425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on June 13, 2017

Filed by OncoGenex Pharmaceuticals, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

Deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: OncoGenex Pharmaceuticals, Inc.

Commission File No.: 033-80623

Achieve Life Science, Inc. plans to present the following presentation to potential investors.

|

|

June 2017

|

|

This presentation contains forward-looking statements, including, but not limited to, statements regarding the terms, timing, conditions to and anticipated completion of the proposed merger; the expected ownership of the combined company and the composition of the combined companys board of directors and management team; the anticipated distribution to OncoGenex Pharmaceuticals, Inc. (OncoGenex) stockholders of contingent value rights (CVRs) and the value of such CVRs; the timing of planned clinical development activities of cytisine; the projected path toward potential regulatory approval; the safety, efficacy and commercial potential of cytisine; the potential market for cytisine; the benefits of cytisine relative to competitors; the anticipated benefits of cytisine; plans, objectives, expectations and intentions with respect to future operations. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. Achieve Life Science, Inc. (Achieve) and/or OncoGenex may not actually achieve the proposed merger, or any plans or product development goals in a timely manner, if at all, or otherwise carry out the intentions or meet the expectations or projections disclosed in these forward-looking statements. These statements are based on managements current expectations and beliefs and are subject to a number of risks, uncertainties and assumptions that could cause actual results to differ materially from those described in the forward-looking statements, including, among others, the failure of the Achieve or OncoGenex stockholders to approve the transaction; the failure of either party to meet the closing conditions of the transaction; delays in completing the transaction and the risk that the transaction may not be completed at all; the success of the combined businesses; operating costs and business disruption during the pendency of and following the proposed merger; general business and economic conditions; the need for and ability to obtain additional financing; the ability to source sufficient amounts of cytisine to meet commercial demand; and the risks associated with the process of developing, obtaining regulatory approval for and commercializing drug candidates that are safe and effective for use as human therapeutics. Achieve undertakes no obligation to update the forward-looking statements contained herein or to reflect events or circumstances occurring after the date hereof, other than as may be required by applicable law.

|

|

This communication is being made in respect of the proposed merger involving OncoGenex

Pharmaceuticals, Inc. and Achieve Life Science, Inc. OncoGenex has filed a registration statement on Form S-4 (File No. 333-216961) with the Securities and Exchange Commission (SEC) which contains a preliminary proxy statement/prospectus/information statement and other relevant materials, and plans to file with the SEC other documents regarding the proposed transaction. The final proxy statement/prospectus/information statement will be sent to the stockholders of OncoGenex and Achieve. The proxy statement/prospectus/information statement contains information about OncoGenex, Achieve, the proposed merger and related matters. STOCKHOLDERS ARE URGED TO READ THE PROXY

STATEMENT/PROSPECTUS/INFORMATION STATEMENT (INCLUDING ANY AMENDMENTS OR

SUPPLEMENTS) AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY AS THEY BECOME AVAILABLE, AS THEY CONTAIN IMPORTANT INFORMATION THAT STOCKHOLDERS SHOULD CONSIDER BEFORE MAKING A DECISION ABOUT THE MERGER AND RELATED MATTERS. In addition to receiving the final proxy statement/prospectus/information statement and proxy card by mail, stockholders will also be able to obtain the proxy statement/prospectus/information statement, as well as other filings containing information about OncoGenex, without charge, from the SECs website (http://www.sec.gov) or, without charge, by directing a written request to: OncoGenex Pharmaceuticals, Inc., 19820 North Creek Parkway, Suite 201, Bothell, WA 98011, Attention: Investor Relations or to Achieve Life Science, Inc., 30 Sunnyside Avenue, Mill Valley, CA 94941, Attention: Rick Stewart.

|

|

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities in connection with the proposed merger shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in Solicitation

OncoGenex and its executive officers and directors may be deemed to be participants in the solicitation of proxies from OncoGenexs stockholders with respect to the matters relating to the proposed merger. Achieve and its officers and directors may also be deemed a participant in such solicitation. Information regarding OncoGenexs executive officers and directors is available in OncoGenexs proxy statement on Schedule 14A, filed with the SEC on April 21, 2016. Information regarding any interest that OncoGenex, Achieve or any of the executive officers or directors of OncoGenex or Achieve may have in the transaction with Achieve will be set forth in the final proxy statement/prospectus/information statement that OncoGenex will file with the SEC in connection with its stockholder vote on matters relating to the proposed merger. Stockholders will be able to obtain this information by reading the final proxy statement/prospectus/information statement when it becomes available.

|

|

Achieve Life Sciences is a specialty pharmaceutical company committed to advancing cytisine as a smoking cessation aid to overcome the global tobacco addiction epidemic

|

|

Built around cytisinea single short-course oral smoking cessation treatment

Founded in 2015 by Rick Stewart and Dr. Anthony Clarke

Skyepharma, Amarin, Huxley Pharma, Brabant Pharma Acquired WW* rights to cytisine from Sopharma AD

One of the largest generic pharmaceutical companies in Eastern Europe Cytisine has over 15 years of in market experience

Strategic merger with OncoGenex (NASDAQ: OGXI) provides platform for growth

Transition from privately held biotech to resourced public company

Strengthens clinical/regulatory/financial infrastructure

Delivers capital to continue cytisines progress towards Phase 3 study

Provides access to public markets

Key clinical development milestones expected over the next 12-18 months NASDAQ ticker ACHV post merger

