DEF 14A: Definitive proxy statements

Published on March 24, 2006

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement

Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant x |

|

|

Filed by a Party other than the Registrant o |

|

|

Check the appropriate box: |

|

|

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

x |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material Pursuant to §240.14a-12 |

|

Sonus Pharmaceuticals, Inc. |

||

|

(Name of Registrant as Specified In Its Charter) |

||

|

|

||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||

|

|

||

|

Payment of Filing Fee (Check the appropriate box): |

||

|

x |

No fee required. |

|

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

(5) |

Total fee paid: |

|

|

|

|

|

o |

Fee paid previously with preliminary materials. |

|

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

(1) |

Amount Previously Paid: |

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

(3) |

Filing Party: |

|

|

|

|

|

|

(4) |

Date Filed: |

|

|

|

|

|

|

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

SONUS PHARMACEUTICALS,

INC.

22026 20th Avenue S.E.

Bothell, Washington 98021

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

May 9, 2006

TO THE STOCKHOLDERS OF SONUS PHARMACEUTICALS, INC.:

The Annual Meeting of Stockholders of Sonus Pharmaceuticals, Inc. (the Company) will be held at the Washington Athletic Club, 1325 6th Avenue, Seattle, Washington, on May 9, 2006, at 9:00 A.M., for the following purposes as more fully described in the accompanying Proxy Statement:

(1) To elect the following five (5) nominees to serve as directors until the next annual meeting of stockholders or until their successors are elected and have qualified:

|

Michelle Burris |

Michael A. Martino |

(2) To approve the Companys 2006 Employee Stock Purchase Plan;

(3) To ratify the appointment of Ernst & Young LLP as independent auditors of the Company for the fiscal year ending December 31, 2006; and

(4) To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

Only stockholders of record at the close of business on March 15, 2006 are entitled to vote at the Annual Meeting or any adjournment or postponement thereof.

By Order of the Board of Directors

Michael A. Martino

President and Chief Executive Officer

March 24, 2006

YOUR VOTE IS IMPORTANT. THEREFORE, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING YOU SHOULD COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY. Any stockholder present at the meeting may withdraw his or her proxy and vote personally on each matter brought before the meeting. Stockholders attending the meeting whose shares are held in the name of a broker or other nominee who desire to vote their shares at the meeting should bring with them a proxy or letter from that firm confirming their ownership of shares.

SONUS

PHARMACEUTICALS, INC.

22026 20th Avenue

S.E.

Bothell, Washington 98021

On or about April 11, 2006, Sonus Pharmaceuticals, Inc., a Delaware corporation (the Company) will begin mailing these proxy materials to all registered owners (sometimes called record holders) of the Companys common stock at the close of business on March 15, 2006 (the Record Date). The Company has sent this Proxy Statement to you because the Board of Directors of the Company is requesting your proxy to vote at the 2006 Annual Meeting and at any adjournment or postponement of such meeting. A copy of this Proxy Statement also has been sent to beneficial owners of the Companys common stock whose shares were held in street-name by banks, brokers and other record holders at the close of business on March 15, 2006.

Solicitation of proxies is expected to be made primarily by mail. However, the Companys directors, officers and employees may communicate with stockholders, brokerage houses and others by telephone or in person to request that proxies be furnished. The Company may reimburse banks, brokers, custodians, nominees, fiduciaries and others for their reasonable out-of-pocket expenses in forwarding proxy materials to the beneficial owners of the shares held by them.

If you are a registered owner (meaning that your shares are registered in the Companys records as being owned in your name), then you may vote on matters presented at the Annual Meeting in the following ways:

· By proxyYou may complete the proxy card and mail it in the postage-paid envelope provided; or

· In personYou may attend the Annual Meeting and cast your vote there.

If you are a beneficial owner whose shares are held in street-name by a bank, broker or other record holder, please refer to your voting instruction card and other materials forwarded by such record holder for information on how to instruct the record holder to vote on your behalf.

If you are a registered holder and vote by proxy, the individuals named on the enclosed proxy card will vote your shares in the way that you indicate. When completing the proxy card, you may specify whether your shares should be voted for or against or to abstain from voting on all, some or none of the following:

(1) To elect the following five (5) nominees to serve as directors until the next annual meeting of stockholders or until their successors are elected and have qualified:

|

Michelle Burris |

Michael A. Martino Dwight Winstead |

(2) To approve the Companys 2006 Employee Stock Purchase Plan.

(3) To ratify the appointment of Ernst & Young LLP as independent auditors of the Company for the fiscal year ending December 31, 2006.

If you do not indicate how your shares should be voted on a matter, the shares represented by your properly completed proxy will be voted as the Board of Directors recommends. If you choose to vote by

mailing a proxy card, your proxy card must be filed with the Corporate Secretary of the Company prior to or at the commencement of the Annual Meeting.

Registered holders who vote by sending in a signed proxy will not be prevented from attending the Annual Meeting and voting in person. You have the right to revoke a proxy at any time before it is exercised by (a) executing and returning a later dated proxy, (b) giving written notice of revocation to the Companys Corporate Secretary at 22026 20th Avenue S.E., Bothell, Washington 98021 or (c) attending the Annual Meeting and voting in person. In order to attend the Annual Meeting and vote in person, a beneficial holder whose shares are held in street name by a bank, broker or other record holder must follow the instructions provided by such record holder for voting in person at the meeting. The beneficial holder also must obtain from such record holder and present at the Annual Meeting a written proxy allowing the beneficial holder to vote the shares in person.

Record Date, Quorum and Voting Requirements

Only holders of record of the Companys common stock at the close of business on March 15, 2006 will be eligible to vote at the Annual Meeting. As of the close of business on March 15, 2006, the Company had 30,640,971 shares of common stock outstanding. Each share of common stock is entitled to one vote.

A quorum of shares is necessary to hold a valid stockholders meeting. A majority of the shares entitled to vote, present in person or represented by proxy, will constitute a quorum at the Annual Meeting. Shares for which an abstention from voting is observed, as well as shares that a broker holds in street name and votes on some matters but not others (broker non-votes), will be counted for purposes of establishing a quorum.

Directors will be elected by a plurality of votes cast at the Annual Meeting. This means that the five nominees for director who receive the most votes will be elected. If you are present at the meeting but do not vote for a particular nominee, or if you have given a proxy and properly withheld authority to vote for a nominee, or if there are broker non-votes, the shares withheld or not voted will not be counted for purposes of the election of directors.

For each other item, the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote on the matter at the Annual Meeting is required for approval. If you are present at the meeting but do not vote on any of these proposals, or if you have given a proxy and abstain on any of these proposals, this will have the same effect as if you voted against the proposal. If there are broker non-votes on the issue, the shares not voted will have no effect on the outcome of the proposal.

Currently, there are five (5) members of the Board of Directors. Directors are elected at each annual stockholders meeting to hold office until the next annual meeting or until their successors are elected and have qualified. Unless otherwise instructed, the proxy holders named in the enclosed proxy will vote the proxies received by them for the five (5) nominees named below. All of the nominees presently are directors of the Company.

If any nominee becomes unavailable for any reason before the election, the enclosed proxy will be voted for the election of such substitute nominee or nominees, if any, as shall be designated by the Board of Directors. The Board of Directors has no reason to believe that any of the nominees will be unavailable to serve.

Under Delaware law, the five (5) nominees receiving the highest number of votes will be elected as directors at the Annual Meeting. As a result, proxies voted to Withhold Authority, which will be

2

counted, and broker non-votes, which will not be counted, will have no practical effect. In addition, the election of directors is a matter on which a broker or other nominee is empowered to vote. Accordingly, no broker non-votes will result from this proposal.

