DEF 14A: Definitive proxy statements

Published on April 26, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ |

|

Preliminary Proxy Statement |

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

|

Definitive Proxy Statement |

☐ |

|

Definitive Additional Materials |

☐ |

|

Soliciting Material Pursuant to Rule 14a-12 |

ACHIEVE LIFE SCIENCES, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ |

|

No fee required |

☐ |

|

Fee paid previously with preliminary materials |

☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

ACHIEVE LIFE SCIENCES, INC.

|

22722 29th Drive SE, Suite 100 Bothell, WA 98021 |

1040 West Georgia, Suite 1030 Vancouver, BC, Canada |

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Achieve Life Sciences, Inc., a Delaware corporation, will be held on June 5, 2024, at 8:00 a.m. Pacific time. The Annual Meeting will be a virtual stockholder meeting and you will be able to participate in the 2024 Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/ACHV2024. You must enter the control number found on your proxy card, voting instruction form or notice you previously received. You may vote during the Annual Meeting by following the instructions available on the meeting website during the meeting.

The Annual Meeting will be held for the following purposes:

Only stockholders of record at the close of business on April 10, 2024 are entitled to notice of, and to vote at, the Annual Meeting. For at least ten days prior to the Annual Meeting, a complete list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder, for any purpose relating to the Annual Meeting, during ordinary business hours at our U.S. principal executive offices at 22722 29th Drive SE, Suite 100, Bothell, WA 98021.

By Order of the Board of Directors, |

|

John Bencich |

Chief Executive Officer |

Bothell, Washington

April 26, 2024

Whether or not you plan to attend the Annual Meeting virtually, we encourage you to vote and submit your proxy by telephone, via the Internet or by mail. For additional instructions on attending virtually, voting by telephone or via the Internet, please refer to the proxy card. To vote and submit your proxy by mail, please complete, sign and date the enclosed proxy card and return it in the enclosed envelope. If you attend the Annual Meeting virtually, you may revoke your proxy and vote at the meeting. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from them to vote your shares. |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 5, 2024

The Company’s Proxy Statement and Annual Report on Form 10-K for the year ended

December 31, 2023 are available at ir.achievelifesciences.com.

TABLE OF CONTENTS

|

Page |

7 |

|

16 |

|

18 |

|

PROPOSAL TWO: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

19 |

21 |

|

22 |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

32 |

34 |

ACHIEVE LIFE SCIENCES, INC.

|

22722 29th Drive SE, Suite 100 Bothell, WA 98021 |

1040 West Georgia, Suite 1030 Vancouver, BC, Canada |

PROXY STATEMENT FOR

2024 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement, or Proxy Statement, is furnished in connection with the solicitation of proxies on behalf of the board of directors, or Board of Directors or Board, of Achieve Life Sciences, Inc., a Delaware corporation, or the Company or Achieve, for use at the Annual Meeting of Stockholders, or the Annual Meeting, to be held on June 5, 2024, at 8:00 a.m. Pacific time for the purposes set forth in this Proxy Statement and in the accompanying Notice of Annual Meeting.

We believe that a virtual stockholder meeting provides greater access to those who may want to attend, and therefore we have chosen that the Annual Meeting be held by virtual meeting. This approach also lowers costs and aligns with our broader sustainability goals. To be admitted virtually to the Annual Meeting at www.virtualshareholdermeeting.com/ACHV2024, you must enter the control number found on your proxy card, voting instruction form or notice you previously received. You may vote during the Annual Meeting by following the instructions available on the meeting website during the Annual Meeting.

This Notice of the Annual Meeting, Proxy Statement, form of proxy and Annual Report on Form 10-K for the year ended December 31, 2023 will first be mailed on or about April 26, 2024 to all stockholders entitled to vote at the Annual Meeting.

Voting Rights

Only stockholders of record at the close of business on April 10, 2024, the record date, are entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement of the Annual Meeting. At the close of business on April 10, 2024, we had 34,251,911 shares of common stock outstanding.

Each stockholder of record is entitled to one vote for each share of common stock held on the record date on all matters. Dissenters’ rights are not applicable to any of the matters being voted on.

Virtual Participation in the Annual Meeting

We will be hosting the Annual Meeting live via Internet webcast. A summary of the information you need to participate in the Annual Meeting online is provided below:

Board Recommendation

Our Board of Directors recommends that you vote:

4

Our directors do not have any substantial interest in any matter to be acted upon except with respect to the nomination of such directors for election to our Board of Directors. None of our executive officers have any substantial interest in any matter to be acted upon.