*Excluding Eastern Europe, and other tertiary territories

|

|

Cytisine is well positioned for U.S. regulatory and commercial success

Safety and efficacy supported by two recent Phase 3 trials (>2000 patients treated)

Both published in NEJM

Marketed in Central and Eastern Europe providing a robust safety dossier (>15MM patients)

Rapid path to regulatory approval anticipated in U.S. and Europe

FDA meeting clarified regulatory pathway

Pivotal Phase 3 trial in the U.S. expected to commence in 1H18 Discussions with regulators regarding EU decentralized MAA approach

Clear differentiation of cytisine versus market leaders including CHANTIX® (varenicline)

Single 25 day short-course of treatment Anti-addiction dosing schedule Distinct MOA with compelling safety profile

® Registered trademark of Pfizer Inc

|

|

Large and expanding global market

Global smoking cessation and nicotine de-addiction market ~ $12 billion in 2016* Chantix sales forecasted to reach $1 billion globally in 2017

Addresses a global public health epidemic

An estimated 1 billion people will die from smoking related diseases this century Global smoking population remains constant

The NIH and WHO est. ~ 1.1 billion people globally are smokers

36.5 million people or 15% of all U.S. adults are smokers

Significant unmet medical need requiring better therapeutics

Despite existing treatments, most smokers fail multiple attempts to quit **

70% of current smokers have expressed a desire to quit

40% attempted to quit in the past year but only 6.2% succeeded

Up to 60% of quitters relapse in the first year due to addictive nature of nicotine

It is estimated that it takes 811 attempts before quitting permanently

Economic cost of smoking related diseases

Smoking-related healthcare costs in the U.S. are estimated to exceed $300 billion annually**

* Coherent Market Insights, in its March 2017 report Smoking Cessation and Nicotine De-addiction Products Market

** Centers for Disease Control 2017

|

|

Current smoking cessation treatment options are limited

The most common treatment is nicotine replacement therapy (NRT)

Available both OTC and Rx and in many formulations such as patch, gum & lozenge

Generally shown to be less effective then Rx treatments

There are two prescriptions treatment options CHANTIX® (varenicline) & ZYBAN® (bupropion hydrochloride)

Both are oral drugs given on average for 12 weeks

Safety has been a concern with both treatments including historic black box warnings

Favorable reimbursement environment

Strong U.S. commercial coverage for smoking cessation medications ( & OTC)

Up to 2 quit attempts per year covered

Coverage includes counseling and 90 days of medication per quit attempt

All branded smoking cessation products covered by Medicaid nationwide

® Registered trademark Glaxo Group

|

|

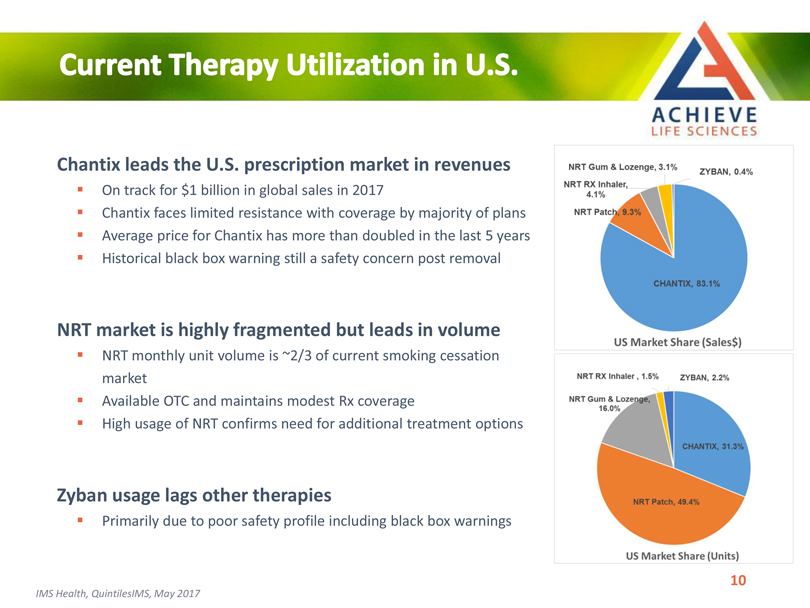

Chantix leads the U.S. prescription market in revenues

On track for $1 billion in global sales in 2017

Chantix faces limited resistance with coverage by majority of plans Average price for Chantix has more than doubled in the last 5 years Historical black box warning still a safety concern post removal

NRT market is highly fragmented but leads in volume

NRT monthly unit volume is ~2/3 of current smoking cessation market Available OTC and maintains modest Rx coverage High usage of NRT confirms need for additional treatment options

