DEFA14A: Additional definitive proxy soliciting materials and Rule 14(a)(12) material

Published on January 12, 2005

|

UNITED STATES |

|||

|

SECURITIES AND EXCHANGE COMMISSION |

|||

|

Washington, D.C. 20549 |

|||

|

|

|||

|

SCHEDULE 14A |

|||

|

|

|||

|

Proxy Statement Pursuant

to Section 14(a) of |

|||

|

|

|||

|

Filed by the Registrant ý |

|||

|

|

|||

|

Filed by a Party other than the Registrant o |

|||

|

|

|||

|

Check the appropriate box: |

|||

|

o |

Preliminary Proxy Statement |

||

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

||

|

o |

Definitive Proxy Statement |

||

|

o |

Definitive Additional Materials |

||

|

ý |

Soliciting Material Pursuant to §240.14a-12 |

||

|

|

|||

|

Sonus Pharmaceuticals, Inc. |

|||

|

(Name of Registrant as Specified In Its Charter) |

|||

|

|

|||

|

|

|||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|||

|

|

|||

|

Payment of Filing Fee (Check the appropriate box): |

|||

|

ý |

No fee required. |

||

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

||

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

|

|

(5) |

Total fee paid: |

|

|

|

|

|

|

|

o |

Fee paid previously with preliminary materials. |

||

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

||

|

|

(1) |

Amount Previously Paid: |

|

|

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

|

|

(3) |

Filing Party: |

|

|

|

|

|

|

|

|

(4) |

Date Filed: |

|

|

|

|

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

|

The following was presented to investors by Sonus Pharmaceuticals, Inc. (SNUS) on January 11, 2005, and relates to the proposed acquisition of Synt:em, S.A.

Searchable text section of graphics shown above

Safe Harbor

This presentation includes forward-looking statements such as those, among others, relating to the development, safety and efficacy of drug delivery products and potential applications for these products. As discussed in Sonus Pharmaceuticals filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K filed on March 12, 2004 and Quarterly Report on Form 10-Q filed November 15, 2004, actual results could differ materially from those projected in the forward-looking statements as a result of the following factors, among others: the Companys and Synt:ems products will require extensive clinical testing and approval by regulatory authorities; such approvals are lengthy and expensive and may never occur; risks that clinical studies with TOCOSOL® Paclitaxel will not be successful; risks that the FDA may not approve the Companys proposed TOCOSOL Paclitaxel New Drug Application; risks that the Company may not be able to effectively or completely integrate the business and operations of Synt:em; risks that the combined company may not be able raise capital to finance the increased costs of the business and operations of both companies; and risks of successful development of additional drug delivery products. Sonus undertakes no obligation to update the forward looking statements contained herein or to reflect events or circumstances occurring after the date hereof.

© 2005 01/05

2

Additional Information About the Synt:em Acquisition and Where to Find It

Sonus will file a proxy statement and other documents concerning the proposed acquisition of Synt:em with the Securities and Exchange Commission (SEC). Sonus stockholders are urged to read the proxy statement when it becomes available and other relevant documents filed with the SEC because they will contain important information. A copy of the proxy statement will be mailed to the stockholders of Sonus. Sonus stockholders may obtain a free copy of the proxy statement and other relevant documents filed by Sonus with the SEC when they become available at the SECs website at www.sec.gov. The proxy statement and these other documents may also be obtained for free from Sonus by directing a request to: Investor Relations, 22026 20th Avenue S.E., Bothell, Washington, 98021, Phone (425) 487-9500.

Sonus and its directors, executive officers and certain of its employees may be deemed to be participants in the solicitation of proxies from the stockholders of Sonus with respect to the proposed transaction. Information regarding the names, affiliations and interests of the participants in the solicitation will be included in the proxy statement.

3

Synt:em Acquisition

Announced Nov. 3, 04

Term modification announced Dec. 28, 04

Drug discovery and early development company

Founded in 1995

Based in Nîmes, France

Privately held

40 employees (half hold doctoral degrees)

Stock-for-stock transaction with significant milestone components

5

TOCOSOL® Paclitaxel Moving Ahead

Phase 3 negotiations proceeding with FDA

End of Phase 2 meeting Dec. 04

Appropriate to conduct Phase 3 pivotal trial and submit 505(b)(2) New Drug Application

Agreement to use Special Protocol Assessment process to begin Phase 3 in 05

Partnership discussions gaining momentum after feedback from FDA

6

Acquisition Benefits

Platform

Drug discovery engine

Applicable to cancer drugs

Synergistic with TOCOSOL® technology

Pipeline

Three near-term preclinical product candidates for pain management; two possibly in clinic within 12 mos.