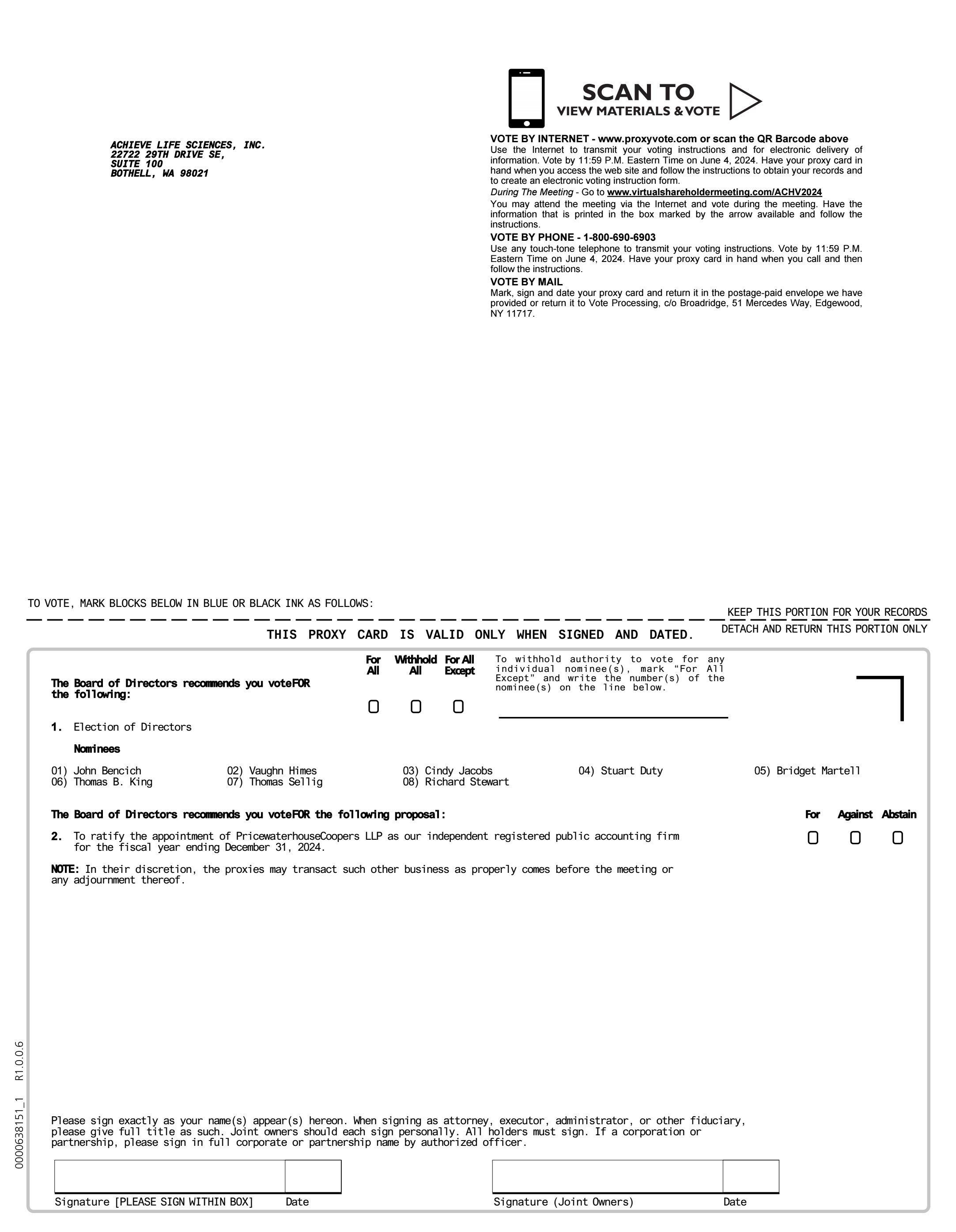

Voting of Proxies

All shares represented by a valid proxy received prior to the Annual Meeting will be voted, and, if you provide specific instructions, your shares will be voted as you instruct. If you sign your proxy card with no further instructions and do not hold your shares beneficially through a broker, bank or other nominee, your shares will be voted FOR each of the nominees for the Board of Directors, FOR the ratification of PwC as our independent registered public accounting firm for the fiscal year ending December 31, 2024, and in the discretion of the proxy holders with respect to any other matters that properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting.