The names and certain information concerning the five (5) nominees for election as directors are set forth below. THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF EACH OF THE NOMINEES NAMED BELOW.

|

Name |

|

|

|

Age |

|

Position with the Company |

|

Michael A. Martino |

|

50 |

|

President, Chief Executive Officer and Director |

||

|

Michelle Burris |

|

40 |

|

Director, Chairperson of the Audit Committee |

||

|

George W. Dunbar, Jr. |

|

59 |

|

Director, Member of the Audit, Compensation and Nominating and Governance Committees |

||

|

Robert E. Ivy |

|

72 |

|

Director, Chairman of the Board, Chairman of the Nominating and Governance Committee and Member of the Audit Committee |

||

|

Dwight Winstead |

|

57 |

|

Director, Chairman of the Compensation Committee and Member of the Audit and Nominating and Governance Committees |

||

Michael A. Martino (50) is the President, Chief Executive Officer and a director of the Company. Mr. Martino joined the Company in September 1998 as President, Chief Operating Officer and a director and was appointed Chief Executive Officer in July 1999. From 1983 to 1998, Mr. Martino held numerous positions of increasing responsibility in strategic planning, business development, marketing and sales, and general management with Mallinckrodt, Inc., a global healthcare products company, including serving as Vice President and General Manager of the Nuclear Medicine Division where he was responsible for annual revenues of approximately $250 million. Mr. Martino holds a B.A. in business from Roanoke College and an M.B.A. from Virginia Tech. He sits on the Presidents Advisory Board of Roanoke College and is a member of the Cascadia Community College Foundation Board of Directors. In addition, Mr. Martino is a past Chairman of the Board of Directors of the Washington Biotechnology and Biomedical Association (WBBA).

Michelle Burris (40) was appointed as a director of the Company in May 2004. Ms. Burris is currently Senior Vice President and Chief Financial Officer of Trubion Pharmaceuticals, Inc, a position she has held since February 2006. From August 2005 to January 2006, Ms. Burris served as Senior Vice President and Chief Financial Officer at Dendreon Corporation. From January 2001 to July 2005, she served as Senior Vice President and Chief Financial Officer at Corixa Corporation, which was sold to GlaxoSmithKline in 2005. Ms. Burris had worked at Corixa since its inception in 1994, and prior to her last position at the firm, had served in various capacities of increasing responsibility in finance and operations. Prior to Corixa, Ms. Burris held several finance and strategic planning positions at The Boeing Company. Ms. Burris is on the Advisory Board of Albers School of Business and Economics at Seattle University. She received a Post Graduate Certificate in accounting and an MBA from Seattle University, and a B.S. from George Mason University. Ms. Burris received her Certified Public Accountant Certification from the State of Washington; however, she is no longer an active CPA.

George W. Dunbar, Jr. (59) was elected as a director of the Company in November 1997 and served as co-chairman of the board from 1999 to 2005. Mr. Dunbar was recently the Chief Executive Officer and a director of Quantum Dot, a company commercializing proprietary labeling and detection nanoparticle bioprobes for multiple applications throughout life science research and medicine. Quantum Dot was sold to Invitrogen during Q4 2005. During 2003 he was Chief Executive Officer of Targesome, developing targeted drug delivery technology, which was restructured and sold during 2004. Mr. Dunbar was

3

previously Chief Executive Officer of Epic Therapeutics, an MPM Capital company, commercializing controlled release formulation technology, which was sold to Baxter Healthcare during 2002. Earlier, as interim Chief Executive Officer, Mr. Dunbar worked with Dr. Irving Weissman and its founders to restructure both StemCells, Inc. and CytoTherapeutics. Mr. Dunbars operating experience includes serving as Chief Executive Officer and a director and engaging in advisory work with many private and public bioscience companies including Molecular Probes, Metra BioSystems, Quidel, DepoTech, Metrika, and LJL BioSystems, as well as senior management positions with Ares Serono, Amersham, and earlier in his career with Motorola. Mr. Dunbar is also a director of Competitive Technologies. Mr. Dunbar is a graduate of Auburn University with degrees in Electrical Engineering and an MBA, and serves on the Business Schools MBA Advisory Board.

Robert E. Ivy (72) was elected as a director of the Company in February 1999 and co-chairman of the board in July 1999. In December 2005, Mr. Ivy was appointed as chairman of the board. Since October 1999, Mr. Ivy has been the President of Insight, Inc. From 1987 until 1999, Mr. Ivy served as President, Chief Executive Officer and Chairman of the Board of Ribi ImmunoChem, a biopharmaceutical company, which was acquired by Corixa Corporation in October 1999. Prior to joining Ribi ImmunoChem, Mr. Ivy served as President, Chief Executive Officer and a director of Oncogene Science, Inc.; President, Chief Executive Officer and a director of Berlex Laboratories, Inc. (a subsidiary of Schering A.G.); and President of the U.S.V. Pharmaceutical Division of Revlon Health Care Group. Mr. Ivy began his career with G.D. Searle & Co. in sales and marketing rising to the position of Vice President, Marketing and Sales. Mr. Ivy holds a B.S. in Chemistry and Biology from Northwestern University and attended Northwestern University Medical School.

Dwight Winstead (57) has served as a director of the Company since July 1995. Mr. Winstead is currently President and Chief Operating Officer of Cardinal Health Clinical Technologies and Services, (CTS) a subsidiary of Cardinal Health, Inc. Prior to his current position at CTS, he served as Group President of Clinical Services and Consulting and President of Pyxis Products, formerly known as AIS (Automated Information Services) since 1997. From 1991 to 1997, Mr. Winstead served as Executive Vice President of VHA, Inc., a performance improvement company serving health care organizations in the United States. Prior to his promotion to Executive Vice President, Mr. Winstead served in various capacities of VHA Supply Company, a subsidiary of VHA, Inc., including Vice President, Sales and Marketing, Senior Vice President, Chief Operating Officer and President from 1987 to 1991. Prior to joining VHA, Inc. in 1984, Mr. Winstead served in a variety of materials management and sales positions in several companies, including Ortho Instruments and Worthington Diagnostics. Mr. Winstead holds a B.S. from Delta State University.

Michael B. Stewart, M.D. (55) is Senior Vice President and Chief Medical Officer, joining the Company in January 2003. Prior to joining the Company, Dr. Stewart was Vice President of Clinical Affairs at ICOS Corporation. Prior to joining ICOS, Dr. Stewart held senior clinical and research and development positions at Bristol-Myers Squibb. He was also a senior investigator at the National Cancer Institute and held faculty positions at the University of Maryland. Dr. Stewart received a B.S. in natural sciences from Johns Hopkins University and a M.D. from the University of Maryland School of Medicine. He is board certified in Internal Medicine and Medical Oncology.

Alan Fuhrman (49) is Senior Vice President and Chief Financial Officer, joining the Company in September 2004. He has over 20 years of successful executive management experience with public and private companies in the life sciences and high technology industries. Prior to joining Sonus, Mr. Fuhrman served as President and Chief Operating Officer of Integrex, Inc. from 2002 until its acquisition in 2004. He has also held Chief Financial Officer positions at Capital Stream, Inc. a startup financial services workflow automation company; Medisystems Corporation, an international medical device manufacturer;

4

and NeoPath, Inc., a publicly held medical device company. Mr. Fuhrman serves on the Board of Directors of the Washington Biotechnology and Biomedical Association (WBBA). He received B.S. degrees in both Accounting and Agricultural Economics from Montana State University.