Additional oncology candidates in discovery portfolio

People

Strong scientific expertise and collaborations

Presence in Europe

7

Synt:em Technology Platform

Pep:trans

Peptides constructed for efficient transport across complex cell membranes

Peptides can have activity alone or can be linked to existing or novel drugs

Acti:map

Validated computational process to discover and optimize new peptide constructs

9

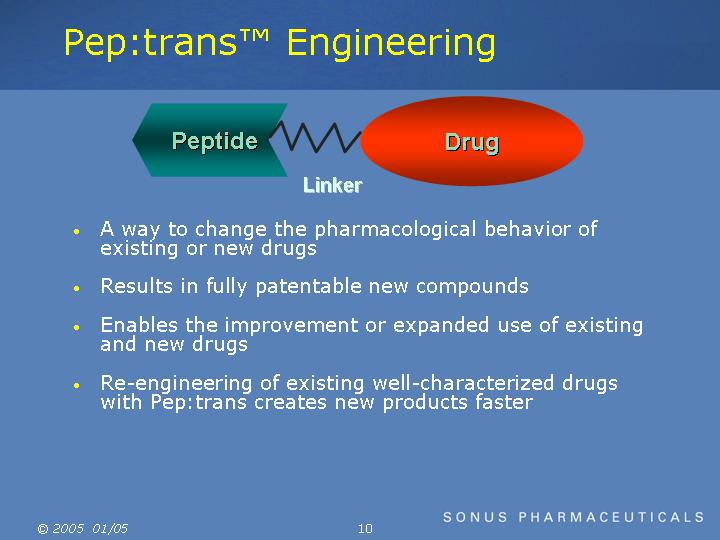

Pep:trans Engineering

|

Peptide |

|

Drug |

|

Linker |

||

A way to change the pharmacological behavior of existing or new drugs

Results in fully patentable new compounds

Enables the improvement or expanded use of existing and new drugs

Re-engineering of existing well-characterized drugs with Pep:trans creates new products faster