How to Vote Your Shares

YOUR VOTE IS IMPORTANT. Your shares can be voted at the Annual Meeting only if you are represented by proxy, please take the time to vote your proxy.

Stockholders of record, or “registered stockholders,” can vote by proxy in the following three ways:

By Telephone: |

|

Call the toll-free number indicated on the enclosed proxy card and follow the recorded instructions. |

|

|

|

Via the Internet: |

|

Go to the website indicated on the enclosed proxy card and follow the instructions provided. |

|

|

|

By Mail: |

|

Mark your vote, date, sign and return the enclosed proxy card in the postage-paid return envelope provided. |

If your shares are held beneficially in “street” name through a nominee such as a financial institution, brokerage firm, or other holder of record, your vote is controlled by that institution, firm or holder. Your vote by proxy may also be cast by telephone or via the Internet, as well as by mail, if your financial institution or brokerage firm offers such voting alternatives. Please follow the specific instructions provided by your nominee on your voting instruction card.

Please note, that if your shares are held beneficially through a bank, broker or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from the record holder. Should you wish to attend the Annual Meeting virtually, you can join at www.virtualshareholdermeeting.com/ACHV2024.

Revocability of Proxies

You may revoke or change any previously delivered proxy (including a proxy sent to you by someone other than us) at any time before the Annual Meeting by:

If you hold shares in street name through a broker, bank or other nominee, you must contact that bank, broker or other nominee to revoke any prior voting instructions.

If you receive a proxy from someone other than us, see “Stockholder Nominations” below.

Quorum

The presence, virtually or by proxy, of at least a majority of the shares of common stock outstanding on the record date will constitute a quorum. Both abstentions and broker non-votes are counted for the purpose of determining the presence of a quorum.

5

Votes Required to Approve Matters Presented at the Annual Meeting

Our directors are elected by a plurality of the votes properly cast at the Annual Meeting. Approval of Proposal Two requires a majority of the votes properly cast at the Annual Meeting.

Broker Non-Votes

For banks, brokers or other nominee accounts, they are entitled to vote shares held for a beneficial owner on “routine” matters without instructions from the beneficial owner of those shares. For “non-routine” matters, the beneficial owner of such shares is required to provide instructions to the bank, broker or other nominee in order for them to be entitled to vote the shares held for the beneficial owner. If you hold shares beneficially in street name and do not provide your broker or other agent with voting instructions, your shares may constitute “broker non-votes.” A “broker non-vote” occurs when shares held by a broker that are represented at the meeting are not voted with respect to a particular proposal because the broker has not received voting instructions from its client(s) with respect to such shares on how to vote and does not have or did not exercise discretionary authority to vote on the matter. Your broker, fiduciary or custodian will only be able to vote your shares with respect to proposals considered to be “routine.” Your broker, fiduciary or custodian is not entitled to vote your shares with respect to “non-routine” proposals, which we refer to as a “broker non-vote.” Whether a proposal is considered routine or non-routine is subject to stock exchange rules and final determination by the stock exchange. Even with respect to routine matters, some brokers are choosing not to exercise discretionary voting authority. If a stockholder does not return voting instructions to their broker on how to vote their shares of common stock, such broker may be prevented from voting, or may otherwise choose not to vote, such shares held by such broker, resulting in broker non-votes with respect to such shares. To make sure that your vote is counted, you should instruct your broker to vote your shares of common stock, following the procedures provided by your broker.

If you hold your shares in street name, it is critical that you cast your vote if you want it to count on all matters to be decided at the Annual Meeting.

Impact on the Vote of Broker Non-Votes, Abstentions and Withholding from Voting

Broker non-votes, abstentions and withholding from voting are counted for purposes of determining whether or not a quorum exists for the transaction of business at the Annual Meeting. However, broker non-votes, abstentions and withholding from voting, will not be treated as votes cast and, therefore, will have no effect on the outcome of Proposal One (election of our directors) and Proposal Two (the ratification of the selection of PwC as our independent public accounting firm).

Solicitation of Proxies

We will bear the cost of soliciting proxies, including preparing, assembling, printing and mailing this Proxy Statement, the proxy card and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of common stock beneficially owned by others to forward to such beneficial owners. We may reimburse persons representing beneficial owners of common stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram, via the Internet or by personal solicitation by our directors, officers or other regular employees. No additional compensation will be paid to these individuals for such services.