The Board of Directors of the Company held sixteen (16) meetings during the fiscal year ended December 31, 2005. Each incumbent director attended at least seventy-five percent (75%) of all meetings of the Board and meetings of all committees of the Board on which he or she served. There are no family relationships among any of the directors or executive officers of the Company.

Committees of the Board of Directors

The Board of Directors has established a Nominating and Governance Committee, a Compensation Committee and an Audit Committee.

Nominating and Governance Committee

The members of the Nominating and Governance Committee are Robert E. Ivy (Chairman), George W. Dunbar, Jr. and Dwight Winstead. Each of the members of the Nominating and Governance Committee meets the definition of independence set forth in the NASDAQ corporate governance listing standards. The Charter for the Nominating and Governance Committee can be accessed electronically on the Companys website at www.sonuspharma.com. The Nominating and Governance Committee held no meetings during the fiscal year ended December 31, 2005.

The Nominating and Governance Committees responsibilities include: (i) establishing criteria for the selection of new directors, (ii) evaluating the qualifications of potential candidates for directors, (iii) reviewing, investigating and accepting or rejecting nominees for the Board of Directors suggested by any stockholder of the Company, (iv) recommending to the Board of Directors the nominees for election at the next annual meeting or any special meeting of stockholders and any person to be considered to fill a Board of Director vacancy or a newly created directorship, (v) reviewing and assessing the performance of the Board of Directors and management, and (vi) reviewing and reassessing the adequacy of the corporate governance principles of the Company.

The Nominating and Governance Committee will consider stockholder recommendations for directors sent to the Nominating and Governance Committee, c/o Chief Executive Officer, Sonus Pharmaceuticals, Inc., 22026 20th Avenue S.E., Bothell, Washington 98021. Stockholder recommendations for director should include:

· the name and address of the stockholder recommending the person to be nominated;

· a representation that the stockholder is a holder of record of stock of the Company, including the number of shares held and the period of holding;

· a description of all arrangements or understandings between the stockholder and the recommended nominee, if any;

· such other information regarding the recommended nominee as would be required to be included in a proxy statement filed pursuant to Regulation 14A promulgated by the SEC pursuant to the Securities Exchange Act of 1934, as amended; and

· the consent of the recommended nominee to serve as a director of the Company if so elected.

To submit a recommendation for director for an upcoming annual stockholder meeting, it is necessary that you notify the Company not less than 120 days or more than 180 days before the first anniversary of

5

the date that the proxy statement for the preceding years annual meeting was first sent to stockholders. The Companys 2006 Proxy Statement will first be sent to stockholders on or about April 11, 2006. Thus, in order for any such nomination to be considered by the Company for the 2007 annual meeting, it must be received not later than December 13, 2006. In addition, the notice must meet all other requirements contained in the Companys Bylaws, if any. Stockholders nominees who comply with these procedures will receive the same consideration that the Nominating and Governance Committees nominees receive.

The Nominating and Governance Committee considers the following minimum criteria when reviewing a director nominee:

· Director candidates must have the highest character and integrity and have an inquiring mind, vision and the ability to work well with others;

· Director candidates must be free of any conflict of interests which would violate applicable law or regulations or interfere with the proper performance of the responsibilities of a director;

· Director candidates must possess substantial and significant experience which would be of particular importance to the Company in the performance of the duties of a director;

· Director candidates must have sufficient time available to devote to the affairs of the Company in order to carry out the responsibilities of a director; and

· Director candidates must have the capacity and desire to represent the balanced, best interests of the stockholders of the Company as a whole and not primarily a special interest group or constituency.

The Nominating and Governance Committee and, as needed, a retained search firm, screens the candidates, does reference checks, prepares a biography for each candidate for the Nominating and Governance Committee to review and conduct interviews. The Nominating and Governance Committee and the Companys Chief Executive Officer interview candidates that meet the criteria, and the Nominating and Governance Committee selects nominees that best suit the Boards needs to recommend to the full Board.

Audit Committee

The members of the Audit Committee of the Board of Directors (the Audit Committee) are Michelle Burris (Chairperson), George W. Dunbar, Jr., Robert E. Ivy, and Dwight Winstead, all of whom meet the definition of independence set forth in the NASDAQ corporate governance listing standards. The Board of Directors has also determined that Michelle Burris is an audit committee financial expert, as defined by the rules of the SEC. The Board of Directors also believes that each of the other members of the Audit Committee would satisfy the requirements of an audit committee financial expert. The Audit Committees responsibilities include: (i) reviewing the independence, qualifications, services, fees, and performance of the independent auditors, (ii) appointing, replacing and discharging the independent auditors, (iii) pre-approving the professional services provided by the independent auditors, (iv) reviewing the scope of the annual audit and reports and recommendations submitted by the independent auditors, (v) reviewing the Companys financial reporting and accounting policies, including any significant changes, with management and the independent auditors and (vi) addressing reports, if any, to the employee hotline established for submission of complaints regarding accounting matters on a confidential or anonymous basis. The Charter for the Audit Committee can be accessed electronically on the Companys website at www.sonuspharma.com. The Audit Committee held five (5) meetings during the fiscal year ended December 31, 2005.

6

Compensation Committee

The members of the Compensation Committee of the Board of Directors (the Compensation Committee) are Dwight Winstead (Chairman) and George W. Dunbar, Jr., each of whom meets the definition of independence set forth in the NASDAQ corporate governance listing standards. The functions of the Compensation Committee include advising the Board of Directors on officer and employee compensation. The Board of Directors, based on input from the Compensation Committee, establishes the annual compensation for the Companys officers. The Charter for the Compensation Committee can be accessed electronically on the Companys website at www.sonuspharma.com. The Compensation Committee held five (5) meetings during the fiscal year ended December 31, 2005.

The Board of Directors has determined that all of the Director nominees for election at the Annual Meeting, except for Michael A. Martino the Companys President and Chief Executive Officer, are independent under the NASDAQ corporate governance listing standards.

The Company has adopted a code of ethics that is applicable to, among others, its principal executive officer, principal financial officer, principal accounting officer and controller, or persons performing similar functions, and has posted such code on the Companys website at www.sonuspharma.com.

Shareholders may communicate with the Board or any of the directors by sending written communications addressed to the Board or any of the directors, c/o Chief Financial Officer, Sonus Pharmaceuticals, Inc., 22026 20th Avenue S.E., Bothell, Washington 98021. All communications are compiled by the Chief Financial Officer and forwarded to the Board or the individual director(s) accordingly.

Director Attendance at Annual Meetings

Directors are strongly encouraged to attend annual meetings of the Companys stockholders. All but one of the Companys directors attended the 2005 annual meeting of the Companys shareholders.