10

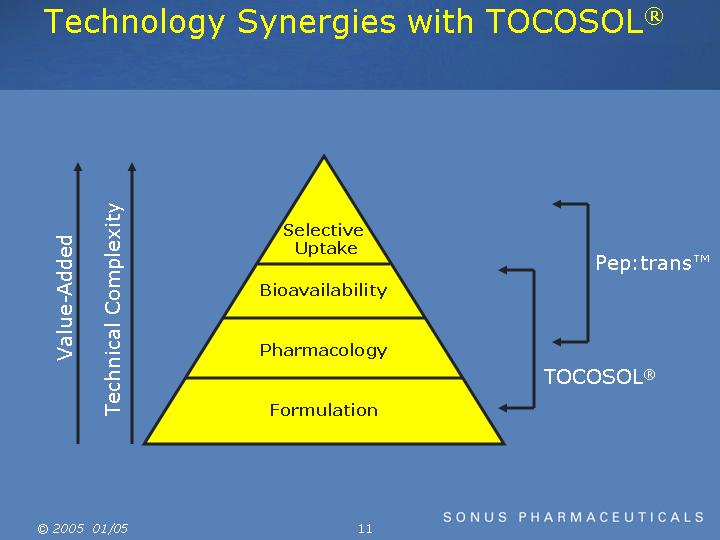

Technology Synergies with TOCOSOL®

|

Value-Added |

|

Selective Uptake |

|

|

Pep:trans |

|

|

|

|

|

||

|

|

Bioavailability |

|

TOCOSOL® |

||

|

|

|

|

|||

|

|

Pharmacology |

|

|||

|

|

|

|

|

||

|

|

Formulation |

|

|

11

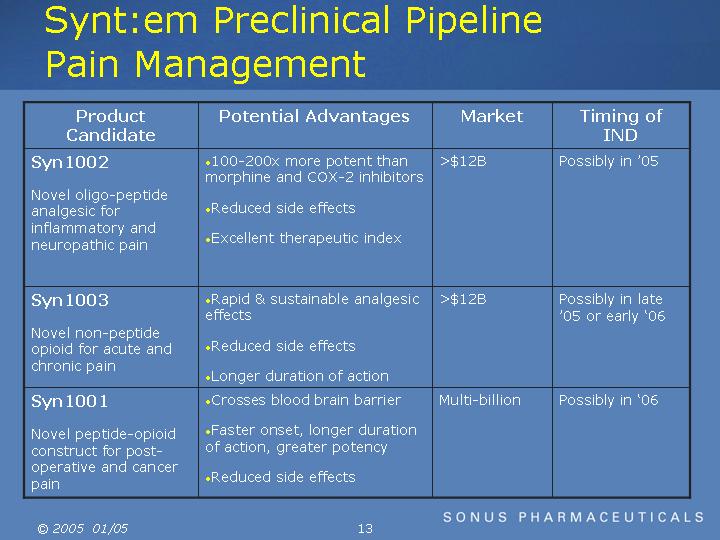

Synt:em Preclinical Pipeline Pain Management

|

Product |

|

Potential Advantages |

|

Market |

|

Timing of |

|

|

|

|

|

|

|

|

|

Syn1002 |

|

100-200x more potent than morphine and

COX-2 inhibitors |

|

>$12B |

|

Possibly in 05 |

|

|

|

|

|

|

|

|

|

Syn1003 |

|

Rapid & sustainable analgesic effects |

|

>$12B |

|

Possibly in late 05 or early 06 |

|

|

|

|

|

|

|

|

|

Syn1001 |

|

Crosses blood brain barrier |

|

Multi-billion |

|

Possibly in 06 |

13

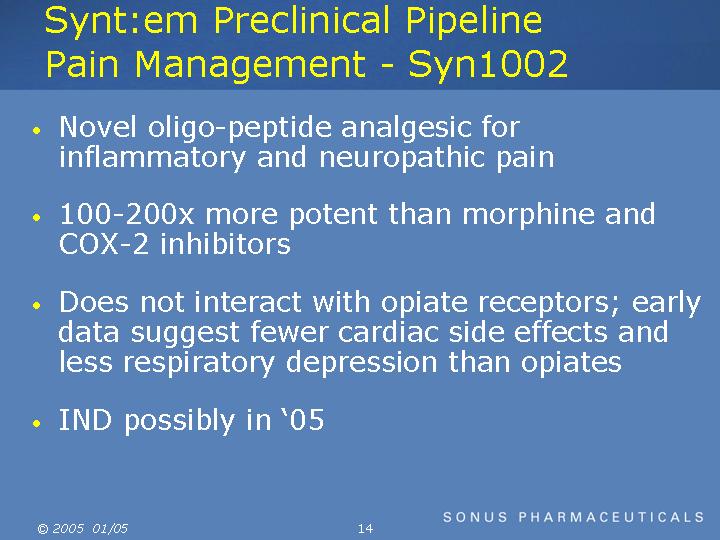

Synt:em Preclinical Pipeline Pain Management - Syn1002

Novel oligo-peptide analgesic for inflammatory and neuropathic pain

100-200x more potent than morphine and COX-2 inhibitors

Does not interact with opiate receptors; early data suggest fewer cardiac side effects and less respiratory depression than opiates

IND possibly in 05

14

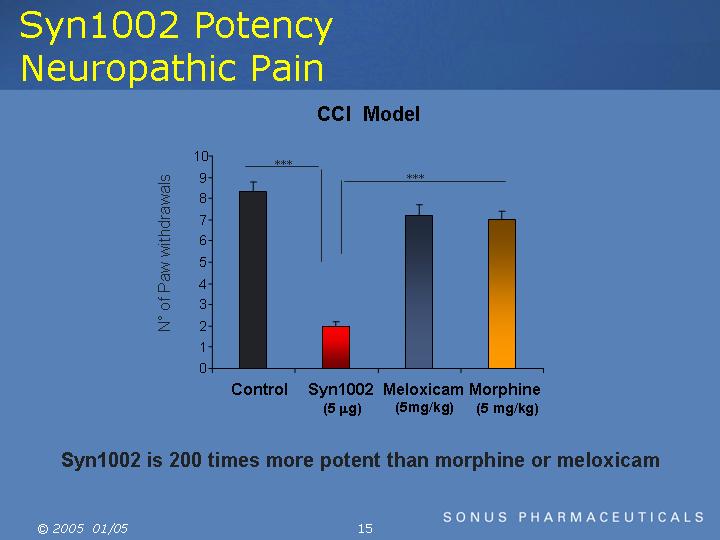

Syn1002 Potency Neuropathic Pain

CCI Model

[CHART]

Syn1002 is 200 times more potent than morphine or meloxicam

15

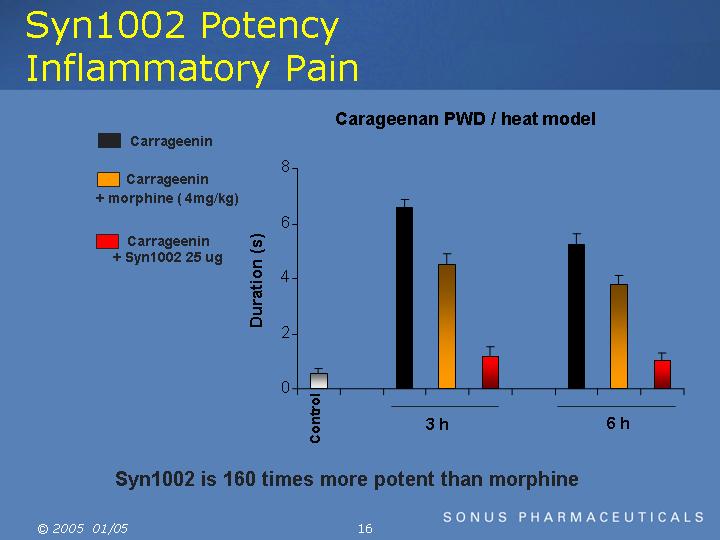

Syn1002 Potency Inflammatory Pain

Carageenan PWD / heat model

[CHART]