Zyban usage lags other therapies

Primarily due to poor safety profile including black box warnings

IMS Health, QuintilesIMS, May 2017

|

|

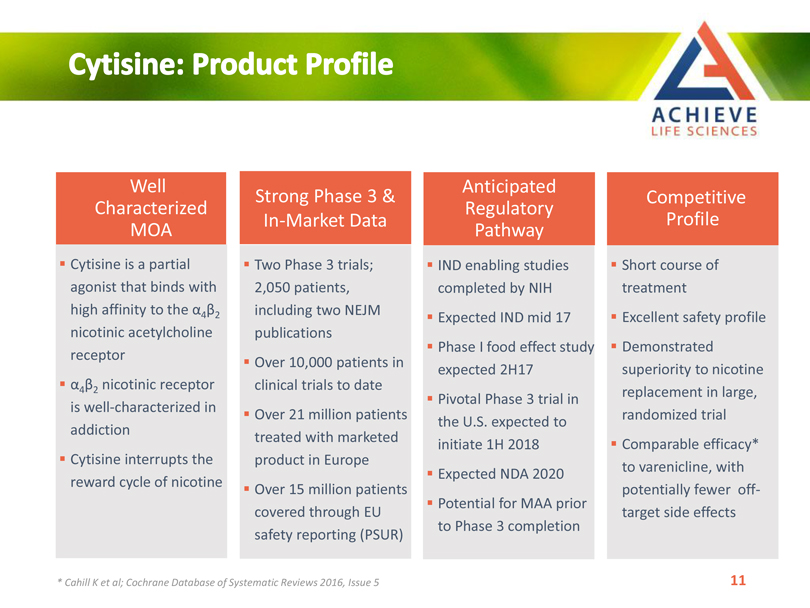

Well

Characterized

MOA

Cytisine is a partial agonist that binds with high affinity to the

4 2

nicotinic acetylcholine receptor

4 2 nicotinic receptor is well-characterized in addiction

Cytisine interrupts the reward cycle of nicotine

Strong Phase 3 &

In-Market Data

Two Phase 3 trials; 2,050 patients, including two NEJM publications

Over 10,000 patients in clinical trials to date

Over 21 million patients treated with marketed product in Europe

Over 15 million patients covered through EU safety reporting (PSUR)

Anticipated Regulatory

Pathway

IND enabling studies completed by NIH

Expected IND mid 17 Phase I food effect study expected 2H17

Pivotal Phase 3 trial in the U.S. expected to initiate 1H 2018

Expected NDA 2020 Potential for MAA prior to Phase 3 completion

Competitive

Profile

Short course of treatment

Excellent safety profile Demonstrated superiority to nicotine replacement in large, randomized trial

Comparable efficacy* to varenicline, with potentially fewer off-target side effects

* Cahill K et al; Cochrane Database of Systematic Reviews 2016, Issue 5

|

|

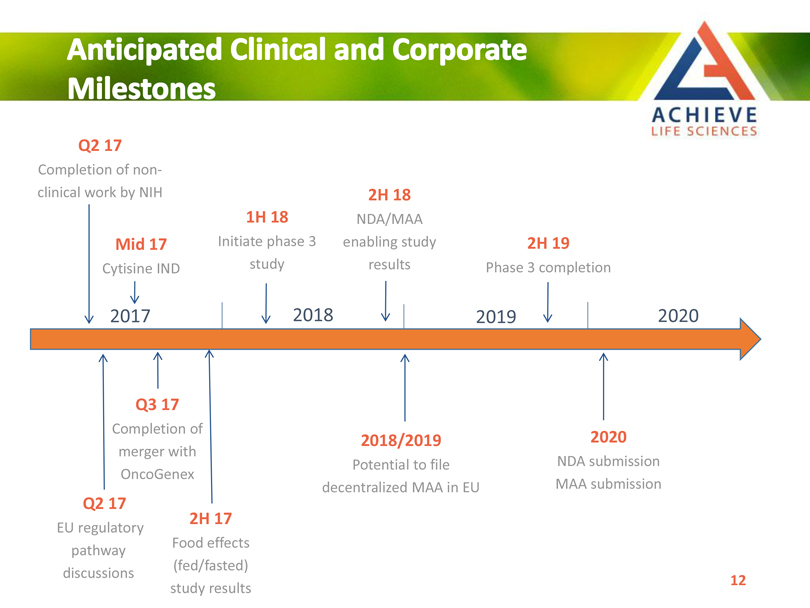

Q2 17

Completion of non-clinical work by NIH

Mid 17

Cytisine IND

2017

1H 18

Initiate phase 3 study

2018

2H 18

NDA/MAA enabling study results

2H 19

Phase 3 completion

2019

2020

Q3 17

Completion of merger with OncoGenex

Q2 17

EU regulatory pathway discussions

2H 17

Food effects (fed/fasted) study results

2018/2019

Potential to file decentralized MAA in EU

2020

NDA submission MAA submission

|

|

Cytisine Clinical Profile & Development Plan

|

|

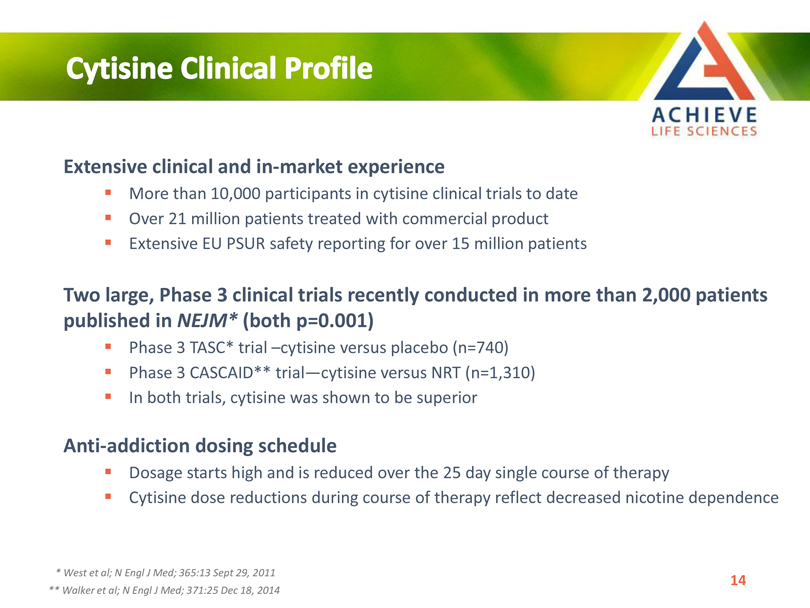

Extensive clinical and in-market experience

More than 10,000 participants in cytisine clinical trials to date Over 21 million patients treated with commercial product Extensive EU PSUR safety reporting for over 15 million patients

