law firms. He received his J.D. degree from the University of Texas School of Law, with honors. The determination was made that Mr. Joseph should serve on our Board of Directors due to his experience as an executive officer and director of a number of companies in the life sciences industry, as well as his extensive legal experience.

Martin Mattingly, Pharm.D., has served as a director since June 2010. Since December 2014, Dr. Mattingly has served as a director of TRACON Pharmaceuticals, Inc. Previously, Dr. Mattingly served as the Chief Executive Officer of Trimeris, Inc., a biopharmaceutical company, from November 2007 until its merger with Synageva in November 2011. He also served on the Board of Directors of Trimeris, Inc. from November 2007 until November 2011. From 2005 to 2007, Dr. Mattingly was employed at Ambrx, Inc., a biopharmaceutical company, where he served as President and Chief Executive Officer. From 2003 to 2005, Dr. Mattingly served as Executive Vice President and Chief Operating Officer of CancerVax Corporation, a biotechnology company. From 1996 to 2003, he provided senior leadership in various management positions at Agouron Pharmaceuticals, Inc. and Pfizer, Inc., including serving as General Manager of the Agouron HIV division, Vice President, Product Development Group at Pfizer and Vice President, Global Marketing Planning at Pfizer. Dr. Mattingly holds a Pharm.D. degree from the University of Kentucky. The determination was made that Dr. Mattingly should serve on the Board of Directors as a result of his executive leadership experience in late-stage clinical development, public company expertise, and commercialization and business development experience with pharmaceuticals and biologics.

Bridget Martell, M.A., M.D., has served as a director since March 2021. Dr. Martell is currently the President and Chief Executive Officer of the privately held biotechnology company Artizan Biosciences, Inc. In December of 2021 she also joined Aligos Therapeutics Inc., a publicly traded biotechnology company, as an independent director. Dr. Martell has served as Acting Chief Medical Officer of Nobias Therapeutics from August 2020 to present and for Verseau Therapeutics since December 2020. In October 2017, Dr. Martell began working with Kura Oncology, a clinical-stage biopharmaceutical company, where she served as VP, Clinical Development from October 2017 to January 2020, as Acting Chief Medical Officer from January 2020 to August 2020 and as Senior Scientific Advisor from August 2020 to December 2021. Concurrently, Dr. Martell served as Chief Medical Officer of RRD International, a boutique Contract Research Organization from April 2018 to January 2020. From January 2015 to September 2017, Dr. Martell served as Senior Vice President, New Product Development at Juniper Pharmaceuticals, a publicly traded specialty pharmaceuticals company. From October 2011 to April 2013, she was Executive Director, Head Medical Affairs at Purdue Pharma L.P., a privately held pharmaceutical company. Previous to that, Dr. Martell held leadership roles of increasing responsibility at Pfizer, Inc., a publicly traded biopharmaceutical company from 2005 to 2011. Dr. Martell earned her B.S. in microbiology from Cornell University, her M.A. in molecular immunology from Boston University and her M.D. from the Chicago Medical School. She completed her internship and residency in internal medicine and was an internal medicine chief resident and RWJ Faculty Clinical Scholar at Yale University. Dr. Martell is board certified in both internal and addiction medicine. The determination was made that Dr. Martell should serve on the Board of Directors due to her diverse background of scientific, clinical and leadership experience in the development and success of numerous marketed products across multiple therapeutic categories.

Jay Moyes has served as a director since August 2017. Mr. Moyes has served as the Chief Financial Officer of Sera Prognostics, Inc., a public commercial stage biotechnology company focused on improving maternal and

7

Table of Contents

neonatal health, since March 2020. Mr. Moyes has served on the Board of Directors of BioCardia, Inc. since 2011, and on the Board of Directors of Puma Biotechnology, Inc. since 2012. He also served as a member of the Board of Directors of Predictive Technology Group, Inc. from February 2019 to December 2019, Osiris Therapeutics, Inc., from May 2006 to December 2017, and Integrated Diagnostics, a privately held molecular diagnostics company, from 2011 to 2016. Mr. Moyes served as a member of the Board of Directors of Amedica Corporation, a publicly traded orthopedics company, and as their Chief Financial Officer from 2013 to 2014. Mr. Moyes also served as Chief Financial Officer of CareDx, a publicly traded cardiovascular diagnostics company from 2008 to 2009. Prior to that, he served as Chief Financial Officer of Myriad Genetics, Inc., a publicly held molecular diagnostics company from 1993 until his retirement in November 2007. From 1991 to 1993, Mr. Moyes served as Vice President of Finance and Chief Financial Officer of Genmark, Inc., a privately held animal genetics company. Mr. Moyes held various positions with the accounting firm of KPMG from 1979 to 1991. He also served as a member of the Board of Trustees of the Utah Life Science Association from 1999 to 2006. Mr. Moyes holds a Masters of Business Administration from the University of Utah, a Bachelor of Arts in economics from Weber State University, and was formerly a Certified Public Accountant. The determination was made that Mr. Moyes should serve on our Board of Directors due to his experience as a member of the boards of directors of a number of companies in the life sciences industry, as well as his extensive finance and accounting experience.

Vaughn B. Himes, Ph.D. has served as Chief Technical Officer at Seagen, Inc., a publicly traded biotechnology company, since August 2016. Dr. Himes joined Seagen, Inc. as Executive Vice President, Technical Operations in April 2009 and served as Executive Vice President, Technical Operations and Process Science from July 2012 until August 2016. Previously, Dr. Himes was with ZymoGenetics, Inc. from November 2005 to March 2009, most recently as Senior Vice President, Technical Operations where his responsibilities included commercial and clinical manufacturing, supply chain and logistics, quality control and process development. From March 2003 to October 2005, he was Vice President, Manufacturing at Corixa, Inc. Prior to that, he held Vice President positions in manufacturing and development at Targeted Genetics and Genovo, Inc. Dr. Himes received a B.A. in Chemistry from Pomona College in California and a Ph.D. in Chemical Engineering from the University of Minnesota.