Syn1002 is 160 times more potent than morphine

16

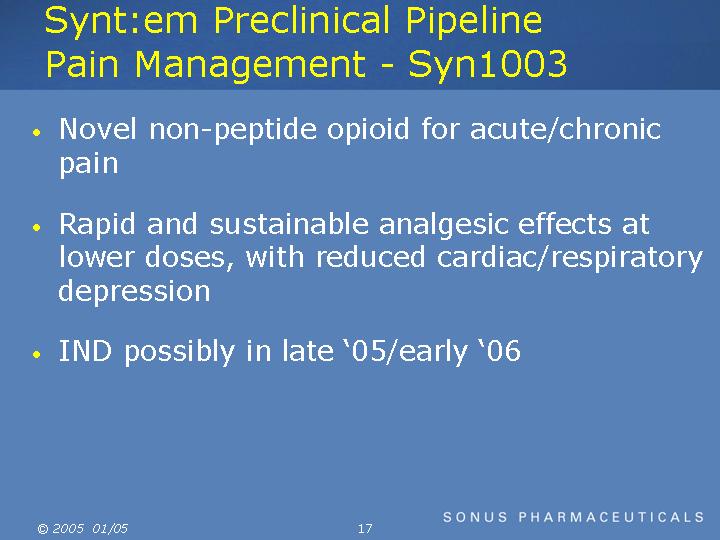

Synt:em Preclinical Pipeline Pain Management - Syn1003

Novel non-peptide opioid for acute/chronic pain

Rapid and sustainable analgesic effects at lower doses, with reduced cardiac/respiratory depression

IND possibly in late 05/early 06

17

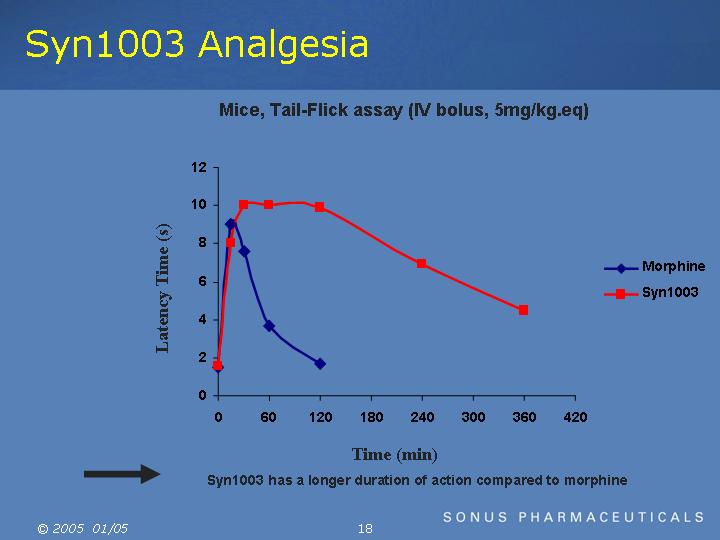

Syn1003 Analgesia

Mice, Tail-Flick assay (IV bolus, 5mg/kg.eq)

[CHART]

=> Syn1003 has a longer duration of action compared to morphine

18

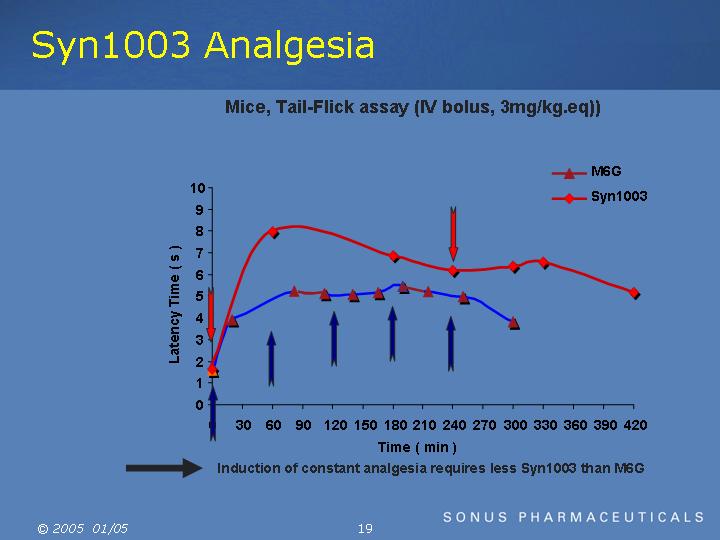

Mice, Tail-Flick assay (IV bolus, 3mg/kg.eq))

[CHART]