Two large, Phase 3 clinical trials recently conducted in more than 2,000 patients published in NEJM* (both p=0.001)

Phase 3 TASC* trial cytisine versus placebo (n=740) Phase 3 CASCAID** trialcytisine versus NRT (n=1,310) In both trials, cytisine was shown to be superior

Anti-addiction dosing schedule

Dosage starts high and is reduced over the 25 day single course of therapy

Cytisine dose reductions during course of therapy reflect decreased nicotine dependence

* West et al; N Engl J Med; 365:13 Sept 29, 2011

** Walker et al; N Engl J Med; 371:25 Dec 18, 2014

|

|

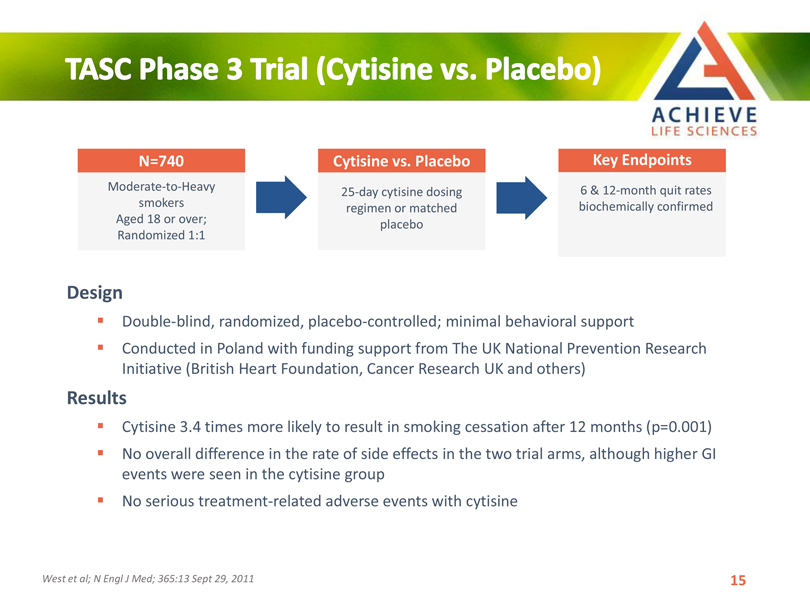

N=740

Moderate-to-Heavy smokers

Aged 18 or over;

Randomized 1:1

Cytisine vs. Placebo

25-day cytisine dosing regimen or matched placebo

Key Endpoints

6 & 12-month quit rates biochemically confirmed

Design

Double-blind, randomized, placebo-controlled; minimal behavioral support

Conducted in Poland with funding support from The UK National Prevention Research Initiative (British Heart Foundation, Cancer Research UK and others)

Results

Cytisine 3.4 times more likely to result in smoking cessation after 12 months (p=0.001) No overall difference in the rate of side effects in the two trial arms, although higher GI events were seen in the cytisine group No serious treatment-related adverse events with cytisine

West et al; N Engl J Med; 365:13 Sept 29, 2011

|

|

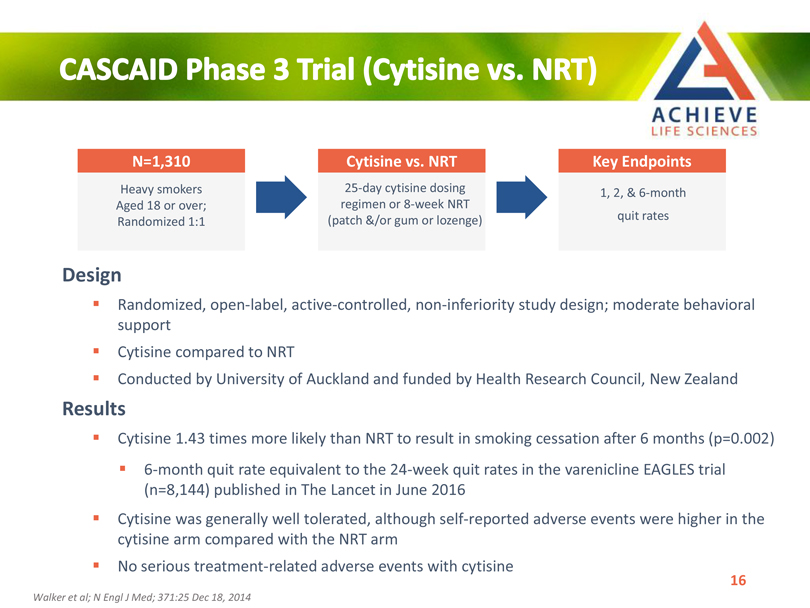

N=1,310

Heavy smokers Aged 18 or over; Randomized 1:1

Cytisine vs. NRT

25-day cytisine dosing regimen or 8-week NRT

(patch &/or gum or lozenge)

Key Endpoints

1, 2, & 6-month quit rates

Design

Randomized, open-label, active-controlled, non-inferiority study design; moderate behavioral support Cytisine compared to NRT