7

The following table sets forth information regarding compensation received for the fiscal year ended December 31, 2005, and during the preceding two fiscal years, by the Companys Chief Executive Officer and its other executive officers (collectively the Named Executive Officers):

|

|

|

|

Annual Compensation |

|

|

|

Long Term |

|

All Other |

|

|||||||||||||

|

Name and Position |

|

|

|

Year |

|

Salary |

|

Bonus(4) |

|

Total |

|

Stock Options |

|

Compensation |

|

||||||||

|

Michael A. Martino(1) |

|

2005 |

|

$ |

345,800 |

|

$ |

233,770 |

|

$ |

579,570 |

|

|

162,000 |

|

|

|

$ |

7,480 |

(5) |

|

||

|

President, Chief Executive |

|

2004 |

|

$ |

333,000 |

|

$ |

107,590 |

|

$ |

440,950 |

|

|

140,000 |

|

|

|

$ |

9,360 |

(5) |

|

||

|

Officer and Director |

|

2003 |

|

$ |

305,000 |

|

$ |

125,720 |

|

$ |

430,720 |

|

|

125,000 |

|

|

|

$ |

10,100 |

(5) |

|

||

|

Michael B. Stewart, M.D.(1)(2) |

|

2005 |

|

$ |

261,100 |

|

$ |

114,400 |

|

$ |

375,500 |

|

|

120,000 |

|

|

|

$ |

4,290 |

(5) |

|

||

|

Senior Vice President and |

|

2004 |

|

$ |

251,500 |

|

$ |

63,200 |

|

$ |

314,700 |

|

|

55,000 |

|

|

|

$ |

1,050 |

(5) |

|

||

|

Chief Medical Officer |

|

2003 |

|

$ |

212,700 |

|

$ |

79,740 |

|

$ |

292,440 |

|

|

80,000 |

|

|

|

$ |

700 |

(5) |

|

||

|

Alan Fuhrman(1)(3) |

|

2005 |

|

$ |

220,000 |

|

$ |

96,300 |

|

$ |

316,300 |

|

|

78,000 |

|

|

|

$ |

1,170 |

(5) |

|

||

|

Senior Vice President and |

|

2004 |

|

$ |

55,850 |

|

$ |

18,685 |

|

$ |

74,535 |

|

|

110,000 |

|

|

|

$ |

|

|

|

||

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

(1) Effective January 1, 2006, the annual base salaries for Messrs. Martino, Stewart and Fuhrman are $361,900, $273,300, and $237,700, respectively.

(2) Dr. Stewart joined the Company in January 2003.

(3) Mr. Fuhrman joined the Company in September 2004.

(4) Bonus amounts include annual performance awards earned in the reporting year.

(5) Other compensation consists of 401(k) matching contributions and executive life and disability payments.

Option/SAR Grants in Last Fiscal Year

|

|

|

Number of |

|

% of Total |

|

Exercise or |

|

Expiration |

|

Potential Realizable Value |

|

|||||||||||||

|

Name |

|

|

|

Granted |

|

Fiscal Year(1) |

|

($/Share) |

|

Date(2) |

|

5% |

|

10% |

|

|||||||||

|

Michael A. Martino |

|

|

162,000 |

|

|

|

15.6 |

% |

|

|

$ |

5.10 |

|

|

12/16/2015 |

|

$ |

519,593 |

|

$ |

1,316,750 |

|

||

|

Michael B. Stewart, M.D. |

|

|

120,000 |

|

|

|

11.5 |

% |

|

|

$ |

5.10 |

|

|

12/16/2015 |

|

$ |

384,884 |

|

$ |

975,370 |

|

||

|

Alan Fuhrman |

|

|

78,000 |

|

|

|

7.5 |

% |

|

|

$ |

5.10 |

|

|

12/16/2015 |

|

$ |

250,174 |

|

$ |

633,991 |

|

||

(1) Options to purchase an aggregate of 1,039,000 shares of Common Stock were granted to employees, including the Named Executive Officers, during the year ended December 31, 2005.

(2) Options granted have a term of 10 years, subject to earlier termination in certain events, and vest over four years.

(3) In accordance with the rules and regulations of the Securities and Exchange Commission, such gains are based on assumed rates of annual compound stock appreciation of 5% and 10% from the date on which the options were granted over the full term of the options. The rates do not represent the Companys estimate or projection of future Common Stock prices, and no assurance can be given that the rates of annual compound stock appreciation assumed will be achieved.

8

Aggregate

Option/SAR Exercises in Last Fiscal Year

and Fiscal Year-End Option Values

|

|

|

Shares |

|

Value |

|

Number of Securities |

|

Value of Unexercised |

|

||||||||||||||||||||

|

Name |

|

|

|

on Exercise |

|

Realized |

|

Exercisable |

|

Unexercisable |

|

Exercisable |

|

Unexercisable |

|

||||||||||||||

|

Michael A. Martino |

|

|

|

|

|

|

|

|

|

|

652,680 |

|

|

|

358,446 |

|

|

|

$ |

305,862 |

|

|

|

$ |

282,923 |

|

|

||

|

Michael B. Stewart, M.D. |

|

|

|

|

|

|

|

|

|

|

174,062 |

|

|

|

245,938 |

|

|

|

$ |

375,039 |

|

|

|

$ |

209,561 |

|

|

||

|

Alan Fuhrman |

|

|

|

|

|

|

|

|

|

|

34,375 |

|

|

|

153,625 |

|

|

|

$ |

61,875 |

|

|

|

$ |

136,125 |

|

|

||

(1) Market value of underlying securities at year-end minus the exercise price of in-the-money options. The closing sale price for the Companys Common Stock as of December 30, 2005 (the last day of trading in fiscal year 2005) on the Nasdaq National Market was $5.03 per share.

During 2005, the Companys non-employee directors received cash compensation in the amount of $3,750 per quarter for service on the Companys Board of Directors. For the fiscal year beginning January 1, 2006, each director who is not an employee of the Company will receive an annual retainer of $24,000, paid quarterly, plus $1,250 for each in-person Board meeting and $750 for each telephonic Board meeting. All directors may be reimbursed for certain expenses incurred for meetings of the Board of Directors for which they attended. For the fiscal year beginning January 1, 2006, committee members shall receive $500 per committee meeting, and the Chairperson of the Audit Committee shall receive an additional annual cash retainer of $3,000, and the Chairperson of the Board shall receive an additional annual cash retainer of $2,000. Each director is also eligible to receive options under the Companys 2000 Stock Incentive Plan. As of January 1, 2006, each eligible director shall receive options to purchase 17,000 shares of stock each year on the day of the Companys Annual Meeting of Stockholders, provided he or she has served as a director of the Company for at least one year as of such Annual Meeting of Stockholders. In the year ended December 31, 2005, each non-employee director, received options resulting from their service as a director to purchase 10,000 shares of the Companys Common Stock at $2.87 per share. In addition, each newly elected director receives options to purchase 22,500 shares of the Companys Common Stock upon joining the Board, an increase from 15,000 in 2005.

10b5-1 Trading Plans and Share Retention Policies

The Company has a 10b5-1 trading policy that restricts the ability of directors, executive officers and key employees to sell shares of common stock of the Company unless such sales are made pursuant to a pre-arranged trading plan approved by the Company and adopted by the director, executive officer or key employee in accordance with Rule 10b5-1 of the Securities and Exchange Act of 1934. Rule 10b5-1 allows persons who are not aware of material, non-public information to adopt written, pre-arranged trading plans. Individuals may use these plans to diversify their investment portfolios and sell shares over an extended period of time. Transactions by directors and executive officers will be publicly reported in accordance with applicable securities laws. The Company does not undertake any obligation to report the adoption of individual 10b5-1 plans.

The share retention policy establishes ownership guidelines that require directors and executive officers to retain a minimum percentage of shares granted by the Company or shares that have a minimum value relative to cash compensation. Under this policy, directors and executive officers must retain 50% of shares and vested options received from the Company as equity awards until such time as the owned shares and vested options have a fair value of at least two times the annual cash retainer for directors, three times the annual base salary for the Chief Executive Officer and two times the annual base salary for other executive officers.

9

The Company has entered into Change-in-Control Agreements with Messrs. Martino, Stewart and Fuhrman. The Agreements provide that upon termination of employment within 12 months following a Change of Control, as defined in the Agreements, either voluntarily for good reason or involuntarily without cause, the Company will pay the employee accrued and unpaid base salary, declared and unpaid incentive compensation and a severance payment equal the employees highest annual base salary in effect within 12 months of termination multiplied by 2.99 for Mr. Martino and 1.00 for Messrs. Stewart and Fuhrman.