Each of the standing committees of our Board of Directors has diverse representation. In addition, on our Board of Directors there are two directors who hold medical doctorates, three directors who hold doctorates in scientific fields and four directors who hold a masters in business administration. The table below provides certain highlights of the composition of our Board of Directors as of the date of this Proxy Statement, as reported by our directors. Each of the categories listed in the table below has the meaning set forth in Nasdaq Rule 5605(f).

Board Diversity Matrix (as of April 1, 2022)

| Board Size: | ||||||||||||||

| Total Number of Directors 8 |

||||||||||||||

| Female | Male | Non-Binary | Gender Undisclosed |

|||||||||||

| Gender: |

||||||||||||||

| Number of Directors Based on Gender Identity |

2 | 5 | 1 | |||||||||||

| Number of Directors Who Identify in Any of the Categories Below: |

|

|||||||||||||

| White |

2 | 5 | ||||||||||||

| Two or More Races or Ethnicities |

||||||||||||||

| Demographic Background Undisclosed |

1 | |||||||||||||

Director Independence

Our Board of Directors has determined that Dr. Himes, Mr. Joseph, Dr. Martell, Dr. Mattingly and Mr. Moyes, are independent under the applicable Securities and Exchange Commission, or the SEC, rules and the criteria established by The Nasdaq Stock Market LLC, or Nasdaq.

8

Table of Contents

Relationships Among Directors, Executive Officers and Director Nominees

There are no family relationships among any of our directors, executive officers or director nominees.

Stockholder Communication with the Board of Directors

Stockholders who are interested in communicating directly with members of the Board of Directors, or the Board of Directors as a group, may do so by writing directly to the member(s) c/o Secretary, Achieve Life Sciences, Inc., 1040 West Georgia Street, Suite 1030, Vancouver, British Columbia, Canada V6E 4H1. The Secretary will promptly forward to the Board of Directors or the individually named directors all written communications received at the above address that the Secretary considers appropriate.

Related-Party Transactions Policy and Procedure

Our Audit Committee is responsible for reviewing and approving all related-party transactions and conflict of interest situations involving a principal stockholder, a member of the Board of Directors or senior management. Our Code of Conduct and Business Ethics requires our executive officers and directors to report any conflicts of interest with our interests to our Audit Committee, and generally prohibits our executive officers and directors from conflicts of interest with our interests. Waivers of our Code of Conduct and Business Ethics with respect to an executive officer or director may only be granted by the Board of Directors or, if permitted by Nasdaq and any other applicable stock exchanges rules, our Nominating and Governance Committee. We do not have a specific policy concerning approval of transactions with stockholders who own more than five percent of our outstanding shares.

Other than as disclosed below and in Proposal One: Election of Directors from January 1, 2021 to the present, there have been no transactions, and there are currently no proposed transactions, in which the amount involved exceeds $120,000 to which we or any of our subsidiaries was or is to be a party and in which any director, director nominee, executive officer, holder of more than 5% of our capital stock, or any immediate family member of any of these individuals, had or will have a direct or indirect material interest.

Board of Directors Committees

The Board of Directors has established separately designated Audit, Compensation and Nominating and Governance Committees to assist it in performing its responsibilities. The Board of Directors designates the members of these committees and the committee chairs annually, based on the recommendations of the Nominating and Governance Committee in consultation with the Chief Executive Officer and the Chairperson of the Board of Directors. The Nominating and Governance Committee reviews committee assignments from time to time and considers the rotation of committee chairpersons and members with a view towards balancing the benefits derived from the diversity of experience and viewpoints of the directors. The Board of Directors has adopted written charters for each of these committees, which are available on our website at ir.achievelifesciences.com under Corporate Governance. The chairperson of each committee develops the agenda for that committee and determines the frequency and length of committee meetings.

Audit Committee and Audit Committee Financial Expert

The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and is currently comprised of Jay Moyes (Chairperson), Donald Joseph, Martin Mattingly and Bridget Martell, each of whom the Board of Directors has determined satisfies the applicable SEC and Nasdaq independence requirements for audit committee members. The Board of Directors has also determined that Mr. Moyes is an audit committee financial expert, as defined by the applicable rules of the SEC. The Audit Committee held four meetings during fiscal year 2021.

9

Table of Contents

Audit Committee Responsibilities

The Audit Committee is responsible for, among other things:

| | reviewing the independence, qualifications, services, fees and performance of our independent registered public accounting firm; |

| | appointing, replacing and discharging our independent registered public accounting firm; |

| | pre-approving the professional services provided by our independent registered public accounting firm; |

| | reviewing the scope of the annual audit and reports and recommendations submitted by our independent registered public accounting firm; and |

| | reviewing our financial reporting and accounting policies, including any significant changes, with our management and our independent registered public accounting firm. |

Please see the sections entitled Report of the Audit Committee and Proposal Two: Ratification of Appointment of Independent Registered Public Accounting Firm for further matters related to the Audit Committee.

Compensation Committee

The Compensation Committee currently consists of Martin Mattingly (Chairperson), Donald Joseph and Bridget Martell, each of whom the Board of Directors has determined satisfies the applicable SEC and Nasdaq independence requirements. In addition, each member of the Compensation Committee has been determined to be a non-employee director under Rule 16b-3 as promulgated under the Exchange Act. The Compensation Committee reviews and recommends to the Board of Directors the compensation for our executive officers and our non-employee directors for their services as members of the Board of Directors. The Compensation Committee does not have any explicit authority to delegate its duties. The Compensation Committee held five meetings during fiscal year 2021.