Conducted by University of Auckland and funded by Health Research Council, New Zealand

Results

Cytisine 1.43 times more likely than NRT to result in smoking cessation after 6 months (p=0.002) 6-month quit rate equivalent to the 24-week quit rates in the varenicline EAGLES trial (n=8,144) published in The Lancet in June 2016 Cytisine was generally well tolerated, although self-reported adverse events were higher in the cytisine arm compared with the NRT arm No serious treatment-related adverse events with cytisine

Walker et al; N Engl J Med; 371:25 Dec 18, 2014

|

|

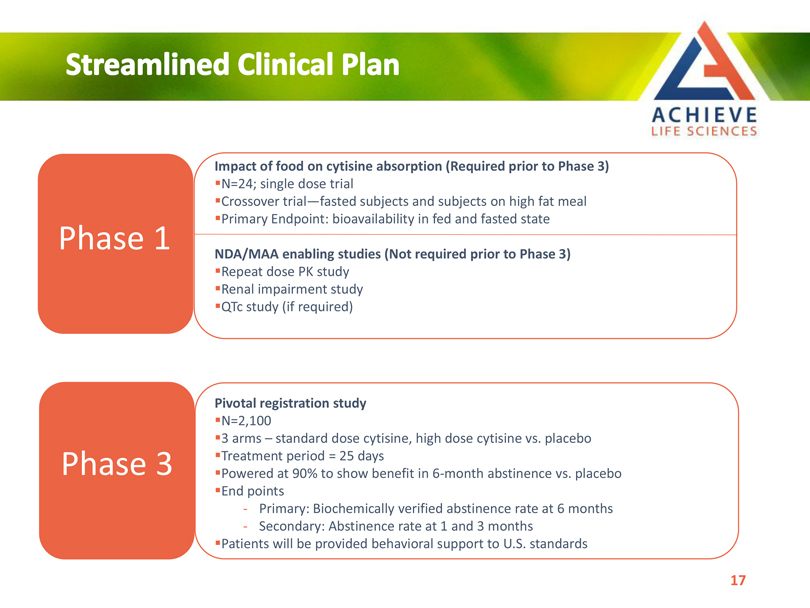

Phase 1

Impact of food on cytisine absorption (Required prior to Phase 3)

N=24; single dose trial

Crossover trialfasted subjects and subjects on high fat meal Primary Endpoint: bioavailability in fed and fasted state

NDA/MAA enabling studies (Not required prior to Phase 3)

Repeat dose PK study Renal impairment study QTc study (if required)

Phase 3

Pivotal registration study

N=2,100

3 arms standard dose cytisine, high dose cytisine vs. placebo Treatment period = 25 days Powered at 90% to show benefit in 6-month abstinence vs. placebo End points

- Primary: Biochemically verified abstinence rate at 6 months

- Secondary: Abstinence rate at 1 and 3 months

Patients will be provided behavioral support to U.S. standards

|

|

Cytisine Competitive Advantage

|

|

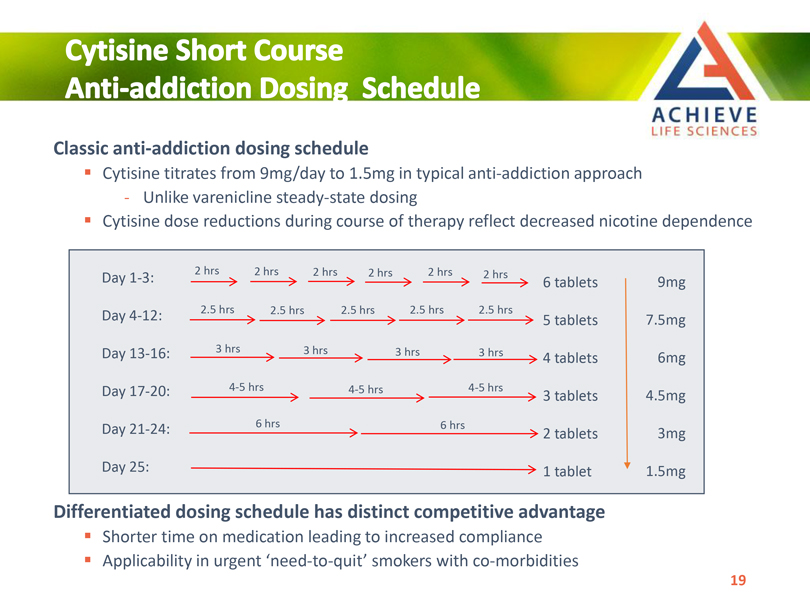

Classic anti-addiction dosing schedule

Cytisine titrates from 9mg/day to 1.5mg in typical anti-addiction approach

- Unlike varenicline steady-state dosing

Cytisine dose reductions during course of therapy reflect decreased nicotine dependence