Compliance with Section 16(a) of the Securities Exchange Act of 1934

Based solely upon its review of the copies of reports furnished to the Company, or written representations from directors, officers and persons holding ten percent (10%) or more of the Companys Common Stock, the Company believes that with the exceptions noted below, all filing requirements under Section 16(a) of the Securities Exchange Act of 1934, as amended, applicable to its directors, officers and any persons holding ten percent (10%) or more of the Companys Common Stock were made with respect to the Companys fiscal year ended December 31, 2005. Mr. Martino, the Companys President and CEO, was late in filing a Form 4 related to an option grant on December 29, 2004 of 140,000 non-qualified stock options and Mr. Stewart, the Companys Senior Vice President and Chief Medical Officer, was late in filing a Form 4 related to an option grant on December 29, 2004 of 55,000 non-qualified stock options.

10

Security Ownership of Management and Certain Beneficial Owners

Set forth below is certain information as of the Record Date regarding the beneficial ownership of the Companys Common Stock by (i) any person who was known by the Company to own more than five percent (5%) of the voting securities of the Company, (ii) all directors and nominees, (iii) each of the Named Executive Officers identified in the Summary Compensation Table, and (iv) all current directors and executive officers as a group.

|

Beneficial Owners |

|

|

|

Amount and Nature of |

|

Percent of Class(1) |

|

||||

|

Schering Berlin Venture Corporation(2) |

|

|

4,875,000 |

|

|

|

15.9 |

% |

|

||

|

340 Changebridge Road,

P.O. Box 1000 |

|

|

|

|

|

|

|

|

|

||

|

Atlas Master Fund, Ltd.(3) |

|

|

3,018,042 |

|

|

|

9.8 |

% |

|

||

|

c/o Walkers SPV Limited |

|

|

|

|

|

|

|

|

|

||

|

Domain Public Equity Partners, L.P.(4) |

|

|

1,964,197 |

|

|

|

6.4 |

% |

|

||

|

One Palmer Square,

Suite 515 |

|

|

|

|

|

|

|

|

|

||

|

Executive Officers and Directors: |

|

|

|

|

|

|

|

|

|

||

|

Michael A. Martino(5) |

|

|

898,161 |

|

|

|

2.9 |

% |

|

||

|

Michael B. Stewart, M.D.(6) |

|

|

206,480 |

|

|

|

* |

|

|

||

|

Alan Fuhrman(7) |

|

|

45,442 |

|

|

|

* |

|

|

||

|

Michelle Burris(8) |

|

|

25,000 |

|

|

|

* |

|

|

||

|

George W. Dunbar, Jr.(9) |

|

|

116,633 |

|

|

|

* |

|

|

||

|

Robert E. Ivy(10) |

|

|

101,833 |

|

|

|

* |

|

|

||

|

Dwight Winstead(11) |

|

|

117,500 |

|

|

|

* |

|

|

||

|

All current executive officers and directors as a group (7 persons) |

|

|

1,511,049 |

|

|

|

4.9 |

% |

|

||

* Less than 1%

(1) Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of Common Stock subject to options and warrants currently exercisable, or exercisable within 60 days of the Record Date, are deemed outstanding for computing the percentage of the person holding such options but are not deemed outstanding for computing the percentage of any other person. Except as indicated by footnote, and subject to community property laws where applicable, the persons named in the table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them.

(2) Includes 975,000 warrants exercisable within 60 days of the Record Date.

(3) Includes 1,277,456 warrants exercisable within 60 days of the Record Date.

(4) Includes 689,188 warrants exercisable within 60 days of the Record Date.

(5) Consists of 213,751 shares owned directly and 684,410 options exercisable within 60 days of the Record Date.

11

(6) Consists of 3,981 shares owned directly and 202,499 options exercisable within 60 days of the Record Date.

(7) Consists of 1,901 shares owned directly and 43,541 options exercisable within 60 days of the Record Date.

(8) Consists of 25,000 options exercisable within 60 days of the Record Date.

(9) Consists of 1,500 shares owned directly and 115,133 options exercisable within 60 days of the Record Date.

(10) Consists of 1,700 shares owned directly and 100,133 options exercisable within 60 days of the Record Date.

(11) Consists of 117,500 options exercisable within 60 days of the Record Date.

REPORT OF THE COMPENSATION COMMITTEE

The Compensation Committee (Committee) of the Board of Directors has direct responsibility for reviewing, approving, and evaluating the director, officer, and employee compensation plans, policies, and programs of the Company. The Committee also makes recommendations to the Board of Directors regarding changes in pay practices. This includes establishing and approving a philosophy and plan for determining an appropriate compensation structure for the Companys officers, including base salary levels, annual incentives, and long-term equity incentive awards under the Companys stock option plans. The Committee is composed entirely of non-employee directors who have no interlocking relationships with the Company.

The Companys executive compensation philosophy is to tightly link compensation with company performance, individual achievement, and the creation of shareholder value. This is accomplished through three primary objectives:

· Provide competitive compensation opportunities to help attract and retain critical leadership and talent.

· Create a direct, meaningful link between business results, individual performance and executive rewards through an annual incentive program.

· Align executive and shareholder interests by providing officers with an opportunity to share in Company long-term value appreciation through a long-term equity program.

Each year, we review officer compensation levels for the upcoming fiscal year, as well as actual bonus payments and equity awards for the completed fiscal year. In determining compensation for a specific officer, we consider many factors, including the scope of the officers particular job, his or her performance in the job, the expected value of the officers future impact or contribution to the Companys success and growth, the Companys recent performance, and market competitiveness. We retain the services of an independent executive compensation consultant to provide advice as to the structuring of an appropriate compensation plan and comparative life sciences industry pay data for executives in companies of similar size and complexity, including specific data for those companies in our geographic area. Company officers are matched to positions in the comparator data with similar job scope and responsibility. In establishing officer compensation recommendations, we review, and give considerable weight to, the recommendations of the Chief Executive Officer, except with respect to his own compensation.

12

Base Salary. The Company targets a median base salary market position for each officer. Depending on the officers experience in the respective position and individual performance, actual salaries may be slightly above or below the median. For 2005, executive officer base salaries averaged 97% of the median salary market position. The officers are eligible for a base salary increase each year that is determined under the Company-wide performance review process and salary guidelines.

Annual Incentives. As part of a comprehensive executive compensation review in 2002, the Company implemented an officer annual incentive plan to strengthen the link between awards paid under the plan and the Companys strategic goals. The plan is structured to deliver total cash compensation (base salary plus annual incentive) that is between the 50th and 75th percentile of the Companys comparator group. Target annual incentive award opportunities are established at the beginning of the fiscal year and range from 35% to 45% of base salary for the officer group; however, actual awards may range up to 150% of each officers target based on performance. The Board approved a modification to the compensation policy in 2005 such that awards are paid for the achievement of specific, well-defined goals based entirely on performance to corporate goals. The Compensation Committee retains the discretion to pay incentive awards in cash, restricted stock, or stock options. Based on the performance against corporate goals, we approved annual incentive payments totaling $444,470 for the executive officer group for 2005 which is equal to 137% of the executive officer groups target annual incentive opportunity. All annual incentive awards for 2005 were paid in February 2006.