In 2021, the Compensation Committee retained Aons Human Capital Solutions practice, a division of Aon plc (formerly known as Radford) (Aon) and a provider of compensation market intelligence to the technology and life sciences industries, to provide a report summarizing relevant benchmark data relating to industry-appropriate peers and make recommendations regarding base salary, target total cash (base salary plus target cash incentives), and terms of long-term equity incentive awards for our executives. No work performed by Aon during fiscal year 2021 raised a conflict of interest.

Please see the sections entitled Executive Compensation and Director Compensation for further matters related to the Compensation Committee and director and executive officer compensation matters.

Nominating and Governance Committee

The Nominating and Governance Committee currently consists of Donald Joseph (Chairperson), Bridget Martell, Martin Mattingly, and Jay Moyes, each of whom the Board of Directors has determined satisfies the applicable SEC and Nasdaq independence requirements.

The Nominating and Governance Committee reviews, evaluates and proposes candidates for election to our Board of Directors, and considers any nominees properly recommended by stockholders. The Nominating and Governance Committee promotes the proper constitution of our Board of Directors in order to meet its fiduciary obligations to our stockholders, and oversees the establishment of, and compliance with, appropriate governance standards. The Nominating and Governance Committee held four meetings during fiscal year 2021.

10

Table of Contents

Board of Directors Leadership Structure

Richard Stewart has served as the Chairman of the Board since the Merger and our Executive Chairman since September 2020 and brings extensive executive leadership and experience with the development of our lead product candidate, cytisinicline. John Bencich has served as Chief Executive Officer since September 2020. Mr. Bencich is an experienced financial executive with over 20 years guiding financial and corporate strategy in the life sciences and technology industries. Our Board of Directors believes that the current Board leadership structure, coupled with a strong emphasis on Board independence and the role of the lead independent director, provides effective independent oversight of management. Independent directors and management sometimes have different perspectives and roles in strategy development. Our independent directors bring experience, oversight and expertise from outside of our company. The Board also believes the current separation of the Chairman and Chief Executive Officer roles allows the Chief Executive Officer to focus his time and energy on operating and managing the Company and leverages the Chairmans experience and perspective.

Lead Independent Director

Donald Joseph has served as our lead independent director since August 2017, and provides an additional measure of balance, ensures the Boards independence and enhances its ability to fulfill its management oversight responsibilities. As lead independent director, among other responsibilities, Mr. Joseph presides over regularly scheduled meetings at which only our independent directors are present, serves as a liaison between the Chief Executive Officer and the independent directors and performs such additional duties as our Board of Directors may otherwise determine and delegate.

Board of Directors Role in Risk Oversight

Consistent with our leadership structure, our management is charged with the day-to-day management of risks that we face or may face and provides our Board of Directors with quarterly risk assessment and mitigation strategy updates, while our Board of Directors and its committees are responsible for oversight of risk management. The Audit Committee has responsibility for oversight of financial reporting related risks, including those related to our accounting, auditing and financial reporting practices. In addition, the Audit Committee annually reviews and assesses the adequacy of our risk management policies and procedures with regard to identifying our management of financial risks, reviews the quarterly updates on these risks that are received from management, and assesses the adequacy of managements implementation of appropriate systems to mitigate and manage financial risks. Furthermore, under our Code of Business Conduct and Ethics, the Audit Committee is responsible for considering reports of conflicts of interest involving officers and directors. The Nominating and Governance Committee oversees corporate governance risks, including implementing procedures to ensure that the Board of Directors operates independently of management and without conflicts of interest. In addition, the Nominating and Governance Committee oversees compliance with our Code of Business Conduct and Ethics. The Compensation Committee oversees risks associated with our compensation policies, plans and practices. The Audit Committee, the Nominating and Governance Committee and the Compensation Committee each report to the Board of Directors regarding the foregoing matters, and the Board of Directors approves any changes in corporate policies, including those pertaining to risk management.

The Board of Directors has also adopted a Whistle Blowing Policy, which provides a means by which concerns about actual and suspected violations of our Code of Business Conduct and Ethics and other public interest matters are to be reported. We recognize that individuals may not feel comfortable reporting a matter directly to the appropriate persons at the Company and therefore the Whistle Blowing Policy provides a mechanism by which a person may report a matter to Nasdaq OMX Group Corporate Services, Inc., a third party retained by us. Under the policy, the Chairperson of the Audit Committee determines whether and, if so, how an investigation is to be conducted and, together with the full Audit Committee in certain instances, resolves reported violations. In all cases, a report of the outcome is to be made to the Board of Directors.

11

Table of Contents

Risk Assessment of Compensation Programs

We have determined that our compensation policies, plans and practices are appropriately balanced and do not create risks that are reasonably likely to have a material adverse effect on our company. To make this determination, our management reviewed the compensation policies, plans and practices for our executive officers, as well as for all other employees. We assessed the following features of our compensation, plans and practices: design, payment methodology, potential payment volatility, relationship to our financial results, length of performance period, risk-mitigating features, performance measures and goals, oversight and controls, and plan features and values compared to market practices. Based on this review, we believe that our compensation policies, plans and practices do not create risks that are reasonably likely to have a material adverse effect on our company.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee during fiscal year 2021 served as one of our officers, former officers or employees nor received directly or indirectly compensation from the Company, other than in the capacity as a member of our Board and Compensation Committee. There was no direct or indirect control by the members of the Compensation Committee of the Company. No member of the Compensation Committee, directly or indirectly, is the beneficial owner of more than 10% of the Companys equity, nor are they an executive officer, employee, director, general partner or a managing member of one or more entities that are together the beneficial owners of more than 10% of the Companys equity. The Compensation Committee members are not aware of any business or personal relationship between (i) a member of the Compensation Committee and any person who has provided or is providing advice to the Compensation Committee; and (ii) an executive officer of the Company and any firm or other person who is employed or is employing such person to provide advice to the Compensation Committee. During fiscal year 2021, none of our executive officers served as a member of the compensation committee of any other entity, one of whose executive officers served as a member of our Board of Directors or Compensation Committee, and none of our executive officers served as a member of the Board of Directors of any other entity, one of whose executive officers served as a member of our Compensation Committee. From January 2018 to October 2021, Cindy Jacobs, our President and Chief Medical Officer, served on the Board of Directors of Renown Pharma Limited, of which Richard Stewart, our Executive Chairman and Chairman of the Board, and Anthony Clarke, our Chief Scientific Officer, are executive officers. Dr. Jacobs did not receive any direct or indirect compensation for serving as a director of Renown.