Day 1-3: 2 hrs 2 hrs 2 hrs 2 hrs 2 hrs 2 hrs

6 tablets 9mg

2.5 hrs 2.5 hrs 2.5 hrs 2.5 hrs 2.5 hrs

Day 4-12: 5 tablets 7.5mg

Day 13-16: 3 hrs 3 hrs 3 hrs 3 hrs

4 tablets 6mg

Day 17-20: 4-5 hrs 4-5 hrs 4-5 hrs 3 tablets 4.5mg

Day 21-24: 6 hrs 6 hrs

2 tablets 3mg

Day 25: 1 tablet 1.5mg

Differentiated dosing schedule has distinct competitive advantage

Shorter time on medication leading to increased compliance

Applicability in urgent need-to-quit smokers with co-morbidities

|

|

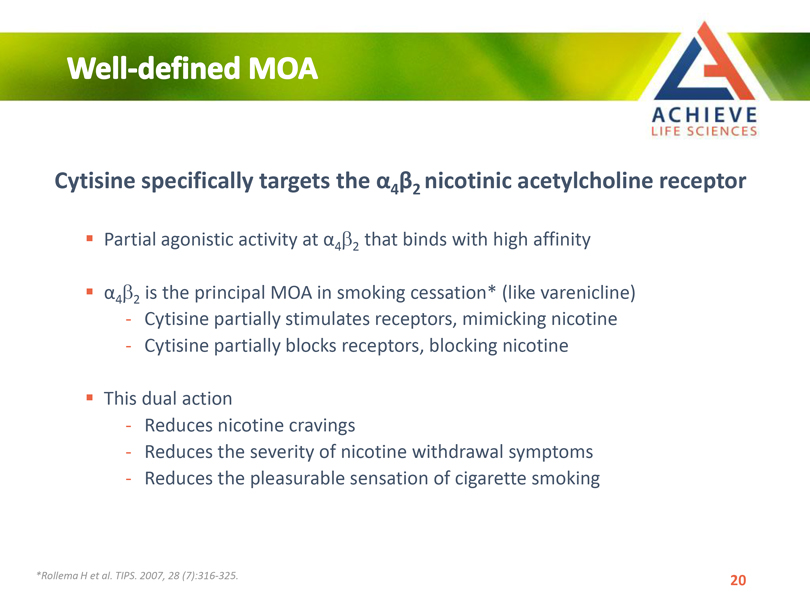

Cytisine specifically targets the 4 2 nicotinic acetylcholine receptor

Partial agonistic activity at 4b2 that binds with high affinity 4b2 is the principal MOA in smoking cessation* (like varenicline)

- Cytisine partially stimulates receptors, mimicking nicotine

- Cytisine partially blocks receptors, blocking nicotine

This dual action

- Reduces nicotine cravings

- Reduces the severity of nicotine withdrawal symptoms

- Reduces the pleasurable sensation of cigarette smoking

*Rollema H et al. TIPS. 2007, 28 (7):316-325.

|

|

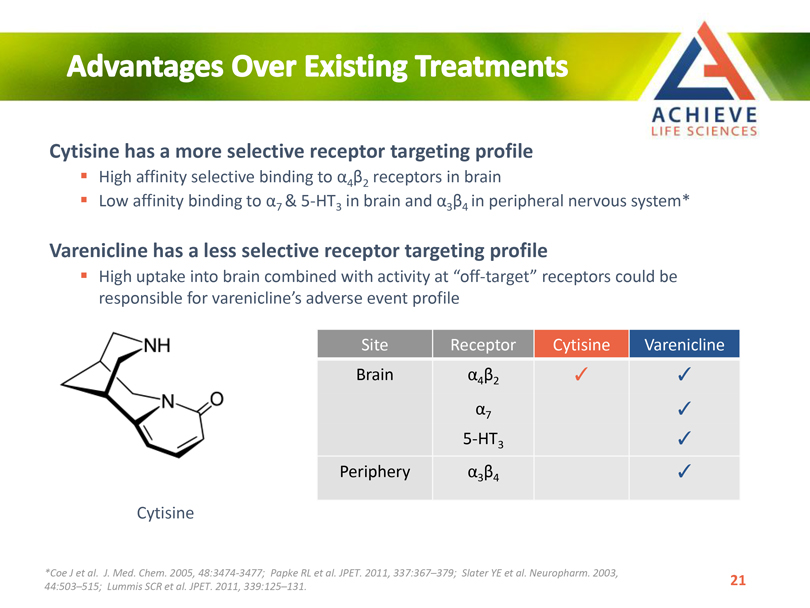

Cytisine has a more selective receptor targeting profile

High affinity selective binding to 4 2 receptors in brain

Low affinity binding to 7 & 5-HT3 in brain and 3 4 in peripheral nervous system*

Varenicline has a less selective receptor targeting profile

High uptake into brain combined with activity at off-target receptors could be responsible for vareniclines adverse event profile

Site Receptor Cytisine Varenicline

Brain 4 2

7

5-HT3

Periphery 3 4

Cytisine

*Coe J et al. J. Med. Chem. 2005, 48:3474-3477; Papke RL et al. JPET. 2011, 337:367379; Slater YE et al. Neuropharm. 2003, 44:503515; Lummis SCR et al. JPET. 2011, 339:125131.