Long-Term Incentives. The Committee believes that long-term incentives, primarily delivered via stock options, are an effective vehicle to encourage ownership in the Company and align the interests of officers with those of shareholders. The Company refined the process for determining individual stock option awards in 2002 as part of the executive compensation review. Stock option awards are designed to target the median of the Companys comparator group, though actual awards may range from 50% to 150% of target depending on specified performance criteria. Factors used to determine individual stock option awards include competitive market practice, Company stock price performance relative to peers, individual performance, the strategic importance of the position, and retention objectives. Stock option grants may be reduced based on the Companys dilution constraints. For 2005, we approved stock option awards totaling 360,000 shares for the executive officer group.

Chief Executive Officer Compensation

The base salary, annual bonus and long-term incentives provided to Mr. Martino for 2005 were determined in accordance with the Companys compensation philosophy and practices, as outlined above. Mr. Martino is eligible to participate in the same compensation plans, including the annual and long-term incentive plans available to other officers and employees of the Company.

The Committee increased Mr. Martinos base salary from $333,000 to $345,800 in 2005, which is approximately 93% of the median of chief executive officers in the Companys comparator group. Mr. Martinos 2005 target incentive opportunity under the officer annual incentive plan was equal to 45% of base salary. Based on the achievement of the overall company metric and corporate and business development goals, we approved an annual incentive payment of $233,770 for Mr. Martino, which is equal to 150% percent of his target annual incentive award opportunity.

Mr. Martino was also eligible to receive an annual stock option grant in 2005 based on performance. Based on the criteria for determining stock option grants, we approved a grant of 162,000 stock options for Mr. Martino, which is 150% of his target opportunity.

13

Policy on Deductibility of Compensation

Section 162(m) of the Internal Revenue Code limits the tax deductibility by the Company of compensation in excess of $1 million paid to any of its most highly compensated executive officers. However, performance-based compensation that has been approved by shareholders is excluded from the $1 million limit if, among other requirements, the compensation is payable only upon attainment of pre-established, objective performance goals and the Board Committee that establishes such goals consists only of outside directors (as defined for purposes of Section 162(m)). All members of the Committee qualify as outside directors.

The Companys policy is to maximize the deductibility of executive compensation so long as the deductibility is compatible with the more important objectives of retaining executives and maintaining competitive performance-based compensation that is aligned with strategic business objectives.

COMPENSATION COMMITTEE

Dwight Winstead, Chairman

George W. Dunbar, Jr.

14

The following is the report of the Audit Committee with respect to the Companys audited financial statements for the year ended December 31, 2005.

The Audit Committee has reviewed and discussed the Companys audited financial statements with management and Ernst & Young LLP, the Companys independent accountants. The Audit Committee has discussed with Ernst & Young LLP the matters required to be discussed by Statement of Auditing Standards No. 61, Communication with Audit Committees. The Audit Committee has also discussed with and received written disclosures and the letter from Ernst & Young LLP required by Independence Standards Board No. 1, which relates to the accountants independence from the Company.

The Audit Committee has also considered whether the services and fees of Ernst & Young LLP other than those rendered in connection with the annual audit and quarterly interim reviews of the Companys financial statements are compatible with maintaining the independence of Ernst & Young LLP and has concluded that these services have not affected their independence. The services and fees of Ernst & Young LLP for 2005 were:

· Audit Fees (annual audit and quarterly reviews)$406,400

· Audit-Related Fees$0

· Tax Fees$11,500

· All Other Fees$0

Each of the members of the Audit Committee qualifies as an independent director under the current listing standards of the National Association of Securities Dealers. The Companys Board of Directors has adopted a written charter for its Audit Committee.

Based on the review and discussions referred to above, the Audit Committee recommended to the Companys Board of Directors that the Companys audited financial statements be included in the Companys Annual Report on Form 10-K for the year ended December 31, 2005.

AUDIT COMMITTEE

Michelle Burris, Chairperson

George W. Dunbar, Jr.

Robert E. Ivy

Dwight Winstead

Notwithstanding anything to the contrary set forth in the Companys previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this Proxy Statement, the foregoing Compensation Committee Report, Audit Committee Report and the following Stock Performance Graph shall not be incorporated by reference into any such filings.

15

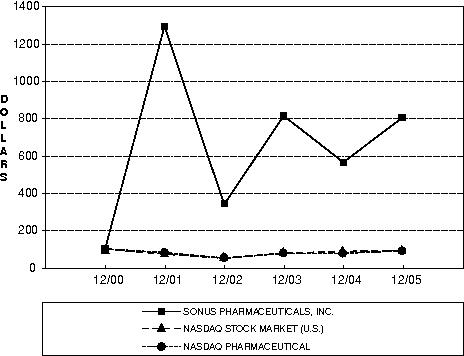

Set forth below is a line graph comparing the cumulative stockholder return on the Companys Common Stock with the cumulative total return of the Nasdaq Pharmaceutical Index and the Nasdaq Stock MarketU.S. Index for the five year period that commenced December 31, 2000 and ended on December 31, 2005.

COMPARISON OF 5

YEAR CUMULATIVE TOTAL RETURN*

AMONG SONUS PHARMACEUTICALS, INC., THE NASDAQ STOCK MARKET (U.S.)

INDEX,

AND THE NASDAQ PHARMACEUTICAL INDEX

* $100 invested on 12/31/00 in stock or indexincluding reinvestment of dividends. Fiscal year ending December 31.

16

PROPOSAL TWO

TO APPROVE THE COMPANYS 2006 EMPLOYEE STOCK PURCHASE PLAN

The Companys 1995 Employee Stock Purchase Plan (the 1995 Plan) expired on December 31, 2005. On March 20, 2006, the Board of Directors adopted, subject to stockholder approval, the Companys 2006 Employee Stock Purchase Plan (the ESPP) effective January 1, 2006. The purposes of the ESPP are to provide to employees an incentive to join and remain in the service of the Company and its subsidiaries, to promote employee morale and to encourage employee ownership of the Companys Common Stock by permitting them to purchase shares at a discount through payroll deductions. The ESPP is intended to qualify as an employee stock purchase plan under Section 423 of the Internal Revenue Code.

A summary of the ESPP is set forth below. The terms of the ESPP are substantially similar to the 1995 Plan. The summary is qualified in its entirety by reference to the full text of the ESPP. The ESPP is attached as Appendix A to this Proxy Statement.

Summary of Employee Stock Purchase Plan

Every full-time employee of the Company, including executive officers, are eligible to participate in offerings made under the ESPP on the first grant date under the ESPP after such employee has been employed by the Company for at least six months. An employee may not participate in an offering under the ESPP if immediately after the purchase the employee would own shares or options to purchase shares of stock possessing 5% or more of the total combined voting power or value of all classes of stock of the Company. As of the Record Date, approximately 47 persons will be eligible to participate in the ESPP.

The ESPP may be administered by either the Board of Directors or a committee appointed by the Board (the Committee). If approved, the Board will delegate administration of the ESPP to the Compensation Committee, which is comprised of two non-employee directors, who are not eligible to participate in the ESPP. Subject to the provisions of the ESPP, the Committee has full authority to implement, administer and make all determinations necessary under the ESPP.

The two semi-annual grants under the ESPP occur on January 1 and July 1, respectively (the Grant Date) and continue for a period of six months (the Offering Period).

Eligible employees who elect to participate in an offering will purchase shares of Common Stock through regular payroll deductions in an amount designated by the employee not to exceed 15% of such employees compensation. Shares of Common Stock will be purchased automatically on the last day of the Offering Period (the Purchase Date) at a price equal to 85% of the fair market value of the shares on the Grant Date or 85% of the fair market value of the shares as of the Purchase Date, whichever is lower. A participant may withdraw from an offering at any time prior to the Purchase Date and receive a refund of his payroll deductions, without interest. A participants rights in the ESPP are nontransferable other than on the death of the participant. The ESPP is administered in a manner designed to ensure that any affiliate participants commencement or discontinuation of participation in the ESPP or increase or decrease of payroll deductions will be effected in compliance with the exemptions from liability under Section 16(b) of the Securities Exchange Act of 1934 as set forth in Rule 16b-3 promulgated thereunder.