Director Nomination Process

Director Qualifications

Members of our Board of Directors must have broad experience and business acumen, a record of professional accomplishment in his or her field, and demonstrate honesty and integrity consistent with our values. In evaluating director nominees, the Nominating and Governance Committee considers a variety of factors, including, without limitation, the director nominees skills, expertise and experience, wisdom, integrity, diversity, the ability to make independent analytical inquiries, the ability to understand our business environment, the willingness to devote adequate time to Board of Directors duties, the interplay of the director nominees experience and skills with those of other directors, and the extent to which the director nominee would be a desirable addition to the Board of Directors and any committees of the Board of Directors. The Nominating and Governance Committee may also consider such other factors as it may deem are in the best interests of us and our stockholders. Additionally, in accordance with the applicable securities laws and Nasdaq requirements, a majority of the members of the Board of Directors must be independent. We do not have a policy regarding diversity, but the Nominating and Governance Committee does and will continue to consider each candidates gender, racial, ethnic and sexual identity, experiences and qualities as described above and how these identities, experiences and qualities complement the diversity of the Board of Directors.

12

Table of Contents

Identification of Nominees by the Board of Directors

The Nominating and Governance Committee identifies nominees by first determining the desired skills and experience of a new nominee based on the qualifications discussed above. The Nominating and Governance Committee will solicit names for possible candidates from other directors, our senior level executives and individuals personally known to the directors, as well as third-party search firms. The Nominating and Governance Committee evaluates all possible candidates, including individuals recommended by stockholders, using the same criteria.

Stockholder Nominations

Our bylaws contain provisions that address the process by which a stockholder may nominate an individual to stand for election to the Board of Directors. The Nominating and Governance Committee will consider nominees properly recommended by stockholders. Stockholders wishing to submit nominations must provide timely written notice to our Corporate Secretary containing the following information:

| | the name and address of the stockholder proposing such business, which we refer to as a Nominating Person; |

| | the class and number of our shares that are owned beneficially by the Nominating Person; |

| | description of any agreement, arrangement or understanding with respect to Nominating Person and their respective affiliates or associates and each director nominee proposed by the Nominating Person; |

| | description of any agreement, arrangement or understanding that has been entered into as of the date of the notice by the Nominating Person, whether or not such instrument or right is subject to settlement in underlying shares of capital stock of ours, the effect or intent of which is to mitigate loss to, manage risk or benefit of share price changes for, or increase or decrease the voting power of, the Nominating Person, with respect to securities of the corporation; |

| | the Nominating Person is a holder of record of stock of ours entitled to vote at the Annual Meeting and intends to appear in person or by proxy at the meeting to propose such nomination; |

| | the Nominating Person intends to deliver a proxy statement and/or form of proxy to holders of a sufficient number of holders of our voting shares to elect such nominee or nominees; |

| | with respect to each director nominee proposed by the Nominating Person, such nominees written consent to being named in our proxy statement as a nominee and to serving as a director, if elected; and |

| | such other information regarding the Nominating Person and each nominee proposed by the Nominating Person as would be required to be disclosed in a proxy statement or other filings required to be made in connection with the solicitations or proxies for election of directors, or would be otherwise required, in each case pursuant to Regulation 14A under the Exchange Act and the rules and regulations promulgated under the Exchange Act. |

To be timely, a Nominating Persons notice in respect of a director nomination must be delivered to or mailed and received by our Corporate Secretary at our principal executive offices, Achieve Life Sciences, Inc., 1040 West Georgia Street, Suite 1030, Vancouver, British Columbia, Canada V6E 4H1, not less than 90 nor more than 120 calendar days prior to the first anniversary of the previous years annual meeting. In the event, however, that the date of the Annual Meeting is more than 30 days before or more than 60 days after the anniversary date, notice must be delivered no more than 120 and not less than 90 days prior to the Annual Meeting or the close of business on the tenth day following the date which public disclosure of the date of such meeting is made.

Hedging and Pledging Prohibitions

As part of our Insider Trading Policy, our employees (including our executive officers) and the non-employee members of our board of directors are prohibited or require pre-clearance approval by our Compliance Officer

13

Table of Contents

from: (i) engaging in transactions involving options or other derivative securities on our securities, such as puts and calls, whether on an exchange or in any other market; (ii) engaging in hedging or monetization transactions involving our securities, such as zero-cost collars and forward sale contracts; (iii) engaging in short sales of our securities, including short sales against the box; and (iv) using or pledging our securities as collateral in a margin account or as collateral for a loan unless the pledge has been approved by our Compliance Officer.

Code of Ethics

We believe that sound corporate governance policies are essential to earning and retaining the trust of investors. We are committed to maintaining the highest standards of integrity. We have adopted a Code of Business Conduct and Ethics that is applicable to our principal executive officer, our principal financial officer and our principal accounting officer, as well as to all of our other employees and directors, and have posted such code on our website at ir.achievelifesciences.com.

