FWP: Filing under Securities Act Rules 163/433 of free writing prospectuses

Published on June 6, 2018

Nasdaq: “ACHV” Corporate Presentation June 2018 Issuer Free Writing Prospectus Filed Pursuant to Rule 433 Registration Statement No. 333-224840 June 6, 2018

Forward Looking Statements This presentation contains forward-looking statements, including, but not limited to, statements regarding the timing of planned clinical development activities of cytisine; the projected path toward potential regulatory approval; the safety, efficacy and commercial potential of cytisine; the potential market for cytisine; the benefits of cytisine relative to competitors; the anticipated benefits of cytisine; plans, objectives, expectations and intentions with respect to future operations. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. Achieve Life Science, Inc. (Achieve) may not actually achieve its plans or product development goals in a timely manner, if at all, or otherwise carry out the intentions or meet the expectations or projections disclosed in these forward-looking statements. These statements are based on management's current expectations and beliefs and are subject to a number of risks, uncertainties and assumptions that could cause actual results to differ materially from those described in the forward-looking statements, including, among others, general business and economic conditions; the need for and ability to obtain additional financing; the risk that cytisine may not demonstrate the hypothesized or expected benefits; the risk that cytisine will not receive regulatory approval or be successfully commercialized; the risk that new developments in the smoking cessation landscape require changes in business strategy or clinical development plans; the risk that Achieve's intellectual property may not be adequately protected; other risks associated with the process of developing, obtaining regulatory approval for and commercializing drug candidates that are safe and effective for use as human therapeutics; and the other factors described in the risk factors set forth in Achieve's filings with the Securities and Exchange Commission from time to time, including Achieve's Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q. Achieve undertakes no obligation to update the forward-looking statements contained herein or to reflect events or circumstances occurring after the date hereof, other than as may be required by applicable law.

Free Writing Prospectus This presentation highlights basic information about us and the contemplated offering. Because it is a summary that has been prepared solely for informational purposes, it does not contain all of the information that you should consider before investing in our company. Except as otherwise indicated, this presentation speaks only as of the date hereof. Neither the Securities and Exchange Commission (SEC) nor any other regulatory body has approved or disapproved of our securities or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. This presentation includes industry and market data that we obtained from industry publications and journals, third-party studies and surveys, internal company studies and surveys, and other publicly available information. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this presentation, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. In addition, we do not know all of the assumptions that were used in preparing the forecasts from the sources relied upon or cited herein. We have filed a Registration Statement on Form S-1 with the SEC, including a preliminary prospectus dated June 6, 2018 (the Preliminary Prospectus), with respect to the offering of our securities to which this communication relates. Before you invest, you should read the Preliminary Prospectus (including the risk factors described therein) and, when available, the final prospectus relating to the offering, and the other documents filed with the SEC and incorporated by reference into the Preliminary Prospectus, for more complete information about us and the offering. You may obtain these documents, including the Preliminary Prospectus, for free by visiting EDGAR on the SEC website at http://sec.gov. Alternatively, we or any underwriter participating in the offering will arrange to send you the prospectus if you request it by contacting Ladenburg Thalmann & Co. Inc., 277 Park Avenue, 26th Floor, New York, NY 10172 or by email at prospectus@ladenburg.com.

Focused on preventing smoking-related diseases rather than treating them Cytisine for the treatment of nicotine addiction Completed NIH-sponsored non-clinical update Completed Phase 1 fed-fasted study Completed Phase 1/2 repeat-dose PK/PD study Preparing for Phase 2b trial Phase 3 trials and NDA plans already reviewed with FDA More than 10,000 participants in cytisine clinical trials to date Completed 2 investigator-led Phase 3 clinical trials in over 2,000 patients Over 20 years of in-market experience in over 21 million patients under brand name TABEX® Over 15 million cases in European safety database Achieve Life Sciences

Proven Leadership Team Achieve founders Richard Stewart, Chairman & CEO, and Anthony Clarke, President, CSO and Director, have a proven track record of value creation Brabant Pharma sold to Zogenix, Inc. (NASDAQ:ZGNX) in 2014 $130M in upfront & milestone payments, NDA submission 2018 Huxley Pharma sold to Biomarin Pharmaceutical Inc. (NASDAQ:BMRN) in 2009 $58M in upfront & milestone payments, NDA filed March 2018 North American rights of Huxley asset now part of Catalyst Pharmaceuticals (NASDAQ:CPRX) Founded Amarin Corporation (NASDAQ:AMRN) Current market capitalization >$800M SkyePharma sold to Vectura Group plc (LSE:VEC) All stock transaction valued at $621M

Achieve At a Glance Exclusively focused on development and commercialization of cytisine Founded in 2015 by Rick Stewart and Dr. Anthony Clarke Acquired global* rights to cytisine from Sopharma AD Sopharma is a leading generics company in Europe - has manufactured and marketed cytisine for over 20 years Substantial Patient Need for New Nicotine Addiction Products 36.5 million smokers in U.S.1 and 1.1 billion smokers globally2 Over $300 billion annual cost in U.S.1 and over $2 trillion globally3 Smoking responsible for ~30% of all cancer deaths in the U.S., and ~ 80% of all lung cancer deaths4 Smoking causes ~80% of all deaths from chronic obstructive pulmonary disease (COPD)1 Platform for advancing cytisine development program Strong and integrated management team History of creating rapid shareholder value Excellence in clinical, regulatory, financial, commercial and operations Milestone oriented 1. U.S. Centers for Disease Control (CDC) 2. World Health Organization (WHO) 3. The Tobacco Atlas, 2016 PPP 4. American Cancer Society (ACS) *Excluding Eastern Europe, and other tertiary territories

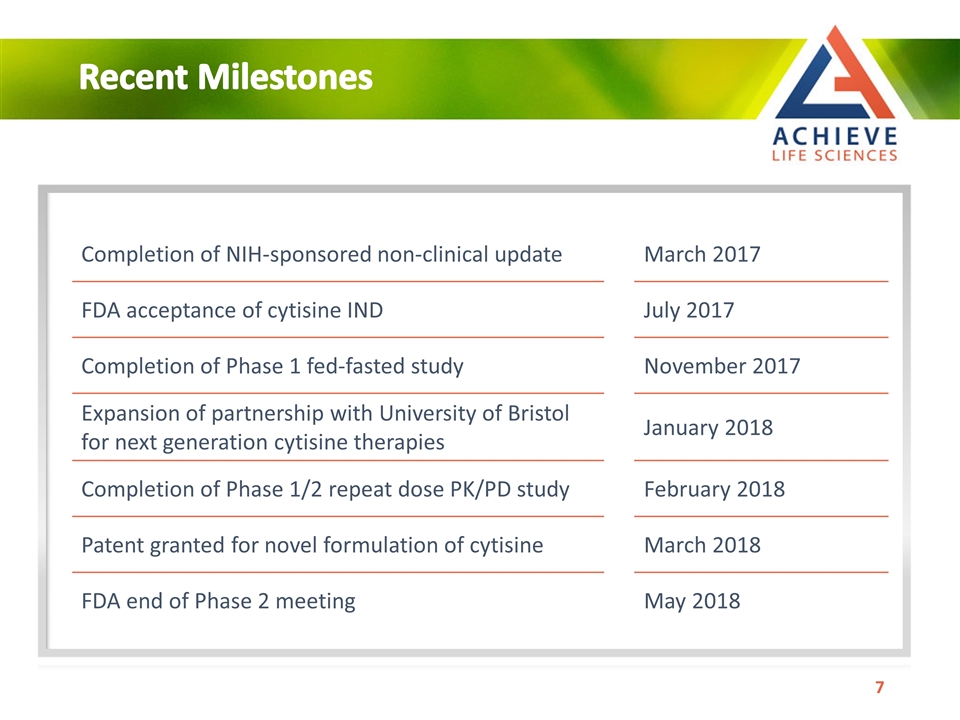

Recent Milestones Completion of NIH-sponsored non-clinical update March 2017 FDA acceptance of cytisine IND July 2017 Completion of Phase 1 fed-fasted study November 2017 Expansion of partnership with University of Bristol for next generation cytisine therapies January 2018 Completion of Phase 1/2 repeat dose PK/PD study February 2018 Patent granted for novel formulation of cytisine March 2018 FDA end of Phase 2 meeting May 2018