|

|

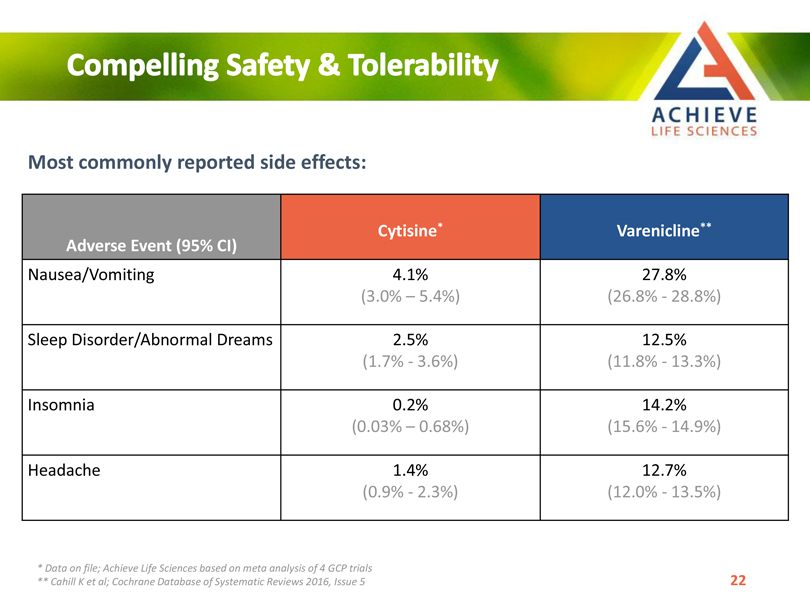

Most commonly reported side effects:

Cytisine(*) Varenicline(**)

Adverse Event (95% CI)

Nausea/Vomiting 4.1% 27.8%

| (3.0% |

|

5.4%) (26.8% 28.8%) |

Sleep Disorder/Abnormal Dreams 2.5% 12.5%

| (1.7%3.6%) |

|

(11.8% 13.3%) |

Insomnia 0.2% 14.2%

| (0.03% |

|

0.68%) (15.6% 14.9%) |

Headache 1.4% 12.7%

| (0.9%2.3%) |

|

(12.0% 13.5%) |

Data on file; Achieve Life Sciences based on meta analysis of 4 GCP trials

Cahill K et al; Cochrane Database of Systematic Reviews 2016, Issue 5

|

|

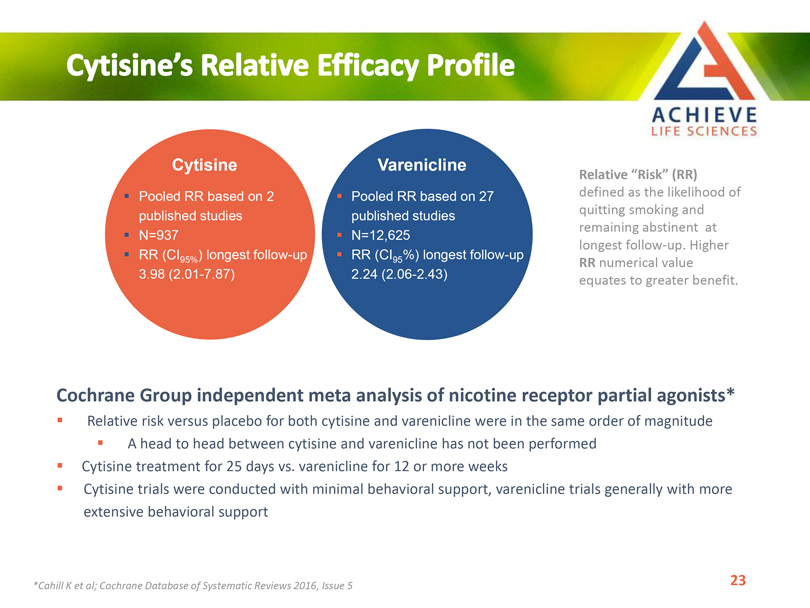

Cytisine

Pooled RR based on 2 published studies N=937 RR (CI95%) longest follow-up 3.98 (2.01-7.87)

Varenicline

Pooled RR based on 27 published studies N=12,625 RR (CI95%) longest follow-up 2.24 (2.06-2.43)

Relative Risk (RR) defined as the likelihood of quitting smoking and remaining abstinent at longest follow-up. Higher RR numerical value equates to greater benefit.

Cochrane Group independent meta analysis of nicotine receptor partial agonists*

Relative risk versus placebo for both cytisine and varenicline were in the same order of magnitude A head to head between cytisine and varenicline has not been performed Cytisine treatment for 25 days vs. varenicline for 12 or more weeks Cytisine trials were conducted with minimal behavioral support, varenicline trials generally with more extensive behavioral support

*Cahill K et al; Cochrane Database of Systematic Reviews 2016, Issue 5

|

|

Commercial Overview

|

|

Sales & Marketing Focus

Direct commercialization

Strategic Partnering

China/Japan/Rest of World

U.S., EU hospital & smoking cessation centers

U.S., EU Primary Care & Specialty Targeting

Out license

Lifecycle & Pipeline

Rx to OTC Switch

Expanded label and new indications

New formulation/ administration options

Evaluate potential OTC switch to target NRT market

Multiple indication opportunities for consideration including obesity, depression, Alzheimers and various addictions