Availability of Proxy Statement and Annual Report on Form 10-K

Our Proxy Statement and Annual Report on Form 10-K for the fiscal year ended December 31, 2023 are available at www.sec.gov and on our website at ir.achievelifesciences.com. We have provided to each stockholder of record as of April 10, 2024 a copy of our consolidated financial statements and related information, which are included in our Annual Report on Form 10-K for fiscal year 2023. We will mail without charge, upon written request, a copy of our Annual Report on Form 10-K for fiscal year 2023, including the consolidated financial statements, schedules and list of exhibits, and any particular exhibit specifically requested. Requests should be sent to: Achieve Life Sciences, Inc., 22722 29th Drive SE, Suite 100, Bothell, WA 98021, Attention: Investor Relations.

6

BOARD OF DIRECTORS

General

Directors are elected at each annual stockholders meeting to hold office until the next annual meeting or until their successors are elected and have qualified. Currently, there are eight members of the Board of Directors. The following table sets forth information with respect to the directors nominated for election at the annual stockholders meeting. The ages of such persons are shown as of April 10, 2024.

Name |

|

Age |

|

Position |

|

Director Since |

John Bencich |

|

47 |

|

Director and Chief Executive Officer |

|

2020 |

Richard Stewart |

|

65 |

|

Director, Executive Chairman. Chairman of the Board |

|

2017 |

Cindy Jacobs |

|

66 |

|

Director, President and Chief Medical Officer |

|

2021 |

Bridget Martell |

|

58 |

|

Director, Chairperson of the Nominating and Governance Committee and Member of the Audit Committee and Compensation Committee |

|

2021 |

Vaughn Himes |

|

63 |

|

Director, Chairperson of the Chemistry, Manufacturing & Controls Committee and Member of the Compensation Committee |

|

2022 |

Stuart Duty |

|

59 |

|

Director, Chairperson of the Audit Committee and Member of the Nominating and Governance Committee |

|

2023 |

Thomas B. King |

|

69 |

|

Lead Director and Member of the Audit Committee, Compensation Committee and Nominating and Governance Committee |

|

2023 |

Thomas Sellig |

|

57 |

|

Director and Member of the Audit Committee and Chemistry, Manufacturing & Controls Committee |

|

2023 |

The Board of Directors held a total of six meetings during fiscal year 2023. During fiscal year 2023, each of our directors attended at least 75% of the aggregate of: (i) the total number of meetings of the Board of Directors held during the period he or she was a director; and (ii) the total number of meetings held by all committees on which the director served during the period he or she was a member.

Although we do not have a formal policy regarding attendance by directors at annual meetings of stockholders, we encourage directors to attend and, historically, most have done so. All of our directors then in office were in attendance at the 2023 annual meeting.

Pursuant to our Corporate Governance Guidelines, the Board of Directors is required to hold at least four regularly scheduled meetings each year. At least one of these meetings must include budgeting and long-term strategic planning. Each director is expected to attend no fewer than 75% of the total of all meetings of the Board of Directors and meetings of the committees on which he or she serves.

Set forth below are the names of, and information concerning, our current directors.

John Bencich has served as our Chief Executive Officer and member of the Board of Directors since September 2020. Previously, Mr. Bencich served as our Vice President and Chief Financial Officer from August 2014 to September 2017, and as our Executive Vice President and Chief Operating Officer from August 2017 to August 2020. Mr. Bencich joined us from Integrated Diagnostics, Inc., a molecular diagnostics company, where he served as Chief Financial Officer from September 2012 to August 2014. Prior to joining Integrated Diagnostics, he served as Chief Financial Officer of Allozyne, Inc. since July 2011. He served as the Vice President, Chief Financial Officer and Treasurer of Trubion Pharmaceuticals, Inc., a publicly traded biotechnology company, from November 2009 until its acquisition by Emergent BioSolutions Inc. in October 2010. Mr. Bencich served as Trubion’s Senior Director of Finance and Accounting from May 2007 through November 2009. Earlier in his career, Mr. Bencich held roles at Onyx Software Corporation, a publicly traded software company, and Ernst & Young LLP an international professional services firm. Mr. Bencich received a B.A. in Accountancy from the University of San Diego and an M.B.A. from Seattle University. Mr. Bencich received his Certified Public Accountant Certification from the State of Washington and held an active license for 17 years. The determination was made that Mr. Bencich should serve on our Board of Directors based on our belief that the Board of Directors have the benefit of management’s perspective and, in particular, that of the Chief Executive Officer, as well as Mr. Bencich’s extensive financial experience.