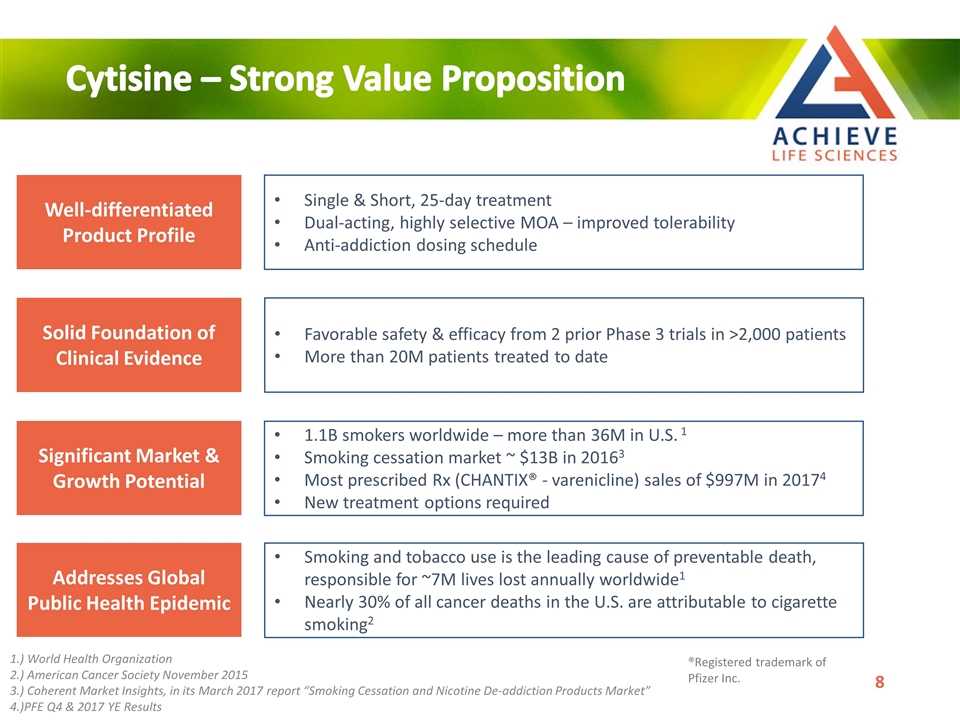

Favorable safety & efficacy from 2 prior Phase 3 trials in >2,000 patients More than 20M patients treated to date Solid Foundation of Clinical Evidence 1.1B smokers worldwide – more than 36M in U.S. 1 Smoking cessation market ~ $13B in 20163 Most prescribed Rx (CHANTIX® - varenicline) sales of $997M in 20174 New treatment options required Significant Market & Growth Potential Single & Short, 25-day treatment Dual-acting, highly selective MOA – improved tolerability Anti-addiction dosing schedule Well-differentiated Product Profile Cytisine – Strong Value Proposition Smoking and tobacco use is the leading cause of preventable death, responsible for ~7M lives lost annually worldwide1 Nearly 30% of all cancer deaths in the U.S. are attributable to cigarette smoking2 Addresses Global Public Health Epidemic 1.) World Health Organization 2.) American Cancer Society November 2015 3.) Coherent Market Insights, in its March 2017 report “Smoking Cessation and Nicotine De-addiction Products Market” 4.)PFE Q4 & 2017 YE Results ®Registered trademark of Pfizer Inc.

The Cytisine Difference Dual-Acting, Highly-Targeted MOA Single & Short Treatment Anti-Addiction Dosing Schedule

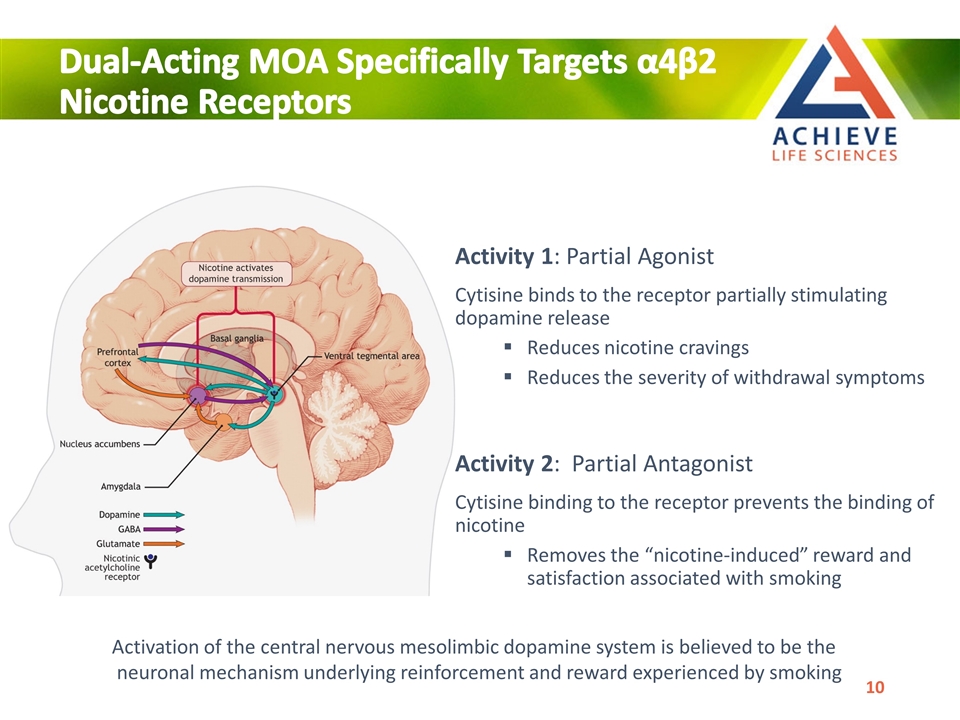

Activity 1: Partial Agonist Cytisine binds to the receptor partially stimulating dopamine release Reduces nicotine cravings Reduces the severity of withdrawal symptoms Activity 2: Partial Antagonist Cytisine binding to the receptor prevents the binding of nicotine Removes the “nicotine-induced” reward and satisfaction associated with smoking Dual-Acting MOA Specifically Targets α4β2 Nicotine Receptors Activation of the central nervous mesolimbic dopamine system is believed to be the neuronal mechanism underlying reinforcement and reward experienced by smoking

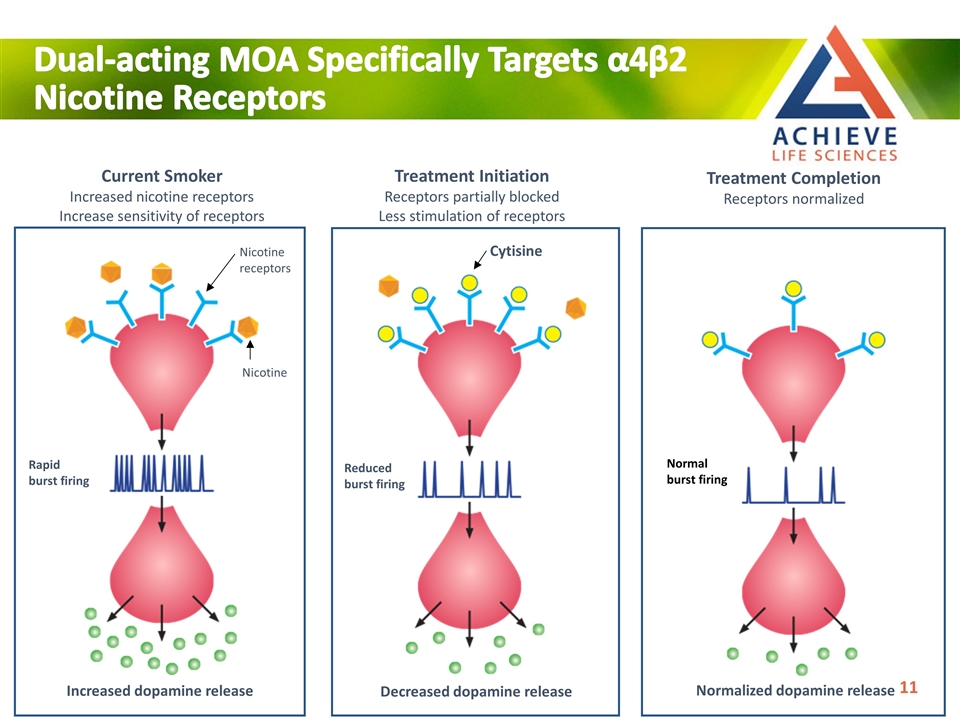

Dual-acting MOA Specifically Targets α4β2 Nicotine Receptors Current Smoker Increased nicotine receptors Increase sensitivity of receptors Treatment Completion Receptors normalized Nicotine receptors Nicotine Increased dopamine release Rapid burst firing Cytisine Treatment Initiation Receptors partially blocked Less stimulation of receptors Decreased dopamine release Normal burst firing Normalized dopamine release Reduced burst firing