Partnership with University of Bristol for evaluation of next generation compounds

|

|

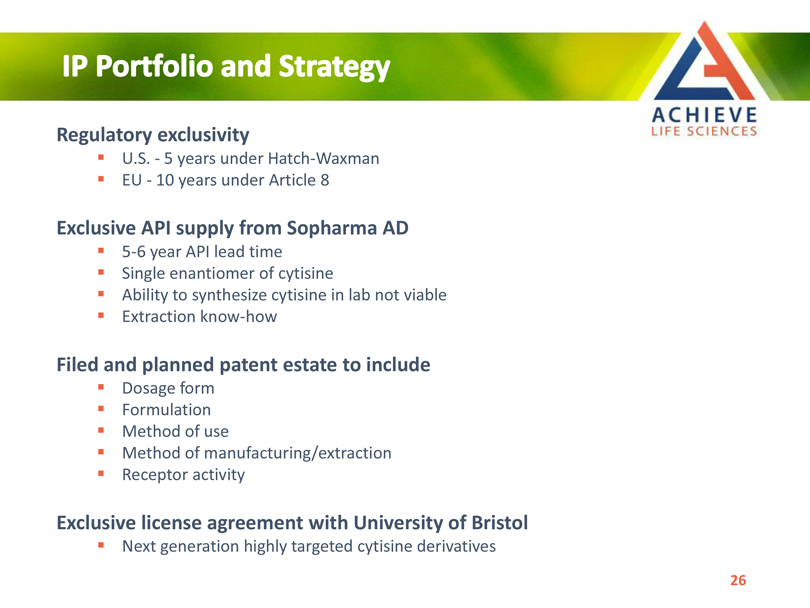

Regulatory exclusivity

U.S.5 years under Hatch-Waxman EU10 years under Article 8

Exclusive API supply from Sopharma AD

5-6 year API lead time Single enantiomer of cytisine

Ability to synthesize cytisine in lab not viable Extraction know-how

Filed and planned patent estate to include

Dosage form Formulation Method of use

Method of manufacturing/extraction Receptor activity

Exclusive license agreement with University of Bristol

Next generation highly targeted cytisine derivatives

|

|

Sopharma AD

API & solid dosage manufacturer

Exclusive supply agreement for 100% of Achieves cytisine requirement Supply for clinical trials and commercial use Competitive cost of goods

EU-GMP compliant state-of-the-art pharmaceutical manufacturing

Opened November 2013 Capacity 4 billion tablets

|

|

Corporate Profile

|

|

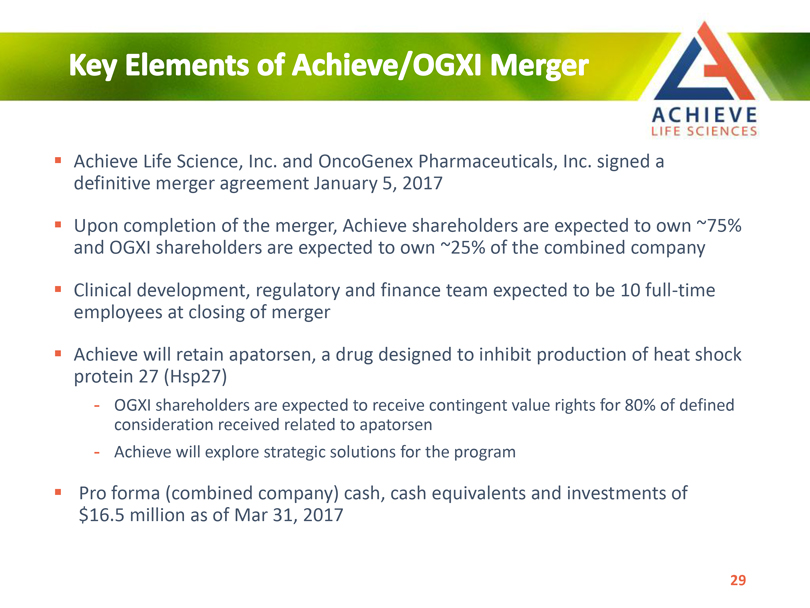

Achieve Life Science, Inc. and OncoGenex Pharmaceuticals, Inc. signed a definitive merger agreement January 5, 2017

Upon completion of the merger, Achieve shareholders are expected to own ~75% and OGXI shareholders are expected to own ~25% of the combined company

Clinical development, regulatory and finance team expected to be 10 full-time employees at closing of merger

Achieve will retain apatorsen, a drug designed to inhibit production of heat shock protein 27 (Hsp27)

- OGXI shareholders are expected to receive contingent value rights for 80% of defined consideration received related to apatorsen

- Achieve will explore strategic solutions for the program

Pro forma (combined company) cash, cash equivalents and investments of $16.5 million as of Mar 31, 2017

|

|

Rick Stewart Chairman & CEO of Ricanto

Chairman & CEO CEO of Brabant Pharma (acquired by Zogenix)

Chairman & CEO of Huxley Pharma (acquired by BioMarin)

CEO of Amarin Corp

Founder & CBO of SkyePharma (acquired by Vectura)

John Bencich, MBA, CPA CFO of OncoGenex

CFO CFO of Integrated Diagnostics

CFO of Allozyne

CFO of Trubion Pharmaceuticals (acquired by Emergent)

Cindy Jacobs, PhD, MD CMO of OncoGenex

CMO CMO of Corixa (acquired by GSK)

VP Clinical Development, CellPro

Anthony Clarke, PhD CSO of Ricanto

CSO CSO of Brabant Pharma (acquired by Zogenix)

CSO of Huxley Pharma (acquired by BioMarin)

VP Clinical and Regulatory, Amarin Corp

|

|

Large market opportunity with rapid path to approval

Substantial global commercial opportunity for smoking cessation treatments Phase 3 ready asset in the U.S. and potential to file MAA earlier in the EU Life cycle opportunity for other indications and formulations

High probability of clinical success

De-risked clinical development pathway

Over 21 million patients already treated with cytisine

Safety and efficacy shown in 2 recent Phase 3 trials in over 2,000 patients

Clear product differentiation

Single short course of treatment Anti-addiction dosing schedule

Distinct MOA with compelling safety profile

|

|