7

Richard Stewart has served as our Executive Chairman since September 2020, and as our Chairman of the Board and a director since the consummation of the merger between OncoGenex Pharmaceuticals, Inc. and Achieve in August 2017, or the Merger. Previously, Mr. Stewart served as Chief Executive Officer from the Merger to September 2020, and was Chairman and a director of Achieve, from its founding in May 2015, through the Merger. Mr. Stewart is also a founder and has served as a director of Ricanto Limited, a pharmaceutical asset optimization company, since 2009. Mr. Stewart has been Chairman and Chief Executive Officer of Renown Pharma Limited, a central nervous system company focused on Parkinson’s disease, since 2016. Prior to Achieve, Mr. Stewart was Chairman and Chief Executive Officer of Huxley Pharmaceuticals, Inc., a single purpose central nervous system company, during 2009, prior to Huxley Pharmaceuticals, Inc.’s acquisition by BioMarin Pharmaceutical Inc. Mr. Stewart was Chief Executive Officer of Brabant Pharma Limited, a single purpose central nervous system company, from 2013 to 2014 prior to its acquisition by Zogenix Inc. He was a co-founder and Chief Executive Officer of Amarin Corporation plc, a central nervous system company focused on Parkinson’s disease and Huntington’s disease, from 2000 to 2007. Mr. Stewart was a co-founder and Chief Financial Officer, and later Chief Business Officer, of SkyePharma plc, a drug delivery company specializing in controlled release formulations, and held such positions from 1995 to 1998. Mr. Stewart holds a B.S. in Business Administration from the University of Bath. The determination was made that Mr. Stewart should serve on our Board of Directors due to his prior service on boards of directors, and extensive experience and innovations in the field of biotechnology. In addition, Mr. Stewart’s accomplishments provide the Board of Directors with in-depth product and field knowledge.

Cindy Jacobs, Ph.D., M.D., has served as our President since September 2020 and our Chief Medical Officer since August 2008, and a member of the Board of Directors since March 2021. Previously, Dr. Jacobs served as Executive Vice President and Chief Medical Officer of OncoGenex Pharmaceuticals, Inc. from September 2005 to August 2008. Dr. Jacobs is also the founder of Eagles Ridge Executive Consulting LLC., an executive consulting business operating since July 2020. From 1999 to July 2005, Dr. Jacobs served as Chief Medical Officer and Senior Vice President, Clinical Development of Corixa Corporation. Prior to 1999, Dr. Jacobs held Vice President, Clinical Research positions at two other biopharmaceutical companies. Dr. Jacobs currently serves on the Board of Directors of Pacylex Pharmaceuticals Inc. since October 2020 and HiberCell Inc. since September 2021 and previously served on the Board of Directors of Renown Pharmaceuticals Private Limited from January 2018 to October 2021. Dr. Jacobs received her Ph.D. degree in Veterinary Pathology/Microbiology from Washington State University and an M.D. degree from the University of Washington Medical School. The determination was made that Dr. Jacobs should serve on our Board of Directors based on our belief that the Board of Directors have the benefit of management’s perspective and, in particular, that of the President and Chief Medical Officer, as well as Dr. Jacob’s extensive clinical and regulatory experience and experience serving on the boards of directors of various companies.