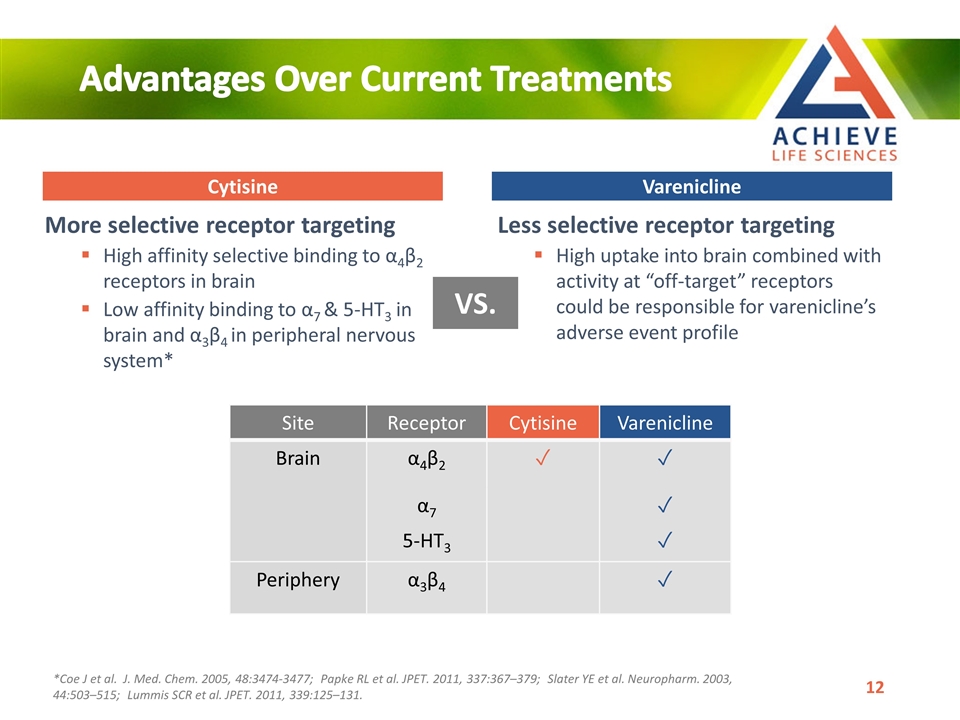

Less selective receptor targeting High uptake into brain combined with activity at “off-target” receptors could be responsible for varenicline’s adverse event profile Advantages Over Current Treatments More selective receptor targeting High affinity selective binding to α4β2 receptors in brain Low affinity binding to α7 & 5-HT3 in brain and α3β4 in peripheral nervous system* Site Receptor Cytisine Varenicline Brain α4β2 ✓ ✓ α7 ✓ 5-HT3 ✓ Periphery α3β4 ✓ *Coe J et al. J. Med. Chem. 2005, 48:3474-3477; Papke RL et al. JPET. 2011, 337:367–379; Slater YE et al. Neuropharm. 2003, 44:503–515; Lummis SCR et al. JPET. 2011, 339:125–131. Cytisine Varenicline VS.

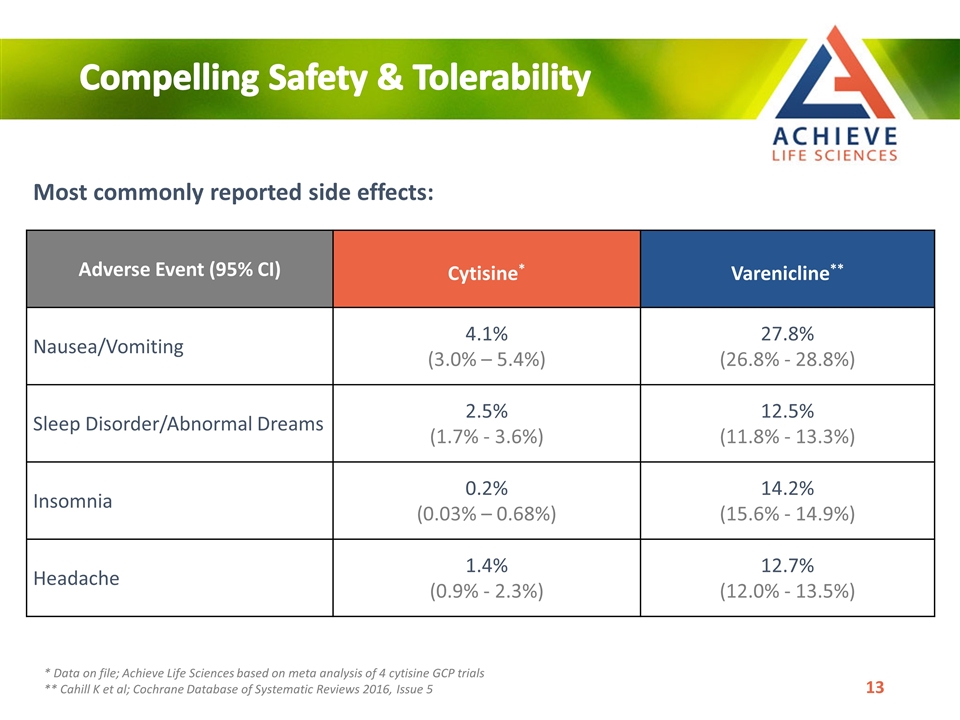

Compelling Safety & Tolerability Most commonly reported side effects: Adverse Event (95% CI) Cytisine* Varenicline** Nausea/Vomiting 4.1% (3.0% – 5.4%) 27.8% (26.8% - 28.8%) Sleep Disorder/Abnormal Dreams 2.5% (1.7% - 3.6%) 12.5% (11.8% - 13.3%) Insomnia 0.2% (0.03% – 0.68%) 14.2% (15.6% - 14.9%) Headache 1.4% (0.9% - 2.3%) 12.7% (12.0% - 13.5%) * Data on file; Achieve Life Sciences based on meta analysis of 4 cytisine GCP trials ** Cahill K et al; Cochrane Database of Systematic Reviews 2016, Issue 5

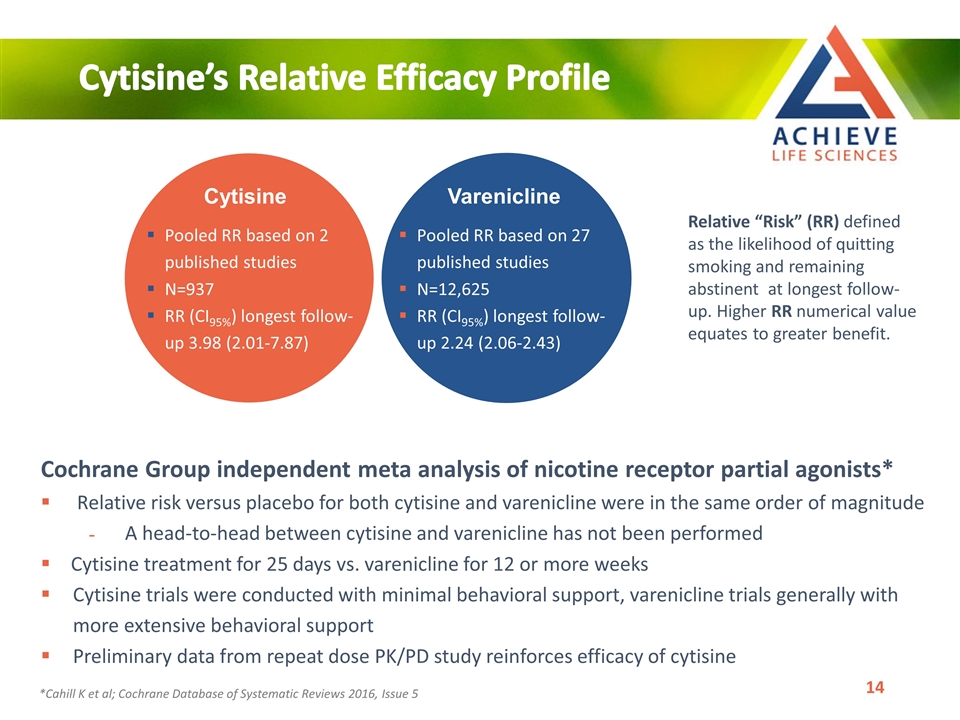

Cytisine’s Relative Efficacy Profile Cochrane Group independent meta analysis of nicotine receptor partial agonists* Relative risk versus placebo for both cytisine and varenicline were in the same order of magnitude A head-to-head between cytisine and varenicline has not been performed Cytisine treatment for 25 days vs. varenicline for 12 or more weeks Cytisine trials were conducted with minimal behavioral support, varenicline trials generally with more extensive behavioral support Preliminary data from repeat dose PK/PD study reinforces efficacy of cytisine *Cahill K et al; Cochrane Database of Systematic Reviews 2016, Issue 5 Relative “Risk” (RR) defined as the likelihood of quitting smoking and remaining abstinent at longest follow-up. Higher RR numerical value equates to greater benefit. Cytisine Pooled RR based on 2 published studies N=937 RR (CI95%) longest follow-up 3.98 (2.01-7.87) Varenicline Pooled RR based on 27 published studies N=12,625 RR (CI95%) longest follow-up 2.24 (2.06-2.43)