14

Table of Contents

ELECTION OF DIRECTORS

Nominees

The following persons are our 2022 director nominees, each of whom was recommended by the Nominating and Governance Committee and approved by the Board of Directors for nomination at the Annual Meeting:

| | John Bencich |

| | Vaughn Himes |

| | Cindy Jacobs |

| | Donald Joseph |

| | Bridget Martell |

| | Martin Mattingly |

| | Jay Moyes |

| | Richard Stewart |

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominees named above. If a nominee is unable to serve or for good cause will not serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who is designated by the present Board of Directors to fill the vacancy. Each nominee has consented to being named in this Proxy Statement and to serve if elected. We do not expect that any nominee will be unable to serve or for good cause will not serve as a director. Each director is elected annually to serve until the next annual meeting of stockholders or until a successor has been duly elected and has qualified.

Biographies of our 2022 director nominees are located above under the heading Board of Directors General.

Director Compensation Overview

The charter of the Compensation Committee provides that the Compensation Committee is to recommend to the Board of Directors matters related to director compensation. The director compensation package for non-employee directors consists of annual cash compensation and stock options exercisable to purchase shares of our common stock. None of our employees who also serve as directors are entitled to receive compensation for service as a director. Therefore, Richard Stewart, John Bencich and Cindy Jacobs receive no compensation for their service as a director. Our director compensation policy for fiscal year 2021 is set forth below under the heading Director Compensation Policy 2021 Director Compensation.

Director Compensation Policy

2021 Director Compensation

As part of its evaluation of compensation levels for the 2021 fiscal year, the Compensation Committee recommended, and the Board of Directors approved the retention of Aon to review compensation levels of our independent directors and committee members. Aon was instructed to benchmark and make recommendations regarding the initial and annual retainer amounts for directors and chairpersons of the Board of Directors and the various committees, as well as the amounts and terms of initial and annual long-term equity incentive awards for directors. On recommendation by Aon in 2021, the equity compensation and cash compensation for non-employee directors in connection with their service on the Board of Directors remains unchanged and is as follows:

| | An annual retainer of $60,000 was paid to the Lead Independent Director and $40,000 was paid to all other non-employee directors. These retainers were paid in quarterly installments. Each quarterly |

15

Table of Contents

| payment was conditioned on the director remaining a director on the date of actual payment, which was typically within 10 days following the completion of the respective calendar quarter. |

| | Additional annual cash compensation for the chairpersons and members of each committee as set forth in the following table and paid on the same schedule and on the same terms as the non-employee director compensation described above: |

| Chairperson | Other Members | |||||||

| Audit Committee |

$ | 15,000 | $ | 7,500 | ||||

| Compensation Committee |

$ | 10,000 | $ | 5,000 | ||||

| Nominating and Governance Committee |

$ | 7,500 | $ | 3,500 | ||||

| | Any new director would have received a one-time initial grant of stock options to acquire 5,650 shares of our common stock upon becoming a director, which would vest monthly over three years from the date of grant. |

| | Each director that was re-elected by our stockholders at an annual meeting was to receive a grant of stock options to acquire 1,100 shares of common stock. However, in May 2021, the Compensation Committee and Board determined to grant an additional 3,750 stock options to each re-elected director based upon the recommendation by Aon after an evaluation of the recent market data and changes in the Companys capital structure. Each annual stock option vests in full on the earlier of the first anniversary of the date of grant or the date immediately prior to our next annual meeting of stockholders. |

Director Compensation Paid for 2021

The following table summarizes all compensation paid to or earned by non-employee directors who served during 2021 as compensation for board service during the 2021 fiscal year. Dr. Martell was appointed to our Board of Directors in March 2021 and Scott Cormack and Stewart Parker did not stand for re-election for 2021, while Dr. Himes was appointed to our Board of Directors in March, 2022 and is not included in the table below as he did not serve as a director in 2021.

| Name |

Fees Earned or Paid in Cash ($) |

Option Awards ($)(1)(2) |

Total ($) |

|||||||||

| Scott Cormack(3) |

14,516 | 0 | 14,516 | |||||||||

| Donald Joseph |

78,506 | 29,846 | 108,352 | |||||||||

| Bridget Martell |

42,036 | 55,896 | 97,932 | |||||||||

| Martin Mattingly |

61,000 | 29,846 | 90,846 | |||||||||

| Jay Moyes |

73,125 | 29,846 | 102,971 | |||||||||

| Stewart Parker(3) |

21,758 | 0 | 21,758 | |||||||||

| (1) | The dollar amounts reflect the aggregate grant date fair value of equity awards granted within the fiscal year in accordance with the Financial Accounting Standards Board, or FASB, Accounting Standards Codification Topic 718 for stock-based compensation. These amounts do not correspond to the actual cash value that will be recognized by the directors when received. Assumptions used in the calculation of the amounts in this column are included in note 12 to our audited consolidated financial statements included in our 2021 Annual Report on Form 10-K. As of December 31, 2021, the following directors had the following number of options outstanding: |

| | Donald Joseph: 5,882 options, of which 2,132 were vested as of December 31, 2021. |

| | Bridget Martell: 5,650 options, of which 1,413 were vested as of December 31, 2021 |

| | Martin Mattingly: 5,872 options, of which 2,122 were vested as of December 31, 2021. |

16

Table of Contents

| | Jay Moyes: 5,882 options, of which 2,132 were vested as of December 31, 2021. |

| (2) | These options were granted on May 11, 2021 under our 2018 Equity Incentive Plan and vest 100% on May 11, 2022. |

| (3) | Mr. Cormack and Ms. Parker did not stand for re-election at our 2021 annual stockholders meeting. |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE ELECTION OF ALL OF THE NOMINEES.