No employee may purchase stock in an amount which would permit his or her rights under the ESPP (and any similar purchase plans of the Company and any parent and subsidiaries of the Company) to accrue at a rate which exceeds $25,000 in fair market value, determined as of the Grant Date, for each calendar year. In addition, no participant may purchase more than 2,000 shares in any Offering Period.

The Board of Directors may at any time amend, suspend or terminate the ESPP; provided that any amendment that would (i) increase the aggregate number of shares authorized for sale under the ESPP (except pursuant to adjustments provided for in the ESPP), (ii) change the standards of eligibility for participation, or (iii) materially increase the benefits which accrue to participants under the ESPP, shall

17

not be effective unless approved by the stockholders within 12 months of the adoption of such amendment by the Board. Unless previously terminated by the Board, the ESPP will terminate on December 31, 2015.

Federal Income Tax Consequences

Generally, no federal income tax consequences will arise at the time an employee purchases Common Stock under the ESPP. If an employee disposes of Common Stock purchased under the ESPP less than one year after the Common Stock is purchased or within two years of the Grant Date, the employee will be deemed to have received compensation taxable as ordinary income for the taxable year in which the disposition occurs in the amount of the difference between the fair market value of the Common Stock at the time of purchase and the amount paid by the employee for the Common Stock. The amount of such ordinary income recognized by the employee will be added to the employees basis in the Common Stock for purposes of determining capital gain or loss upon the disposition of the Common Stock by the employee. If an employee holds the shares of Common Stock purchased under the ESPP for at least one year after the Common Stock is purchased and at least two years after the Grant Date before disposing of such shares, then the employee will be deemed to have received compensation taxable as ordinary income for the taxable year in which the disposition occurs in an amount equal to the lesser of (a) the excess of the fair market value of the Common Stock on the date of disposition over the purchase price paid by the employee, or (b) the excess of the fair market value of the Common Stock on the offering date over the purchase price paid by the employee. The amount of such ordinary income recognized by the employee will be added to the employees basis in the Common Stock for purposes of determining capital gain or loss upon the disposition of the Common Stock by the employee. If an employee dies before disposing of the Common Stock purchased under the ESPP, he or she will be deemed to have received compensation taxable as ordinary income in the taxable year closing with the employees death in an amount equal to the lesser of clauses (a) or (b) as set forth in the first sentence of this paragraph. The employee will not realize any capital gain or loss at death.

The Company generally will not be entitled to a deduction with respect to the Common Stock purchased by an employee under the ESPP, unless the employee disposes of the Common Stock less than one year after the Common Stock is transferred to the employee or less than two years after the Grant Date.

Accounting Treatment Under Generally Accepted Accounting Principles

The ESPP is classified under FAS 123(R) as a compensatory plan because participants have the right to purchase Common Stock at less than 95% of the fair market value on the Grant Date and because the plan allows for a look-back to allow participants to purchase stock based upon the fair market value on the Grant Date as opposed to the Purchase Date. Under FAS 123(R), the Company must record a charge to earnings equal to the fair value of the right to purchase Common Stock under the ESPP determined as of the Grant Date.

No current directors who are not employees will receive any benefit under the ESPP. The benefits that will be received under the ESPP by the Companys current executive officers and by all eligible employees are not currently determinable.

Approval of the Amendment to the ESPP will require the affirmative vote of the holders of a majority of the shares present in person or by proxy at the meeting and entitled to vote. Proxies solicited by management for which no specific direction is included will be voted for the approval of the ESPP.

18

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR APPROVAL OF THE COMPANYS 2006 EMPLOYEE STOCK PURCHASE PLAN.

PROPOSAL THREE

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee has selected Ernst & Young LLP, independent auditors, to audit the financial statements of the Company for the fiscal year ending December 31, 2006, and recommends that stockholders vote for ratification of such appointment. In the event of a negative vote on such ratification, the Audit Committee will reconsider its selection. Even if the selection is ratified, the Audit Committee, in its sole discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

Ernst & Young LLP has audited the Companys financial statements annually since inception of the Company. Its representatives are expected to be present at the meeting with the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions.

Principal Accountant Fees and Services

The following is a summary of the fees billed to the Company by Ernst & Young LLP for professional services rendered for the fiscal years ended December 31, 2005 and December 31, 2004:

|

Fee Category |

|

|

|

Fiscal 2005 Fees |

|

Fiscal 2004 Fees |

|

||||||

|

Audit Fees |

|

|

$ |

406,400 |

|

|

|

$ |

361,460 |

|

|

||

|

Audit Related Fees |

|

|

0 |

|

|

|

80,200 |

|

|

||||

|

Tax Fees |

|

|

11,500 |

|

|

|

10,000 |

|

|

||||

|

All Other Fees |

|

|

0 |

|

|

|

0 |

|

|

||||

|

Total Fees |

|

|

$ |

417,900 |

|

|

|

$ |

451,660 |

|

|

||

Audit Fees. Consists of fees billed for professional services rendered for the audit of the Companys financial statements ($143,400 in 2005, $139,960 in 2004), review of the interim financial statements included in quarterly reports ($48,000 in 2005, $33,550 in 2004), and Sarbanes-Oxley Section 404 attestation services ($215,000 in 2005 $187,950 in 2004).

Audit-Related Fees. Consists of fees billed for assurance and related services by the principal accountant that are reasonably related to the performance of the audit or review of the registrants financial statements. These services primarily include consultations related to the corporate acquisitions.

Tax Fees. Consists of fees billed for professional services for tax compliance, tax advice and tax planning. These services include assistance related to state tax incentives.

All Other Fees. Consists of all other non-audit services.

Policy on Audit Committee Pre-Approval of Audit Services and Permissible Non-Audit Services of Independent Auditors

The Audit Committees policy is to pre-approve all audit and permissible non-audit services performed by the independent auditors. These services may include audit services, audit-related services, tax services and other services. For audit services, the independent auditor provides an engagement letter in advance of the February meeting of the Audit Committee, outlining the scope of the audit and related audit fees. If agreed to by the Audit Committee, this engagement letter is formally accepted by the Audit Committee at its February Audit Committee meeting.

19

For non-audit services, the Companys senior management will submit from time to time to the Audit Committee for approval non-audit services that it recommends the Audit Committee engage the independent auditor to provide for the fiscal year. The Companys senior management and the independent auditor will each confirm to the Audit Committee that each non-audit service is permissible under all applicable legal requirements. A budget, estimating non-audit service spending for the fiscal year, will be provided to the Audit Committee along with the request. The Audit Committee must approve both permissible non-audit services and the budget for such services. The Audit Committee will be informed routinely as to the non-audit services actually provided by the independent auditor pursuant to this pre-approval process.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR RATIFICATION OF THE SELECTION OF ERNST & YOUNG LLP AS THE COMPANYS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

Any stockholder desiring to submit a proposal for action at the 2007 Annual Meeting of Stockholders and presentation in the Companys Proxy Statement with respect to such meeting should arrange for such proposal to be delivered to the Company at its principal place of business no later than December 13, 2006 in order to be considered for inclusion in the Companys proxy statement relating to that meeting. Matters pertaining to such proposals, including the number and length thereof, eligibility of persons entitled to have such proposals included and other aspects are regulated by the Securities Exchange Act of 1934, Rules and Regulations of the Securities and Exchange Commission and other laws and regulations to which interested persons should refer. The Company anticipates that its next annual meeting will be held in May 2007.