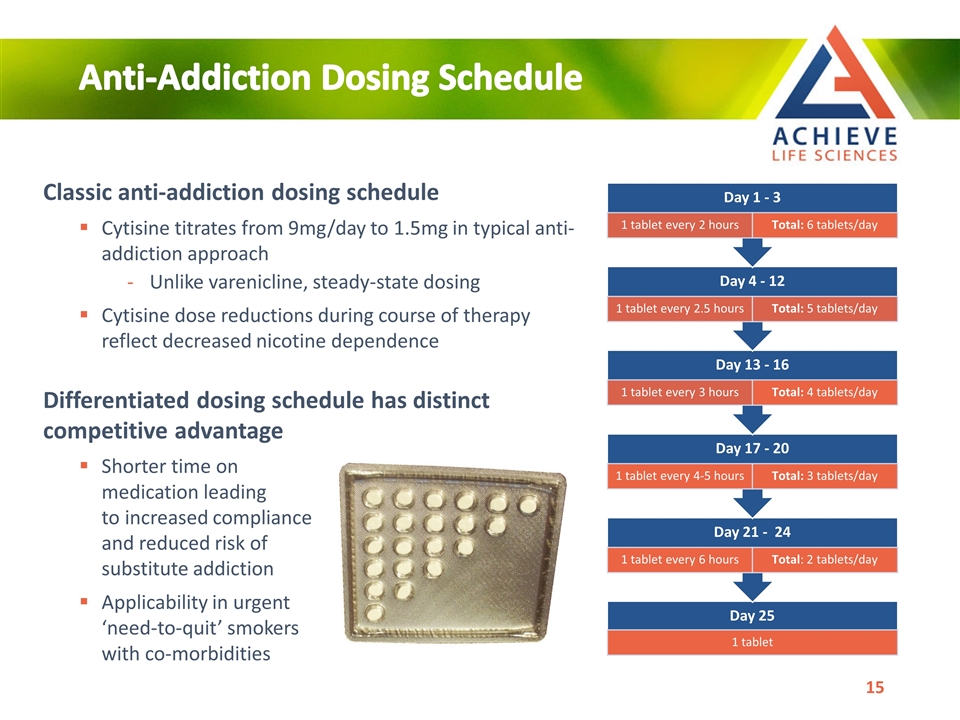

Classic anti-addiction dosing schedule Cytisine titrates from 9mg/day to 1.5mg in typical anti-addiction approach Unlike varenicline, steady-state dosing Cytisine dose reductions during course of therapy reflect decreased nicotine dependence Differentiated dosing schedule has distinct competitive advantage Shorter time on medication leading to increased compliance and reduced risk of substitute addiction Applicability in urgent ‘need-to-quit’ smokers with co-morbidities Anti-Addiction Dosing Schedule Day 1 - 3 1 tablet every 2 hours Total: 6 tablets/day Day 4 - 12 1 tablet every 2.5 hours Total: 5 tablets/day Day 13 - 16 1 tablet every 3 hours Total: 4 tablets/day Day 17 - 20 Day 21 - 24 Day 25 1 tablet every 4-5 hours Total: 3 tablets/day 1 tablet every 6 hours Total : 2 tablets/day 1 tablet

Cytisine Clinical Profile & Development Plan

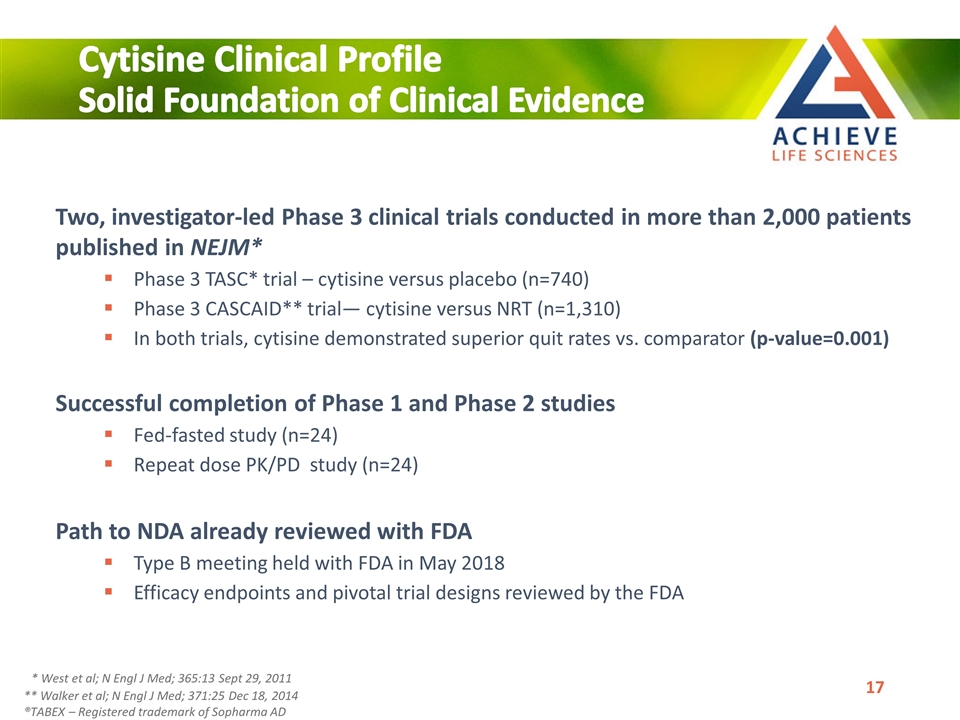

Cytisine Clinical Profile Solid Foundation of Clinical Evidence Two, investigator-led Phase 3 clinical trials conducted in more than 2,000 patients published in NEJM* Phase 3 TASC* trial – cytisine versus placebo (n=740) Phase 3 CASCAID** trial— cytisine versus NRT (n=1,310) In both trials, cytisine demonstrated superior quit rates vs. comparator (p-value=0.001) Successful completion of Phase 1 and Phase 2 studies Fed-fasted study (n=24) Repeat dose PK/PD study (n=24) Path to NDA already reviewed with FDA Type B meeting held with FDA in May 2018 Efficacy endpoints and pivotal trial designs reviewed by the FDA * West et al; N Engl J Med; 365:13 Sept 29, 2011 ** Walker et al; N Engl J Med; 371:25 Dec 18, 2014 ®TABEX – Registered trademark of Sopharma AD

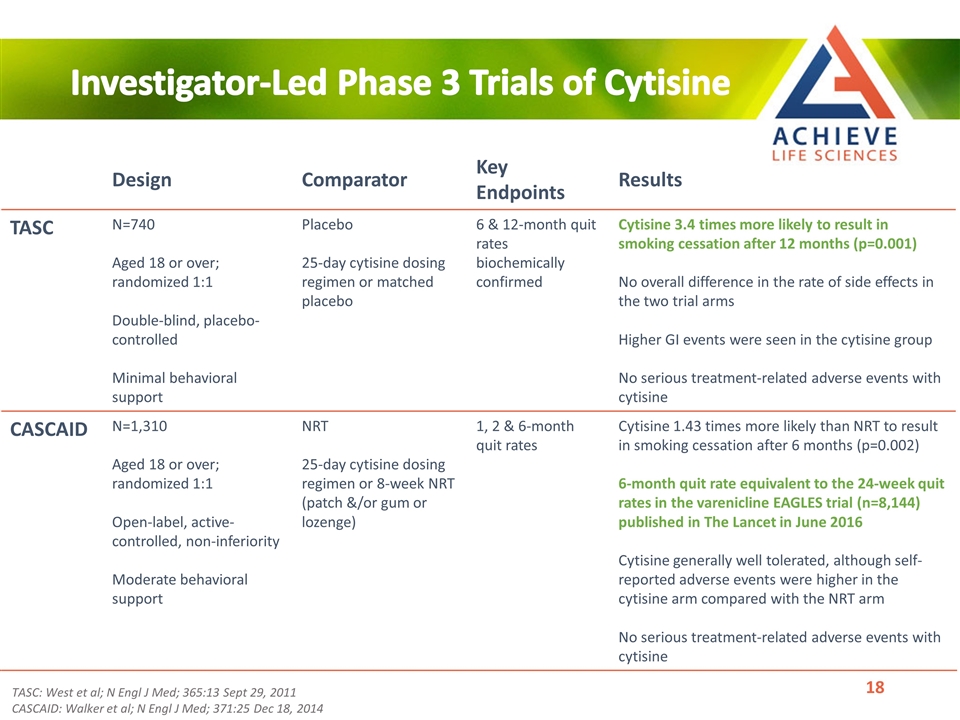

Design Comparator Key Endpoints Results TASC N=740 Aged 18 or over; randomized 1:1 Double-blind, placebo-controlled Minimal behavioral support Placebo 25-day cytisine dosing regimen or matched placebo 6 & 12-month quit rates biochemically confirmed Cytisine 3.4 times more likely to result in smoking cessation after 12 months (p=0.001) No overall difference in the rate of side effects in the two trial arms Higher GI events were seen in the cytisine group No serious treatment-related adverse events with cytisine CASCAID N=1,310 Aged 18 or over; randomized 1:1 Open-label, active-controlled, non-inferiority Moderate behavioral support NRT 25-day cytisine dosing regimen or 8-week NRT (patch &/or gum or lozenge) 1, 2 & 6-month quit rates Cytisine 1.43 times more likely than NRT to result in smoking cessation after 6 months (p=0.002) 6-month quit rate equivalent to the 24-week quit rates in the varenicline EAGLES trial (n=8,144) published in The Lancet in June 2016 Cytisine generally well tolerated, although self-reported adverse events were higher in the cytisine arm compared with the NRT arm No serious treatment-related adverse events with cytisine TASC: West et al; N Engl J Med; 365:13 Sept 29, 2011 CASCAID: Walker et al; N Engl J Med; 371:25 Dec 18, 2014 Investigator-Led Phase 3 Trials of Cytisine