17

Table of Contents

In connection with the consolidated financial statements for the fiscal year ended December 31, 2021, the Audit Committee has:

| | reviewed and discussed the audited consolidated financial statements with management; |

| | discussed with PwC, our independent registered public accounting firm, the matters required to be discussed by Auditing Standard No. 16 adopted by the Public Company Accounting Oversight Board (United States) regarding Communication with Audit Committees; and |

| | received the written disclosures and letter from PwC required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firms communications with the audit committee concerning independence, and has discussed with PwC its independence from us. |

Based on the Audit Committees review of the audited consolidated financial statements and its discussions with management and PwC, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements for the 2021 fiscal year be included in our Annual Report on Form 10-K filed with the SEC.

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

Jay Moyes, Chairperson

Donald Joseph

Bridget Martell

Martin Mattingly

The information contained in the report above shall not be deemed to be soliciting material or to be filed with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, except to the extent specifically incorporated by reference in such filing.

18

Table of Contents

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed PricewaterhouseCoopers LLP, or PwC, as our independent registered public accounting firm for the fiscal year ending December 31, 2022. PwC audited our financial statements for the fiscal years ended December 31, 2021 and 2020. A representative of PwC will be present at the Annual Meeting, will be given the opportunity to make a statement, if he or she desires, and will be available to respond to appropriate questions.

Proxies solicited by management for which no specific direction is included will be voted FOR the ratification of the appointment of PwC as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

Fees Billed by Independent Registered Public Accounting Firm

The following is a summary of the fees billed by PwC for the fiscal years ended December 31, 2021 and December 31, 2020: Amounts are presented in USD.

| Fee Category | Fiscal 2021 PwC Fees(1) | Fiscal 2020 PwC Fees(1) | ||||||

| Audit Fees |

$ | 153,155 | (2) | $ | 145,692 | (2) | ||

| Audit-Related Fees |

$ | 53,806 | $ | 136,439 | ||||

| Tax Fees |

| $ | 15,142 | (3) | ||||

| All Other Fees |

| | ||||||

|

|

|

|

|

|||||

| Total Fees |

$ | 206,961 | $ | 297,273 | ||||

| (1) | Accountant fees and services charged by PwC are paid in Canadian dollars and shown in USD. For fiscal 2021, the fees were CDN$259,426 and was converted at an average exchange rate of US$1.00=CDN$1.2535. For fiscal 2020, the fees were CDN$398,792 and was converted at an average exchange rate of US$1.00=CDN$1.3415. |

| (2) | Audit Fees for fiscal 2021 and fiscal 2020 are fees billed and to be billed for the audit of our consolidated financial statements, review of the consolidated financial statements included in our quarterly reports, and for services in connection with regulatory filings and engagements. |

| (3) | Tax fees billed by PwC relate to tax consulting services provided by PwC to Achieve Life Sciences, Inc. in fiscal 2020 and 2021. |

Audit Fees. Consists of fees billed for professional services rendered for the audit of our consolidated financial statements and review of the interim consolidated financial statements included in quarterly reports on Form 10-Q that are filed with the SEC.

Audit-Related Fees. Consists of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements, including accounting consultations and fees related to registration of securities.

Policy on Audit Committee Pre-Approval of Audit Services and Permissible Non-Audit Services

The Audit Committees policy is to pre-approve all audit and permissible non-audit services performed by our independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. For audit services, our independent registered public accounting firm typically provides audit service detail in advance of the second quarter meeting of the Audit Committee, which outlines the scope of the audit and related audit fees. If agreed to by the Audit Committee, an engagement letter is formally accepted by the Audit Committee.

19

Table of Contents

For non-audit services, our senior management will submit from time to time to the Audit Committee for approval non-audit services that it recommends the Audit Committee engage our independent registered public accounting firm to provide for the fiscal year. Our senior management and our independent registered public accounting firm will each confirm to the Audit Committee that each non-audit service is permissible under all applicable legal requirements. A budget, estimating non-audit service spending for the fiscal year, will be provided to the Audit Committee along with the request. The Audit Committee must approve both permissible non-audit services and the budget for such services. The Audit Committee will be informed routinely as to the non-audit services actually provided by our independent registered public accounting firm pursuant to this pre-approval process.

For the 2020 and 2021 fiscal years, the Audit Committee approved all of the services provided by PwC described above.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2022.

20

Table of Contents

The following table provides information regarding our current executive officers as of April 1, 2022.

| Name | Age | Position With the Company | ||||

| John Bencich |

44 | Chief Executive Officer | ||||

| Richard Stewart |

63 | Executive Chairman | ||||

| Cindy Jacobs |

64 | President and Chief Medical Officer | ||||

| Anthony Clarke |

66 | Chief Scientific Officer | ||||

| Jerry Wan |

40 | Principal Accounting Officer | ||||

Following are the biographies of the foregoing persons, except the biographies of Mr. Bencich, Mr. Stewart and Dr. Jacobs, which are located above under the heading Board of DirectorsGeneral.