=> Induction of constant analgesia requires less Syn1003 than M6G

19

Synt:em Preclinical Pipeline Pain Management - Syn1001

Novel peptide-opioid conjugate analgesic for post-operative and cancer pain

Crosses blood-brain barrier

Faster onset, longer duration of action, greater potency

Reduced side effects (e.g. respiratory depression)

IND possibly in 06

20

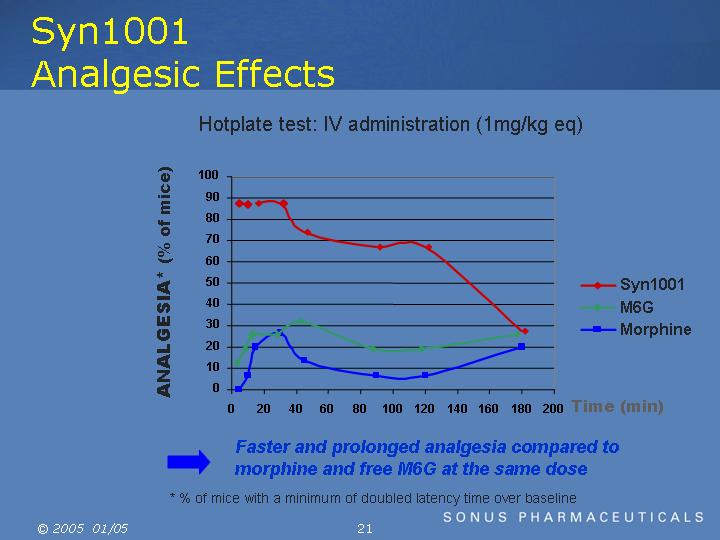

Syn1001 Analgesic Effects

Hotplate test: IV administration (1mg/kg eq)

[CHART]

=> Faster and prolonged analgesia compared to morphine and free M6G at the same dose

* % of mice with a minimum of doubled latency time over baseline

21

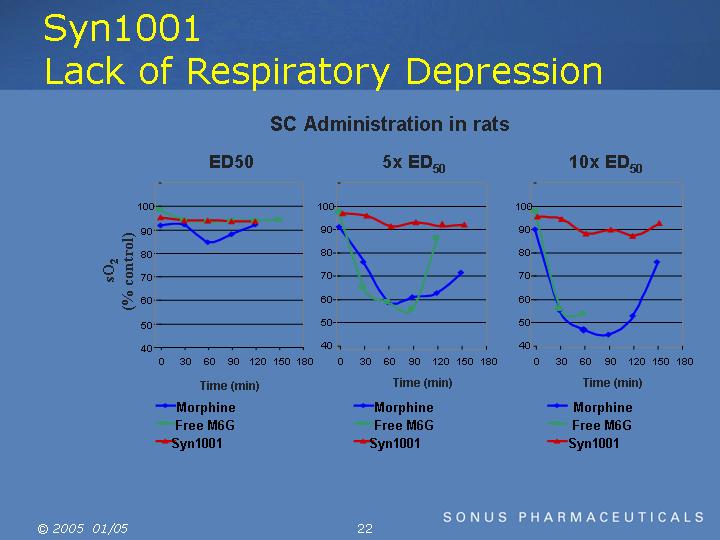

Syn1001

Lack of Respiratory Depression

SC Administration in rats

|

ED50 |

|

(5)x ED50 |

|

(10)x ED50 |

|

|

|

|

|

|

|

[CHART] |

|

[CHART] |

|

[CHART] |

22

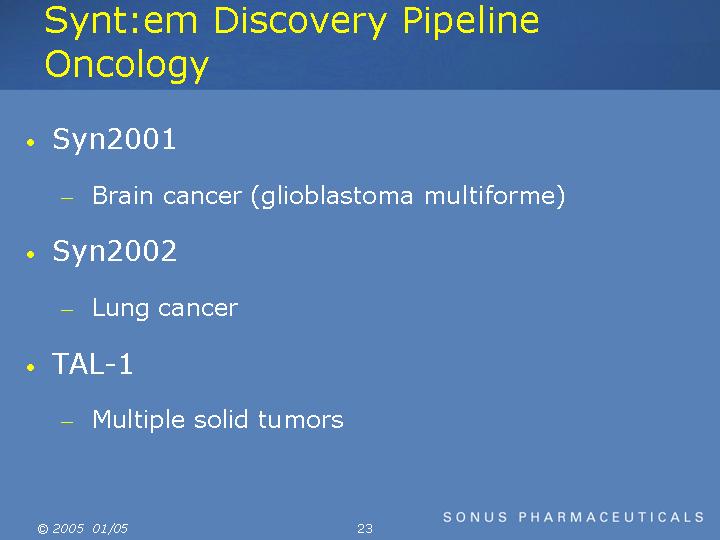

Synt:em Discovery Pipeline

Oncology

Syn2001

Brain cancer (glioblastoma multiforme)