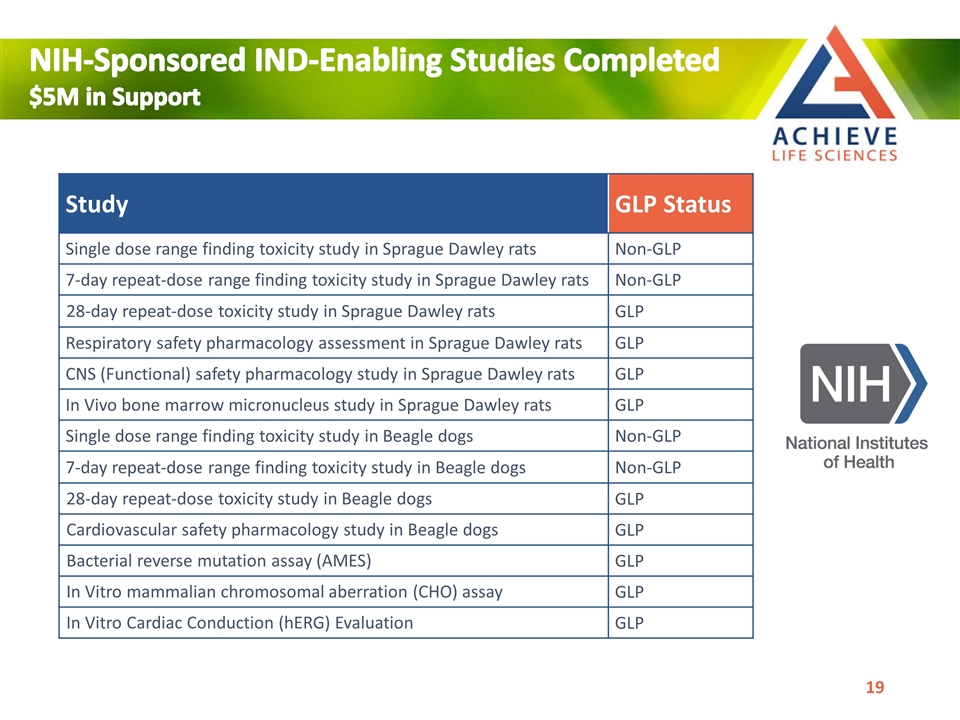

Study GLP Status Single dose range finding toxicity study in Sprague Dawley rats Non-GLP 7-day repeat-dose range finding toxicity study in Sprague Dawley rats Non-GLP 28-day repeat-dose toxicity study in Sprague Dawley rats GLP Respiratory safety pharmacology assessment in Sprague Dawley rats GLP CNS (Functional) safety pharmacology study in Sprague Dawley rats GLP In Vivo bone marrow micronucleus study in Sprague Dawley rats GLP Single dose range finding toxicity study in Beagle dogs Non-GLP 7-day repeat-dose range finding toxicity study in Beagle dogs Non-GLP 28-day repeat-dose toxicity study in Beagle dogs GLP Cardiovascular safety pharmacology study in Beagle dogs GLP Bacterial reverse mutation assay (AMES) GLP In Vitro mammalian chromosomal aberration (CHO) assay GLP In Vitro Cardiac Conduction (hERG) Evaluation GLP NIH-Sponsored IND-Enabling Studies Completed $5M in Support

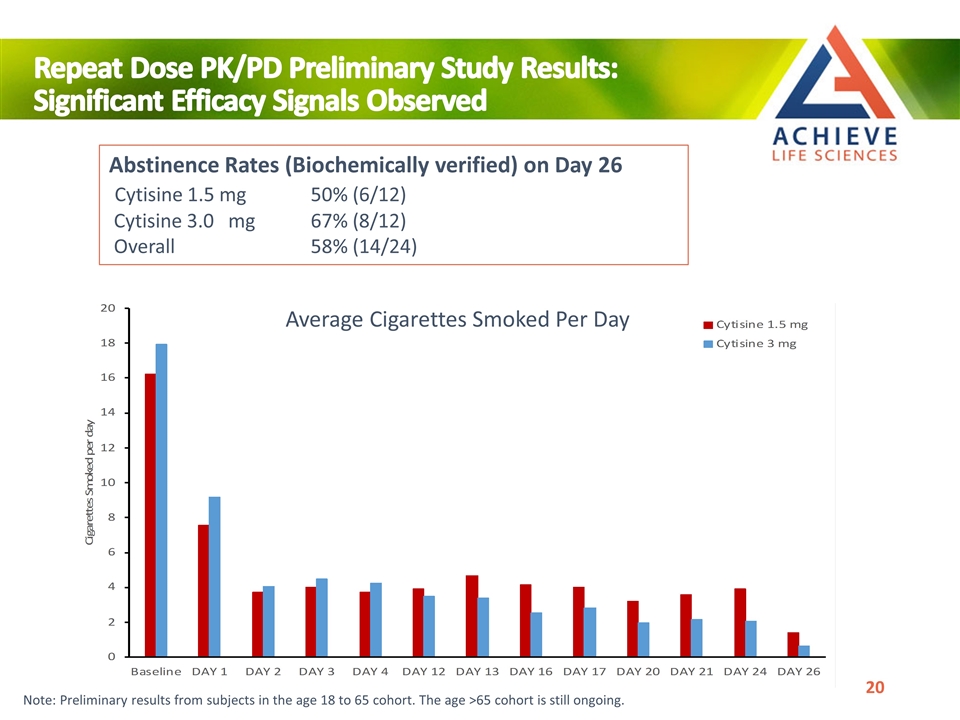

Abstinence Rates (Biochemically verified) on Day 26 Cytisine 1.5 mg 50% (6/12) Cytisine 3.0 mg 67% (8/12) Overall 58% (14/24) Repeat Dose PK/PD Preliminary Study Results: Significant Efficacy Signals Observed Average Cigarettes Smoked Per Day Note: Preliminary results from subjects in the age 18 to 65 cohort. The age >65 cohort is still ongoing.

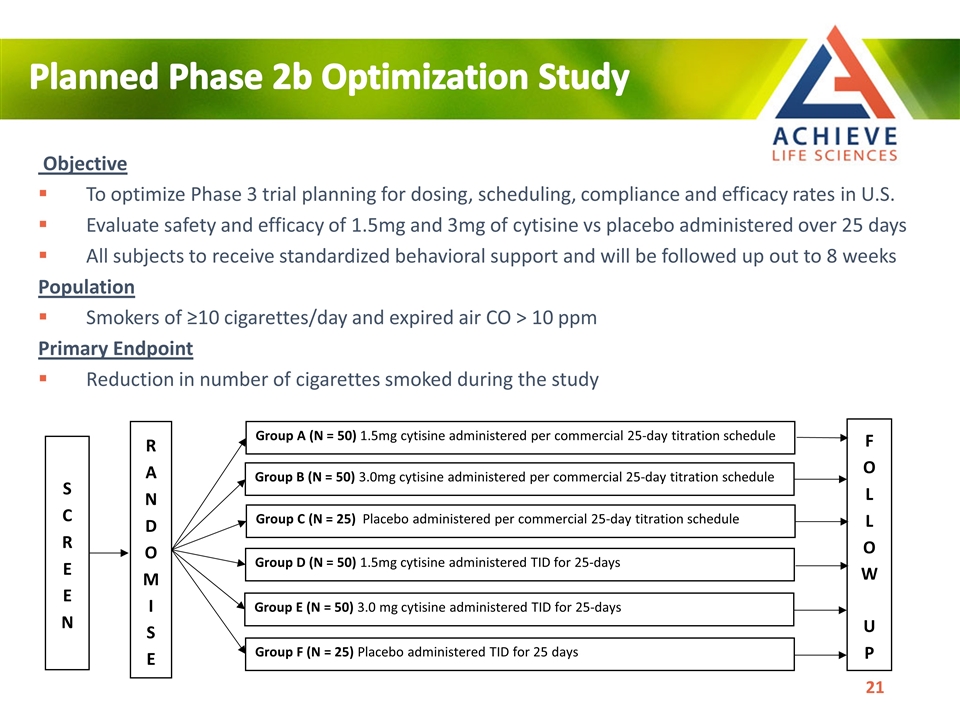

Objective To optimize Phase 3 trial planning for dosing, scheduling, compliance and efficacy rates in U.S. Evaluate safety and efficacy of 1.5mg and 3mg of cytisine vs placebo administered over 25 days All subjects to receive standardized behavioral support and will be followed up out to 8 weeks Population Smokers of ≥10 cigarettes/day and expired air CO > 10 ppm Primary Endpoint Reduction in number of cigarettes smoked during the study Planned Phase 2b Optimization Study SCREEN RANDOMISE Group A (N = 50) 1.5mg cytisine administered per commercial 25-day titration schedule Group B (N = 50) 3.0mg cytisine administered per commercial 25-day titration schedule Group C (N = 25) Placebo administered per commercial 25-day titration schedule FOLLOW UP Group D (N = 50) 1.5mg cytisine administered TID for 25-days Group E (N = 50) 3.0 mg cytisine administered TID for 25-days Group F (N = 25) Placebo administered TID for 25 days