Anthony Clarke has served as our Chief Scientific Officer since August 2017. Previously, Dr. Clarke served as our President and director from August 2017 to September 2020. Prior to the Merger, Dr. Clarke served as Achieve Life Science, Inc.s Chief Scientific Officer and as a member of Achieve Life Science, Inc.s Board of Directors since 2015. Dr. Clarke is a founder and director of Ricanto Limited since 2009. From 2016 to the present, Dr. Clarke has been Chief Scientific Officer of Renown Pharma Limited. Dr. Clarke was Chief Scientific Officer of Huxley Pharmaceuticals, Inc. during 2009, prior to Huxley Pharmaceuticals, Inc.s acquisition by BioMarin Pharmaceutical Inc. Prior to Achieve, Dr. Clarke served as Chief Scientific Officer of Brabant Pharma Limited from 2013 to 2014 prior its acquisition by Zogenix Inc. Dr. Clarke served as Company Secretary of Alexza UK Ltd. and as Vice President International Development Operations of Alexza Pharmaceuticals Inc., a pharmaceutical development company, holding both positions from 2008 to 2009. Dr. Clarke served as the Vice President, Clinical Research and Regulatory Affairs at Amarin Corporation from 2005 to 2008. In addition, Dr. Clarke was Senior Director, Clinical and Regulatory Affairs, of Cephalon Europe and as Senior Director, Worldwide Pain Management, of Cephalon, Inc. from 2000 to 2004. Dr. Clarke held a number of management roles in other pharmaceutical companies prior to 2000 as well as academic posts and honorary academic posts. Dr. Clarke holds a Bachelors degree in Pharmacology from the University of Sunderland and a Ph.D. in psychopharmacology from the University of London. He was a Fellow of the Royal Statistical Society (UK) and is a current Fellow of the Royal Society of Medicine (UK).

Jerry Wan has served as our Principal Accounting Officer since September 2020 and served as our Senior Director, Accounting Operations since June 2018. He previously served as our Director, Accounting Operations from August 2017 to June 2018 and as the Director, Accounting Operations of OncoGenex Pharmaceuticals, Inc. from July 2014 to August 2017. From July 2012 to July 2014, Mr. Wan served as OncoGenexs Senior Manager, Finance and Accounting and, from October 2011 to July 2012, as its Manager, Financial Reporting and Analysis. Prior to joining OncoGenex, Mr. Wan served as Manager, Management Reporting at Gateway Casinos and Entertainment Limited from 2010 to 2011. From 2006 to 2010, Mr. Wan was an employee of PricewaterhouseCoopers LLP, an international professional services firm, where he last served as Manager, Audit and Assurance Group. Mr. Wan received his Bachelor of Commerce in Accounting from The University of British Columbia and a Chartered Accountant Designation from the Canadian Institute of Chartered Accountants.

21

Table of Contents

During the 2021 fiscal year, our Named Executive Officers and their respective positions were as follows: John Bencich, Chief Executive Officer; Richard Stewart, Executive Chairman; and Cindy Jacobs, Ph.D., M.D., President and Chief Medical Officer.

Mr. Bencich, Dr. Jacobs and Mr. Stewart are referred to as our Named Executive Officers for purposes of this Proxy Statement.

SEC rules require that this discussion regarding 2021 executive officer compensation cover executive officers that served during 2021.

Summary Compensation Table

The following table sets forth information regarding the compensation of our Named Executive Officers for each of the fiscal years ended December 31, 2021, 2020 and 2019. The components of the compensation reported in the Summary Compensation Table are described below.

| Name and Principal Position | Year | Salary ($) |

Stock Awards ($)(1) |

Option ($)(2) |

Non-Equity Plan Compensation |

Total ($) |

||||||||||||||||||

| John Bencich, |

2021 | 465,000 | 196,350 | 648,283 | 302,250 | 1,611,883 | ||||||||||||||||||

| Chief Executive Officer |

2020 | 420,914 | (4) | | 263,208 | 199,610 | 883,732 | |||||||||||||||||

| 2019 | 405,300 | | 43,657 | 121,590 | 570,547 | |||||||||||||||||||

| Richard Stewart, |

2021 | 400,000 | 130,900 | 540,235 | 260,000 | 1,331,135 | ||||||||||||||||||

| Executive Chairman |

2020 | 473,846 | (5) | | 333,029 | 225,630 | 1,032,505 | |||||||||||||||||

| 2019 | 500,000 | | 109,144 | 187,500 | 796,644 | |||||||||||||||||||

| Cindy Jacobs, |

2021 | 440,000 | 65,450 | 324,141 | 228,800 | 1,058,391 | ||||||||||||||||||

| President and Chief Medical Officer |

2020 | 420,231 | (6) | | 194,091 | 159,580 | 773,902 | |||||||||||||||||

| 2019 | 413,230 | | 43,657 | 123,970 | 580,857 | |||||||||||||||||||

| (1) | The dollar amounts in this column reflect the aggregate grant date fair value of equity awards granted during the fiscal year in accordance with FASB Accounting Standards Codification Topic 718 for stock-based compensation. |

| (2) | The dollar amounts in this column reflect the aggregate grant date fair value of equity awards granted during the fiscal year in accordance with FASB Accounting Standards Codification Topic 718 for stock-based compensation. These amounts do not correspond to the actual cash value that will be recognized by each of the Named Executive Officers when received. For a discussion of the assumptions and methodologies used to value the awards reported in this column, see note 12 to our audited consolidated financial statements, which are included in our 2021 Annual Report on Form 10-K. |

| (3) | The dollar amounts in this column reflect the aggregate non-equity incentive plan compensation earned by each Named Executive Officer in 2021. For more information, see 2021 Bonuses below. |

| (4) | Mr. Bencich was appointed as Chief Executive Officer and resigned as Chief Financial Officer and Chief Operating Officer as of September 28, 2020. |

| (5) | Mr. Stewart resigned as our Chief Executive Officer and was appointed Executive Chairman of the Board as of September 28, 2020. |

| (6) | Dr. Jacobs was appointed President as of September 28, 2020. |

2021 Equity Awards

Equity awards are granted to executive officers at the discretion of the Compensation Committee. In January 2021, the Compensation Committee granted option to purchase 60,000 shares of common stock to John Bencich,

22

Table of Contents

options to purchase 50,000 shares of common stock to Richard Stewart, and options to purchase 30,000 shares of common stock to Cindy Jacobs. The stock options have an exercise price of $13.09 and vested as to 25% on January 26, 2022, and thereafter vest in equal monthly installments over 36 months. At the same time, the Compensation Committee also granted 15,000 restricted stock units (RSUs) to John Bencich, 10,000 RSUs to Richard Stewart and 5,000 RSUs to Cindy Jacobs. The RSUs vest as to 50% of the total options on the achievement of the positive Phase 3 ORCA-2 data results and thereafter 50% vest on the first anniversary of the achievement.