Syn2002

Lung cancer

TAL-1

Multiple solid tumors

23

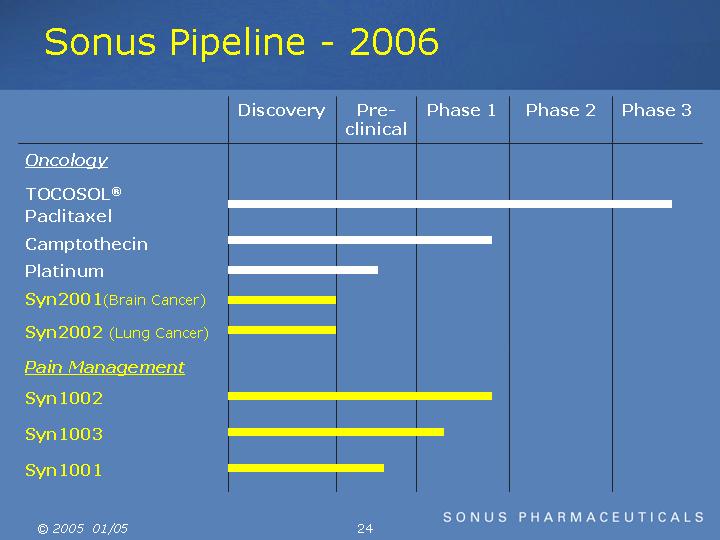

Sonus Pipeline - 2006

|

|

|

Discovery |

|

Pre- |

|

Phase 1 |

|

Phase 2 |

|

Phase 3 |

|

|

Oncology |

|

|

|

|

|

|

|

|

|

|

|

|

TOCOSOL® Paclitaxel |

|

=> |

|

|

|

|

|

|

|

|

|

|

Camptothecin |

|

=> |

|

|

|

|

|

|

|

|

|

|

Platinum |

|

=> |

|

|

|

|

|

|

|

|

|

|

Syn2001(Brain Cancer) |

|

=> |

|

|

|

|

|

|

|

|

|

|

Syn2002 (Lung Cancer) |

|

=> |

|

|

|

|

|

|

|

|

|

|

Pain Management |

|

|

|

|

|

|

|

|

|

|

|

|

Syn1002 |

|

=> |

|

|

|

|

|

|

|

|

|

|

Syn1003 |

|

=> |

|

|

|

|

|

|

|

|

|

|

Syn1001 |

|

=> |

|

|

|

|

|

|

|

|

|

24

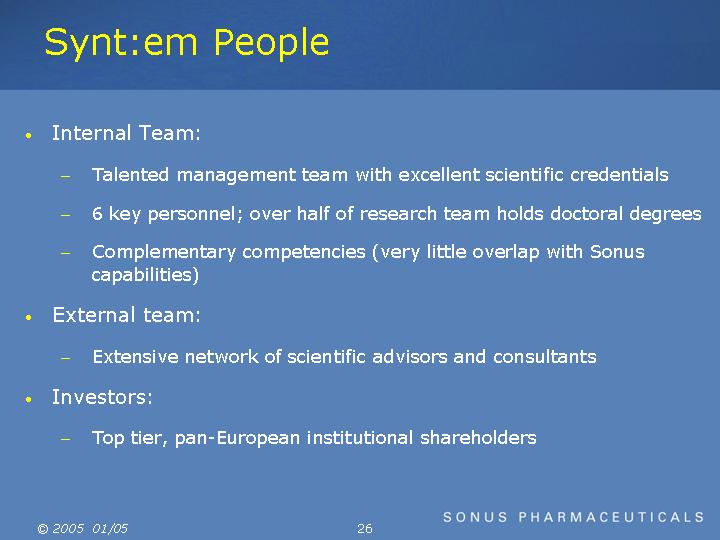

Synt:em People

Internal Team:

Talented management team with excellent scientific credentials

6 key personnel; over half of research team holds doctoral degrees

Complementary competencies (very little overlap with Sonus capabilities)

External team:

Extensive network of scientific advisors and consultants

Investors:

Top tier, pan-European institutional shareholders

26

Synt:em Management Team

Michel Kaczorek, Chairman and CEO. PhD, Biology

Inst. Pasteur, Harvard MS, R&D Pasteur Vaccins, Protéine Performance, VP France Biotech

Jamal Temsamani, Preclinical Development. PhD., Mol. Bio

Worcester Foundation and Hybridon

Roger Lahana, Drug Discovery. PhD, Chemistry

CNRS, Molecular Chemistry, P. Fabre, Oxford Molecular (UK)

Luc-Andre Granier, Medical Development. PhD, MD, Neurology

Forenap, Eli Lilly

Caroline Roussel, Operations. Ing. Bio

EIEA Montpellier, Protéine Performance

Gordon Waldron, Finance & Administration.