Cytisine Planned Development Program & Milestones Q3 Phase 2b Enrollment Period Enrollment start Enrollment complete LPLV Data results Q4 Activity Anticipated Timing Drug to drug interaction study results Q2 2018 Fed/fasted study results with new formulation Q3 2018 First patient enrolled P2b Q4 2018 Last patient enrolled P2b Q1 2019 Repeat Dose Study Final Study Results Q1 2019 Last patient last visit P2b Q2 2019 Top line results P2b Q2 2019 2018 2019 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2020 Phase 3 Program

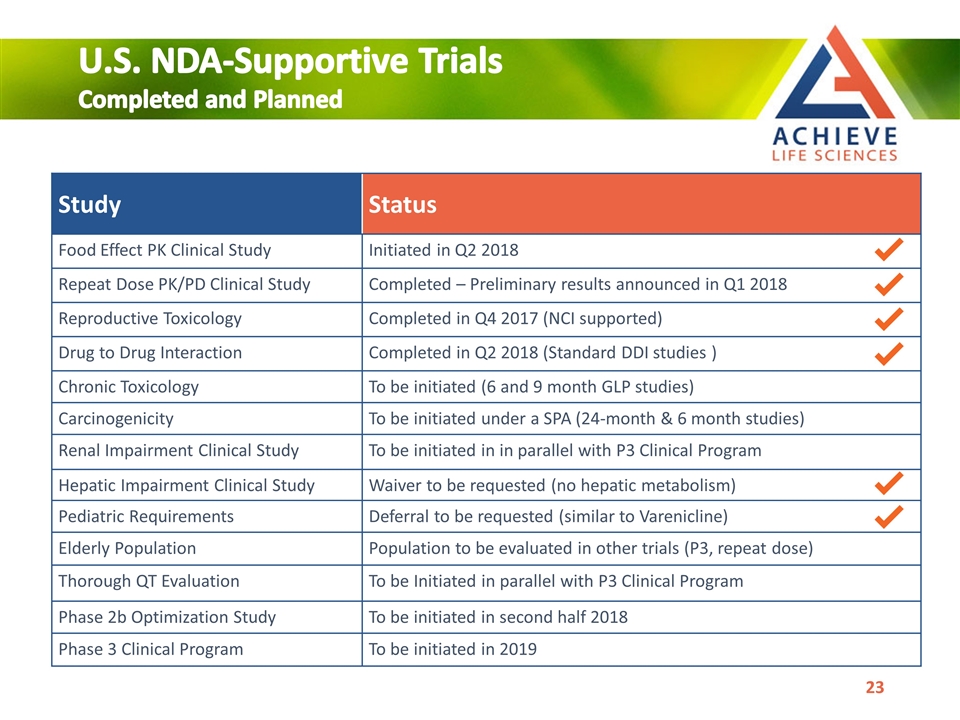

Study Status Food Effect PK Clinical Study Initiated in Q2 2018 Repeat Dose PK/PD Clinical Study Completed – Preliminary results announced in Q1 2018 Reproductive Toxicology Completed in Q4 2017 (NCI supported) Drug to Drug Interaction Completed in Q2 2018 (Standard DDI studies ) Chronic Toxicology To be initiated (6 and 9 month GLP studies) Carcinogenicity To be initiated under a SPA (24-month & 6 month studies) Renal Impairment Clinical Study To be initiated in in parallel with P3 Clinical Program Hepatic Impairment Clinical Study Waiver to be requested (no hepatic metabolism) Pediatric Requirements Deferral to be requested (similar to Varenicline) Elderly Population Population to be evaluated in other trials (P3, repeat dose) Thorough QT Evaluation To be Initiated in parallel with P3 Clinical Program Phase 2b Optimization Study To be initiated in second half 2018 Phase 3 Clinical Program To be initiated in 2019 U.S. NDA-Supportive Trials Completed and Planned

Commercial Overview

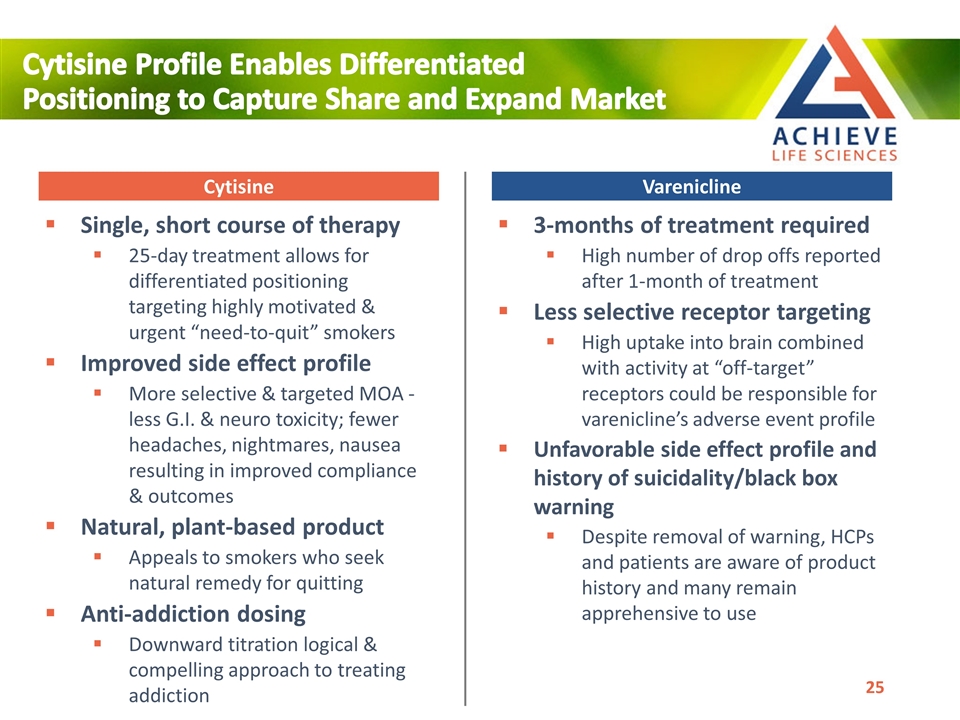

3-months of treatment required High number of drop offs reported after 1-month of treatment Less selective receptor targeting High uptake into brain combined with activity at “off-target” receptors could be responsible for varenicline’s adverse event profile Unfavorable side effect profile and history of suicidality/black box warning Despite removal of warning, HCPs and patients are aware of product history and many remain apprehensive to use Cytisine Profile Enables Differentiated Positioning to Capture Share and Expand Market Single, short course of therapy 25-day treatment allows for differentiated positioning targeting highly motivated & urgent “need-to-quit” smokers Improved side effect profile More selective & targeted MOA - less G.I. & neuro toxicity; fewer headaches, nightmares, nausea resulting in improved compliance & outcomes Natural, plant-based product Appeals to smokers who seek natural remedy for quitting Anti-addiction dosing Downward titration logical & compelling approach to treating addiction Cytisine Varenicline

Treatment options are limited with nothing new in over a decade Chantix (varenicline) and ZYBAN® (bupropion hydrochloride) Both are oral drugs given on average for 12 weeks Safety has been a concern with both treatments including historic black box warnings Nicotine replacement ineffective and creates costly, substitute addiction Quitting is Hard! Multiple attempts and treatments are typical 70% of current smokers have expressed a desire to quit, 55% attempted to quit in the past year but only ~7% succeeded* Up to 60% of quitters relapse in the first year due to addictive nature of nicotine* Estimated 8–11 attempts before quitting permanently* Health and economic consequences prompted intervention strategies Smoking-related healthcare costs in the U.S. are estimated to exceed $300 billion annually* Favorable reimbursement for smoking cessation medications includes coverage for multiple quit attempts and counseling services Smoking Cessation Market Primed for New Treatment Options ®Registered trademark Glaxo Group *Centers for Disease Control & Prevention, Quitting Smoking Among Adults – United States, 2000-2015