2021 Bonuses

Annual bonuses for our executive officers are based on the achievement of corporate performance objectives, which in 2021 included the achievement of clinical development, financial milestones and stretch goals to accelerate the ORCA program. In January 2022, our Compensation Committee determined that approximately 130% of our 2021 corporate performance objectives were achieved and determined that 130% of each executive officers target bonus should be awarded based on the completion of the last follow-up phase of the Phase 3 ORCA-2 clinical trial, initiation of the Phase 3 ORCA-3 clinical trial, successfully obtaining NIH grant funding for development of cytisinicline for nicotine e-cigarette cessation, completion of regulatory and operational activities for the ORCA-V1 clinical trial, expansion of the patent portfolio, and completion of financing transactions.

With respect to the payment of these bonuses, John Bencichs target bonus was equal to 50% of his annual base salary of $465,000 and he was awarded $302,250, Richard Stewarts target bonus was equal to 50% of his annual base salary of $400,000 and he was awarded $260,000, and Cindy Jacobs target bonus was equal to 40% of her annual base salary of $440,000 and she was awarded $228,800.

Outstanding Equity Awards at Fiscal Year-End

The following table provides information regarding the outstanding equity awards held by the Named Executive Officers as of December 31, 2021.

| OPTION AWARDS | STOCK AWARDS | |||||||||||||||||||||||

| Name |

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price ($) |

Option Expiration Date |

Number of Shares or Units or Other Rights that Have Not Vested(#) |

Market Value of Shares or Units or Other Rights that Have Not Vested ($) |

||||||||||||||||||

| John Bencich, |

18 | | 6,974.00 | 08/12/24 | (1) | | | |||||||||||||||||

| Chief Executive Officer |

11 | | 4,092.00 | 05/19/25 | (2) | | | |||||||||||||||||

| 1,370 | | 578.00 | 08/01/27 | (3) | | | ||||||||||||||||||

| 1,068 | 182 | 67.40 | 7/26/28 | (4) | | | ||||||||||||||||||

| 2,032 | 468 | 51.20 | 09/20/28 | (5) | | | ||||||||||||||||||

| 1,097 | 403 | 28.40 | 01/29/29 | (6) | | | ||||||||||||||||||

| 500 | | 28.40 | 01/29/29 | (7) | | | ||||||||||||||||||

| 4,800 | 5,200 | 11.20 | 01/28/30 | (8) | | | ||||||||||||||||||

| | 20,000 | 10.36 | 11/16/30 | (9) | | | ||||||||||||||||||

| | 60,000 | 13.09 | 01/26/31 | (10) | | | ||||||||||||||||||

| | | | | 15,000 | (11) | 196,350 | ||||||||||||||||||

23

Table of Contents

| OPTION AWARDS | STOCK AWARDS | |||||||||||||||||||||||

| Name |

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price ($) |

Option Expiration Date |

Number of Shares or Units or Other Rights that Have Not Vested(#) |

Market Value of Shares or Units or Other Rights that Have Not Vested ($) |

||||||||||||||||||

| Richard Stewart, |

2,222 | 378 | 67.40 | 07/26/28 | (4) | | | |||||||||||||||||

| Executive Chairman |

4,105 | 945 | 51.20 | 09/20/28 | (5) | | | |||||||||||||||||

| 2,736 | 1,014 | 28.40 | 01/29/29 | (6) | | | ||||||||||||||||||

| 1,250 | | 28.40 | 01/29/29 | (7) | | | ||||||||||||||||||

| 10,785 | 11,715 | 11.20 | 01/28/30 | (8) | | | ||||||||||||||||||

| | 15,000 | 10.36 | 11/16/30 | (9) | | | ||||||||||||||||||

| | 50,000 | 13.09 | 01/26/31 | (10) | | | ||||||||||||||||||

| | | | | 10,000 | (11) | 130,900 | ||||||||||||||||||

| Cindy Jacobs, |

6 | | 28,600.00 | 05/08/22 | (12) | | | |||||||||||||||||

| President and Chief Medical Officer |

9 | | 26,290.00 | 03/12/23 | (13) | | | |||||||||||||||||

| 11 | | 25,938.00 | 03/14/24 | (14) | | | ||||||||||||||||||

| 17 | | 4,092.00 | 05/19/25 | (2) | | | ||||||||||||||||||

| 1,370 | | 578.00 | 08/01/27 | (3) | | | ||||||||||||||||||

| 860 | 140 | 67.40 | 07/26/28 | (4) | | | ||||||||||||||||||

| 1,508 | 342 | 51.20 | 09/20/28 | (5) | | | ||||||||||||||||||

| 1,097 | 403 | 28.40 | 01/29/29 | (6) | | | ||||||||||||||||||

| 500 | | 28.40 | 01/29/29 | (7) | | | ||||||||||||||||||

| 4,800 | 5,200 | 11.20 | 01/28/30 | (8) | | | ||||||||||||||||||

| | 12,000 | 10.36 | 11/16/30 | (9) | | | ||||||||||||||||||

| | 30,000 | 13.09 | 01/26/31 | (10) | | | ||||||||||||||||||

| | | | | 5,000 | (11) | 65,450 | ||||||||||||||||||