Duke Univ., Spie Batignolles, Texas Instruments

27

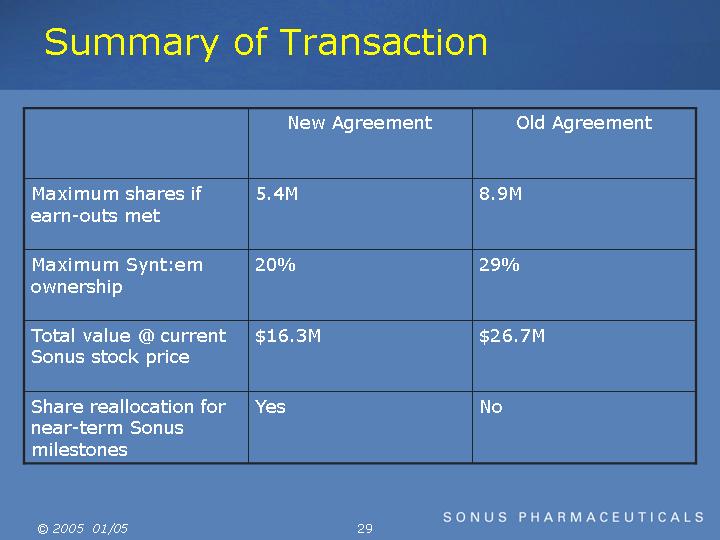

Summary of Transaction

|

|

|

New Agreement |

|

Old Agreement |

|

||

|

|

|

|

|

|

|

||

|

Maximum shares if earn-outs met |

|

5.4 |

M |

8.9 |

M |

||

|

|

|

|

|

|

|

||

|

Maximum Synt:em ownership |

|

20 |

% |

29 |

% |

||

|

|

|

|

|

|

|

||

|

Total value @ current Sonus stock price |

|

$ |

16.3 |

M |

$ |

26.7 |

M |

|

|

|

|

|

|

|

||

|

Share reallocation for near-term Sonus milestones |

|

Yes |

|

No |

|

||

29

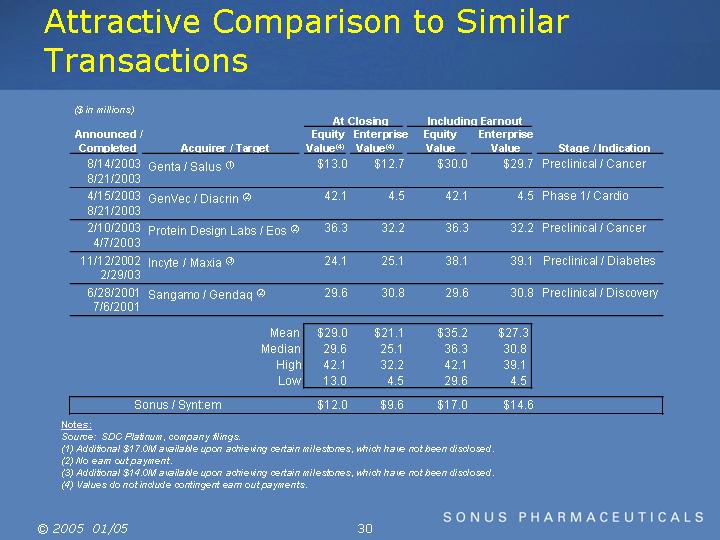

Attractive Comparison to Similar Transactions

($ in millions)

|

|

|

|

|

At Closing |

|

Including Earnout |

|

|

|

|||||||||||||||||||||

|

Announced / |

|

Acquirer / Target |

|

Equity |

|

Enterprise |

|

Equity |

|

Enterprise |

|

Stage / Indication |

|

|||||||||||||||||

|

8/14/2003 |

|

Genta / Salus |

(1) |

$ |

13.0 |

|

$ |

12.7 |

|

$ |

30.0 |

|

$ |

29.7 |

|

Preclinical / Cancer |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

4/15/2003 |

|

GenVec / Diacrin |

(2) |

42.1 |

|

4.5 |

|

42.1 |

|

4.5 |

|

Phase 1/ Cardio |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

2/10/2003 |

|

Protein Design Labs / Eos |

(2) |

36.3 |

|

32.2 |

|

36.3 |

|

32.2 |

|

Preclinical / Cancer |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

11/12/2002 |

|

Incyte / Maxia |

(3) |

24.1 |

|

25.1 |

|

38.1 |

|

39.1 |

|

Preclinical / Diabetes |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

6/28/2001 |

|

Sangamo / Gendaq |

(2) |

29.6 |

|

30.8 |

|

29.6 |

|

30.8 |

|

Preclinical / Discovery |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

Mean |

|

$ |

29.0 |

|

$ |

21.1 |

|

$ |

35.2 |

|

$ |

27.3 |

|

|

|

|||||||||||||

|

|

|

Median |

|

29.6 |

|

25.1 |

|

36.3 |

|

30.8 |

|

|

|

|||||||||||||||||

|

|

|

High |

|

42.1 |

|

32.2 |

|

42.1 |

|

39.1 |

|

|

|

|||||||||||||||||

|

|

|

Low |

|

13.0 |

|

4.5 |

|

29.6 |

|

4.5 |

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Sonus / Synt:em |

|

$ |

12.0 |

|

$ |

9.6 |

|

$ |

17.0 |

|

$ |

14.6 |

|

|

|

|||||||||||||||

Notes:

Source: SDC Platinum, company filings.