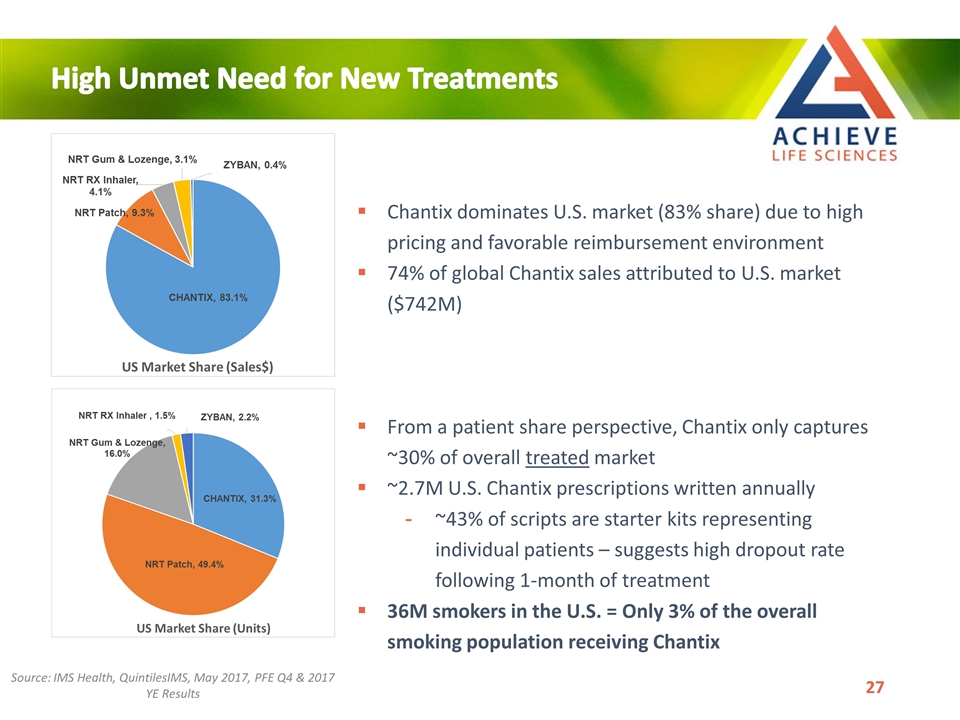

Chantix dominates U.S. market (83% share) due to high pricing and favorable reimbursement environment 74% of global Chantix sales attributed to U.S. market ($742M) From a patient share perspective, Chantix only captures ~30% of overall treated market ~2.7M U.S. Chantix prescriptions written annually ~43% of scripts are starter kits representing individual patients – suggests high dropout rate following 1-month of treatment 36M smokers in the U.S. = Only 3% of the overall smoking population receiving Chantix High Unmet Need for New Treatments Source: IMS Health, QuintilesIMS, May 2017, PFE Q4 & 2017 YE Results

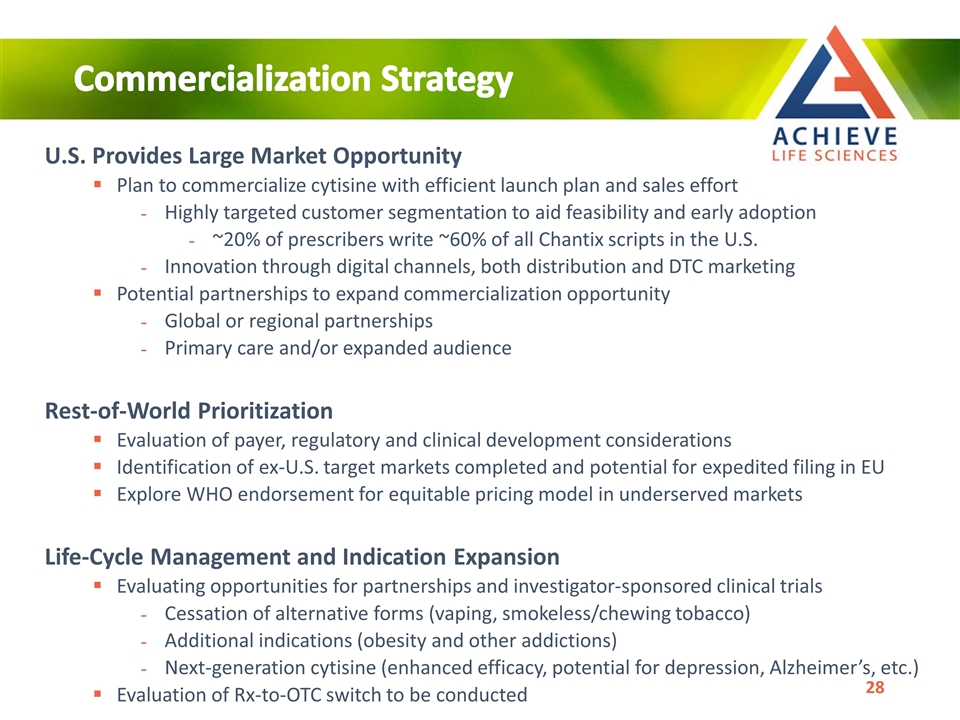

U.S. Provides Large Market Opportunity Plan to commercialize cytisine with efficient launch plan and sales effort Highly targeted customer segmentation to aid feasibility and early adoption ~20% of prescribers write ~60% of all Chantix scripts in the U.S. Innovation through digital channels, both distribution and DTC marketing Potential partnerships to expand commercialization opportunity Global or regional partnerships Primary care and/or expanded audience Rest-of-World Prioritization Evaluation of payer, regulatory and clinical development considerations Identification of ex-U.S. target markets completed and potential for expedited filing in EU Explore WHO endorsement for equitable pricing model in underserved markets Life-Cycle Management and Indication Expansion Evaluating opportunities for partnerships and investigator-sponsored clinical trials Cessation of alternative forms (vaping, smokeless/chewing tobacco) Additional indications (obesity and other addictions) Next-generation cytisine (enhanced efficacy, potential for depression, Alzheimer’s, etc.) Evaluation of Rx-to-OTC switch to be conducted Commercialization Strategy

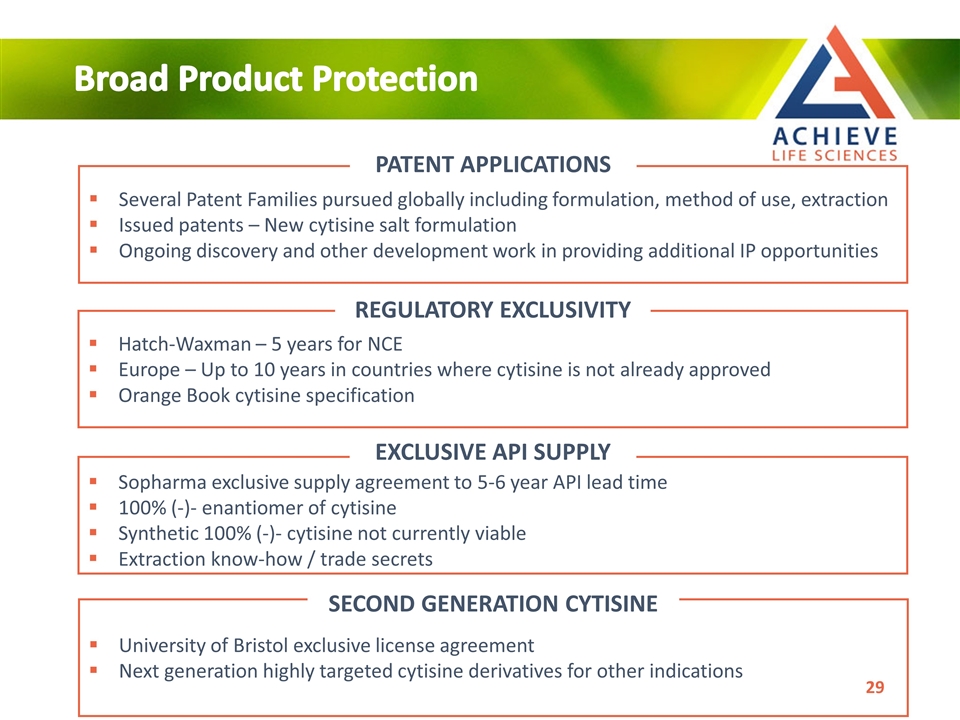

Several Patent Families pursued globally including formulation, method of use, extraction Issued patents – New cytisine salt formulation Ongoing discovery and other development work in providing additional IP opportunities PATENT APPLICATIONS Hatch-Waxman – 5 years for NCE Europe – Up to 10 years in countries where cytisine is not already approved Orange Book cytisine specification REGULATORY EXCLUSIVITY Sopharma exclusive supply agreement to 5-6 year API lead time 100% (-)- enantiomer of cytisine Synthetic 100% (-)- cytisine not currently viable Extraction know-how / trade secrets EXCLUSIVE API SUPPLY Broad Product Protection University of Bristol exclusive license agreement Next generation highly targeted cytisine derivatives for other indications SECOND GENERATION CYTISINE