Proxies submitted to the Company will confer discretionary authority to vote on matters proposed by stockholders if a proponent of a proposal fails to notify the Company at least 45 days prior to the anniversary of mailing of the prior years proxy statement, without any discussion of the matter in the proxy statement. With respect to the Companys 2007 Annual Meeting of Stockholders, if the Company has not been provided with notice of a stockholder proposal by February 24, 2007, the Company will be allowed to use its voting authority as described above.

20

Management is not aware of any other matters to come before the meeting. If any other matter not mentioned in this Proxy Statement is brought before the meeting, the proxy holders named in the enclosed Proxy will have discretionary authority to vote all proxies with respect thereto in accordance with their judgment.

By Order of the Board of Directors

Michael A. Martino

President and Chief Executive Officer

March 24, 2006

The Annual Report to Stockholders of the Company for the fiscal year ended December 31, 2005 is being mailed concurrently with this Proxy Statement to all stockholders of record as of March 15, 2006. The Annual Report is not to be regarded as proxy soliciting material or as a communication by means of which any solicitation is to be made.

COPIES OF THE COMPANYS ANNUAL REPORT ON FORM 10-K FILED WITH THE SECURITIES AND EXCHANGE COMMISSION FOR THE YEAR ENDED DECEMBER 31, 2005 WILL BE PROVIDED TO STOCKHOLDERS WITHOUT CHARGE UPON WRITTEN REQUEST TO INVESTOR RELATIONS, SONUS PHARMACEUTICALS, INC., 22026 20TH AVENUE S.E., BOTHELL, WASHINGTON 98021.

21

APPENDIX A

2006 EMPLOYEE STOCK PURCHASE PLAN

SONUS PHARMACEUTICALS, INC.

2006 EMPLOYEE STOCK PURCHASE PLAN

This 2006 EMPLOYEE STOCK PURCHASE PLAN (the Plan) is hereby established by SONUS PHARMACEUTICALS, INC. (the Company) effective January 1, 2006 (the Effective Date).

1.1 Purpose. The Company has determined that it is in its best interests to provide an incentive to attract and retain employees and to increase employee morale by providing a program through which employees may acquire a proprietary interest in the Company through the purchase of shares of the common stock of the Company (Company Stock). The Plan is hereby established by the Company to permit employees to subscribe for and purchase directly from the Company shares of the Company Stock at a discount from the market price, and to pay the purchase price in installments by payroll deductions. The Plan is intended to qualify as an employee stock purchase plan under Section 423 of the Internal Revenue Code of 1986, as amended from time to time (the Code). The provisions of the Plan are to be construed in a manner consistent with the requirements of Section 423 of the Code. The Plan is not intended to be an employee benefit plan under the Employee Retirement Income Security Act of 1974, and therefore is not required to comply with that Act.

2.1 Compensation. Compensation means the amount indicated on the Form W-2, including any elective deferrals with respect to a plan of the Company qualified under either Section 125 or Section 401(a) of the Internal Revenue Code of 1986, issued to an employee by the Company.

2.2 Employee. Employee means each person currently employed by the Company or any of its operating subsidiaries whose customary employment is at least twenty (20) hours per week and more than five (5) months in any calendar year.

2.3 Effective Date. Effective Date means January 1, 2006.

2.4 5% Owner. 5% Owner means an Employee who, immediately after the grant of any rights under the Plan, would own Company Stock or hold outstanding options to purchase Company Stock possessing 5% or more of the total combined voting power of all classes of stock of the Company. For purposes of this Section, the ownership attribution rules of Code Section 425(d) shall apply.

2.5 Grant Date. Grant Date means the first day of each Offering Period (January 1 and July 1) under the Plan.

2.6 Participant. Participant means an Employee who has satisfied the eligibility requirements of Section 3.1 and has become a participant in the Plan in accordance with Section 3.2.

2.7 Plan Year. Plan Year means the twelve consecutive month period ending on December 31.

2.8 Offering Period. Offering Period means the six consecutive month periods beginning January 1 through June 30 and July 1 through December 31 each Plan Year.

2.9 Purchase Date. Purchase Date means the last day of each Offering Period (June 30 or December 31).

ARTICLE III

ELIGIBILITY AND PARTICIPATION

3.1 Eligibility. Each Employee of the Company on the Effective Date may become a Participant in the Plan on the Effective Date. Each other Employee of the Company may become a Participant in the Plan on the Grant Date coincident with or next following the date on which such Employee first becomes an Employee of the Company.

3.2 Participation. An Employee who has satisfied the eligibility requirements of Section 3.1 may become a Participant in the Plan upon his completion and delivery to the Human Resources Department of the Company of a subscription agreement provided by the Company (the Subscription Agreement) authorizing payroll deductions. Payroll deductions for a Participant shall commence on the Grant Date coincident with or next following the filing of the Participants Subscription Agreement and shall remain in effect until revoked by the Participant by the filing of a notice of withdrawal from the Plan under Article VIII or by the filing of a new Subscription Agreement providing for a change in the Participants payroll deduction rate under Section 5.2.

3.3 Special Rules. Under no circumstances shall:

(a) A 5% Owner be granted a right to purchase Company Stock under the Plan;

(b) A Participant be entitled to purchase Company Stock under the Plan which, when aggregated with all other employee stock purchase plans of the Company, exceeds an amount equal to the Aggregate Maximum. Aggregate Maximum means an amount equal to $25,000 worth of Company Stock (determined using the fair market value of such Company Stock at each applicable Grant Date) during each Plan Year; or

(c) The number of shares of Company Stock purchasable by a Participant on any Purchase Date exceed 2,000 shares, subject to periodic adjustments under Section 10.4.

4.1 Offering Periods. The initial grant of the right to purchase Company Stock under the Plan shall commence on the Effective Date and terminate on June 30, 2006. Thereafter, the Plan shall provide for Offering Periods commencing on each Grant Date and terminating on the next following Purchase Date.

5.1 Participant Election. Upon the Subscription Agreement, each Participant shall designate the amount of payroll deductions to be made from his or her paycheck to purchase Company Stock under the Plan. The amount of payroll deductions shall be designated in whole dollar amounts of Compensation, of at least the greater of $50 or 1% of Compensation not to exceed 15% of Compensation for any Plan Year. The amount so designated upon the Subscription Agreement shall be effective as of the next Grant Date and shall continue until terminated or altered in accordance with Section 5.2 below.

5.2 Changes in Election. A Participant may terminate participation in the Plan at any time prior to the close of an Offering Period as provided in Article VIII. A Participant may decrease or increase the rate of payroll deductions at any time during any Offering Period by completing and delivering to the Human Resources Department of the Company a new Subscription Agreement setting forth the desired change. A Participant may also terminate payroll deductions and have accumulated deductions for the Offering Period applied to the purchase of Company Stock as of the next Purchase Date by completing and delivering to the Human Resources Department a new Subscription Agreement setting forth the desired

2

change. Any change under this Section shall become effective on the next payroll period (to the extent practical under the Companys payroll practices) following the delivery of the new Subscription Agreement.

5.3 Participant Accounts. The Company shall establish and maintain a separate account (Account) for each Participant. The amount of each Participants payroll deductions shall be credited to his Account. No interest will be paid or allowed on amounts credited to a Participants Account. All payroll deductions received by the Company under the Plan are general corporate assets of the Company and may be used by the Company for any corporate purpose. The Company is not obligated to segregate such payroll deductions.

ARTICLE VI

GRANT OF PURCHASE RIGHTS