(1) Additional $17.0M available upon achieving certain milestones, which have not been disclosed.

(2) No earn out payment.

(3) Additional $14.0M available upon achieving certain milestones, which have not been disclosed.

(4) Values do not include contingent earn out payments.

30

Company Comp Analysis

|

|

|

At 1/6/05 |

|

|

|

|

|

|

|

||||

|

|

|

Equity |

|

Enterprise |

|

# of Drugs |

|

||||||

|

Company |

|

Value |

|

Value |

|

Pre-clinical |

|

Phase 1 |

|

Beyond Phase 1 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

StemCells. Inc. |

|

$ |

313.6 |

|

$ |

292.4 |

|

3 |

|

0 |

|

0 |

|

|

Alnylam Pharmaceuticals, Inc. |

|

174.7 |

|

134.5 |

|

2 |

|

0 |

|

0 |

|

||

|

Compugen Ltd. |

|

139.1 |

|

114.1 |

|

4 |

|

0 |

|

0 |

|

||

|

VIRxSYS (private) |

|

82.0 |

|

72.0 |

|

0 |

|

1 |

|

0 |

|

||

|

Memory Pharmaceuticals Corp. |

|

112.9 |

|

68.6 |

|

3 |

|

2 |

|

0 |

|

||

|

Pro-Pharmaceuticals, Inc. |

|

78.1 |

|

65.7 |

|

1 |

|

1 |

|

0 |

|

||

|

Plexxikon (private) |

|

66.3 |

|

41.3 |

|

1 |

|

0 |

|

0 |

|

||

|

Ecopia Biosciences, Inc. |

|

51.6 |

|

39.9 |

|

3 |

|

0 |

|

0 |

|

||

|

Avigen, Inc. |

|

96.3 |

|

23.1 |

|

3 |

|

1 |

|

0 |

|

||

|

Rejuvenon (private) |

|

52.0 |

|

15.0 |

|

0 |

|

1 |

|

0 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Maximum |

|

$ |

116.3 |

|

$ |

86.3 |

|

|

|

|

|

|

|

|

Mean |

|

89.2 |

|

67.2 |

|

|

|

|

|

|

|

||

|

Median |

|

313.6 |

|

292.4 |

|

|

|

|

|

|

|

||

|

Minimum |

|

47.9 |

|

15.0 |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Synt:em |

|

$ |

17.0 |

(1) |

$ |

14.6 |

(2) |

3+ |

|

0 |

|

0 |

|

Notes:

(1) Based on Sonus 20-day trailing average stock price of $3.14 and 5.425M shares issued.

(2) Assumes cash at close of $2.4M.

Enterprise values for private companies assumes no debt and cash levels equal to the amount raised in the most recent round of financing.

31

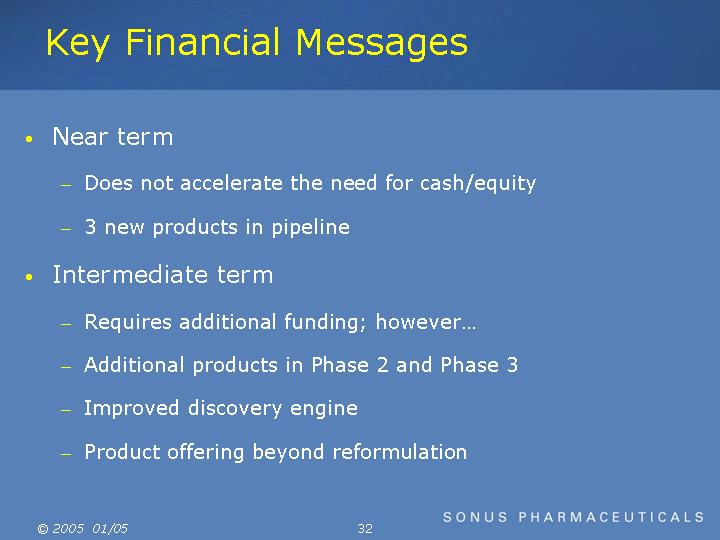

Key Financial Messages

Near term

Does not accelerate the need for cash/equity

3 new products in pipeline

Intermediate term

Requires additional funding; however

Additional products in Phase 2 and Phase 3

Improved discovery engine

Product offering beyond reformulation

32

Next Steps to Acquisition Closing

Proxy filing in January

Proxy mailing March (assuming SEC review)

Sonus shareholders meeting in April

33