Manufacturing & Supply Chain API & solid dosage manufacturer Exclusive supply agreement for 100% of Achieve’s cytisine requirement Supply for clinical trials and commercial use Competitive cost of goods EU-GMP compliant state-of-the-art pharmaceutical manufacturing Opened November 2013 Capacity 4 billion tablets annually Sopharma AD

Corporate Profile

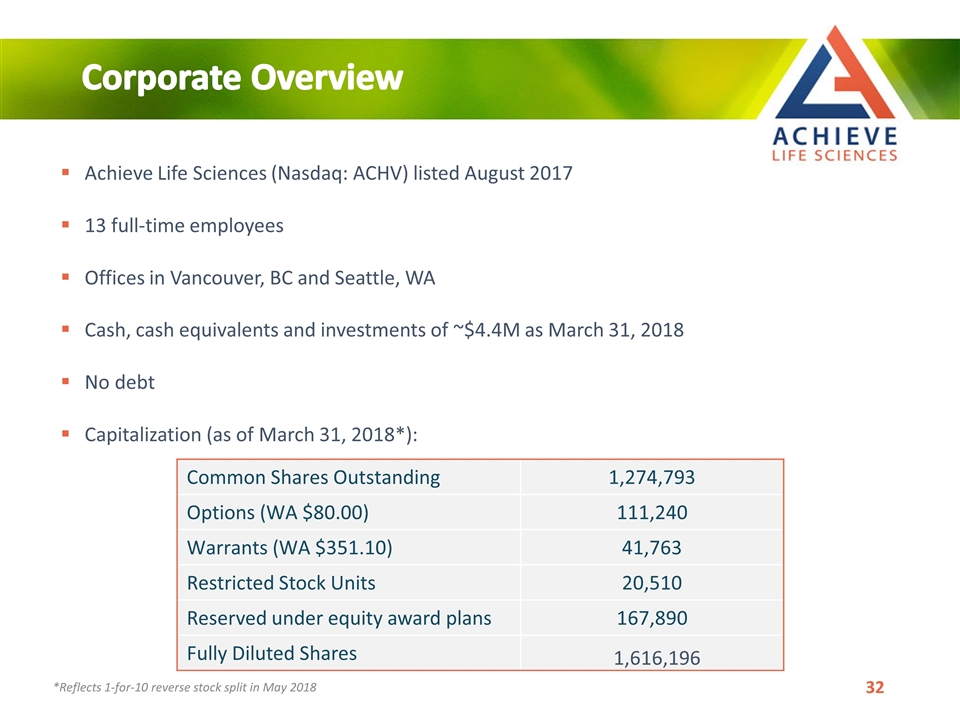

Corporate Overview Achieve Life Sciences (Nasdaq: ACHV) listed August 2017 13 full-time employees Offices in Vancouver, BC and Seattle, WA Cash, cash equivalents and investments of ~$4.4M as March 31, 2018 No debt Capitalization (as of March 31, 2018*): Common Shares Outstanding 1,274,793 Options (WA $80.00) 111,240 Warrants (WA $351.10) 41,763 Restricted Stock Units 20,510 Reserved under equity award plans 167,890 Fully Diluted Shares 1,616,196 *Reflects 1-for-10 reverse stock split in May 2018

*PFE Q4 & 2017 YE Results Investment Highlights Novel MOA positions Achieve to significantly impact the global public health epidemic of tobacco addiction Addresses tobacco addiction, a major driver of both cancer and cardiovascular disease deaths MOA differentiation from leading approved products, with history of black box warnings, has positive implications for safety Large market opportunity ~$13B nicotine addiction market, with sales of leading product Chantix of ~$1B in 2017* Solid foundation of clinical evidence with regards to both safety and efficacy Two completed Phase 3 trials, with over 2,000 patients dosed, supports safety and efficacy of cytisine Clear path to market Recent FDA guidance in U.S.; potential to file MAA in EU prior to U.S. approval Proven management team Management team has a history of leading successful biopharma companies, including through acquisition

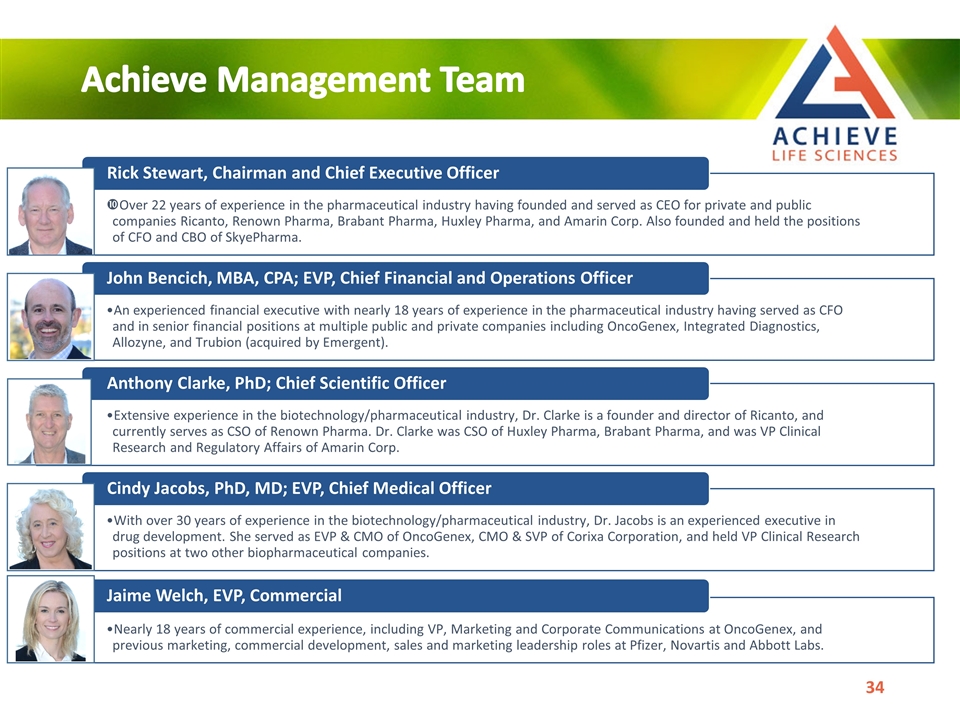

Achieve Management Team Rick Stewart, Chairman and Chief Executive Officer John Bencich , MBA, CPA; EVP, Chief Financial and Operations Officer Over 22 years of experience in the pharmaceutical industry having founded and served as CEO for private and public companies Ricanto , Renown Pharma , Brabant Pharma , Huxley Pharma , and Amarin Corp. Also founded and held the positions of CFO and CBO of SkyePharma . An experienced financial executive with nearly 18 years of experience in the pharmaceutical industry having served as CFO and in senior financial positions at multiple public and private companies including OncoGenex , Integrated Diagnostics, Allozyne , and Trubion (acquired by Emergent). Cindy Jacobs, PhD, MD; EVP, Chief Medical Officer Anthony Clarke, PhD; Chief Scientific Officer Extensive experience in the biotechnology/pharmaceutical industry, Dr. Clarke is a founder and director of Ricanto , and currently serves as CSO of Renown Pharma . Dr. Clarke was CSO of Huxley Pharma , Brabant Pharma , and was VP Clinical Research and Regulatory Affairs of Amarin Corp. With over 30 years of experience in the biotechnology/pharmaceutical industry, Dr. Jacobs is an experienced executive in drug development. She served as EVP & CMO of OncoGenex , CMO & SVP of Corixa Corporation, and held VP Clinical Research positions at two other biopharmaceutical companies. Jaime Welch, EVP, Commercial Nearly 18 years of commercial experience, including VP, Marketing and Corporate Communications at OncoGenex , and previous marketing, commercial development, sales and marketing leadership roles at Pfizer, Novartis and Abbott Labs.

Achieve Board of Directors Rick Stewart, Chairman and Chief Executive Officer Anthony Clarke, PhD; Chief Scientific Officer Jay Moyes , Audit Chair Donald Joseph, Lead Independent Director Over 20 years of biopharmaceutical industry experience with senior management positions in global health non-profit organizations. Currently serves as consultant, legal advisor, and general counsel to many biopharma and global health organizations including KaloBios , Abgenix , and Renovis . Former partner at Baker and McKenzie. Considerable board experience in the life sciences industry – Osiris, BioCardia and Puma Biotechnology – and a number of CFO and accounting roles throughout his career. Dr. Martin Mattingly, Compensation Committee Chair Executive leadership experience in late-stage clinical development, public company expertise, and commercialization and business development experience with pharmaceuticals and biologics including director of OncoGenex and TRACON Pharmaceuticals, CEO of Trimeris and Ambrx , Inc. Stewart Parker, Nominating and Corporate Governance Chair Former CEO of OncoGenex with comprehensive experience leading public life science companies and deep industry knowledge. Extensive biopharmaceutical and biologics experience. Senior executive leadership roles spanning financial, operational, business and clinical development. Scott Cormack