Bridget Martell, M.A., M.D., is the Founder and Managing Partner of her consultancy practice, BAM Consultants, which she started in 2013. She previously served as President and Chief Executive Officer of the privately held biotechnology company Artizan Biosciences, Inc. from July 2021 until August of 2023. Prior to that, Dr. Martell was at Kura Oncology, Inc., a public, clinical-stage biopharmaceutical company, where she served in varied roles first as VP, Clinical Development, Acting Chief Medical Officer, and Senior Scientific Advisor from October 2017 until December 2021. She has served as the Acting Chief Medical Officer of a number of privately held early-stage biotechnology companies, including Nobias Therapeutics, Inc. from August 2020 to August 2021 and August 2023 to present, for Verseau Therapeutics, Inc. from October 2020 to September 2021, and most recently at Glycyx Therapeutics, Inc. starting in August 2023. Additionally, Dr. Martell served as Chief Medical Officer of RRD International, Inc., a privately held boutique Contract Research Organization from April 2018 to January 2020. From 2015 to 2017, Dr. Martell served as Senior Vice President, New Product Development and Chief Medical Officer at Juniper Pharmaceuticals, a publicly traded specialty pharmaceuticals company. Previous to that, Dr. Martell held leadership roles of increasing responsibility at Pfizer, Inc., a publicly traded biopharmaceutical company from 2005 to 2011. Dr. Martell currently serves as an independent director of Aligos Therapeutics Inc. and Ayala Pharmaceuticals, Inc., each a publicly traded biotechnology company, and previously served as a director of POINT Biopharma Global, Inc, a cancer treatment biotechnology company, from June 2023 until its acquisition by Eili Lilly and Company, a pharmaceutical company, in December 2023. Dr. Martell holds a B.S. in microbiology from Cornell University, an M.A. in molecular immunology from Boston University and an M.D. from the Chicago Medical School. She completed her internship and residency in internal medicine and was an internal medicine chief resident and RWJ Faculty Clinical Scholar at Yale University. Dr. Martell is board certified in both internal and addiction medicine. Dr. Martell was a Teaching Attending and Clinical Associate Professor at Yale from 2005 to 2020 and has continued her engagement at Yale as an Entrepreneur In Residence at Yale Ventures since 2017. The determination was made that Dr. Martell should serve on the Board of Directors due to her diverse background of scientific, clinical and leadership experience in the clinical development, success of numerous marketed products across multiple therapeutic categories, leadership in her operational roles, and engagement with key industry and business stakeholders in the biopharmaceutical space.

Vaughn B. Himes, Ph.D. previously served as Chief Technical Officer at Seagen, Inc., a publicly traded biotechnology company, from August 2016 to December 2023. Dr. Himes joined Seagen, Inc. as Executive Vice President, Technical Operations in April 2009 and served as Executive Vice President, Technical Operations and Process Science from July 2012 until August 2016. Previously, Dr.

8

Himes was with ZymoGenetics, Inc. from November 2005 to March 2009, most recently as Senior Vice President, Technical Operations where his responsibilities included commercial and clinical manufacturing, supply chain and logistics, quality control and process development. From March 2003 to October 2005, he was Vice President, Manufacturing at Corixa, Inc. Prior to that, he held Vice President positions in manufacturing and development at Targeted Genetics and Genovo, Inc. Dr. Himes has served on the board of directors of VBI Vaccines Inc., a publicly traded biopharmaceutical company, since April 2023. Dr. Himes received a B.A. in Chemistry from Pomona College in California and a Ph.D. in Chemical Engineering from the University of Minnesota. The determination was made that Dr. Himes should serve on our Board of Directors due to his extensive CMC and technical operations expertise, as well as his public company executive experience.

Stuart Duty was a Senior Managing Director at Guggenheim Securities, LLC, a global investment and advisory financial services firm, from June 2012 to March 2023. Previously, he served as Managing Director, Co-Head, Healthcare Investment Banking at Piper Jaffray Companies, a global investment firm, from 2007 to 2012, as the Chief Operating Officer of Oracle Partners, L.P., a private healthcare focused investment fund, from 2002 to 2007, as Managing Director, Co-Head, Healthcare Investment Banking at Piper Jaffray, Inc., an global investment bank, from 1992 to 2002, as Managing Director, Healthcare Investment Banking at Montgomery Securities, an investment bank, from 1993 to 1999 and as the Director of Business Development at Curative Technologies, Inc., a biotherapeutics company, from 1992 to 1993. Mr. Duty has served on the board of directors of Eyepoint Pharmaceuticals, Inc. since October 2023. Mr. Duty holds a B.A. in Biochemistry from Occidental College and an M.B.A from Harvard Business School. The determination was made that Mr. Duty should serve on our Board of Directors due to his extensive experience in the banking and finance industry.

Thomas B. King has served as an independent biotechnology consultant and advisor since August 2016. Mr. King has served on the board of directors of TFF Pharmaceuticals, Inc., a publicly-traded biopharmaceutical company since December 2023, as well as on the boards of directors of other privately held biotechnology companies. Mr. King served on the board of directors of Satsuma Pharmaceuticals, Inc., a biopharmaceutical company, from September 2017 to June 2023, when it was acquired by Shin Nippon Biomedical Laboratories, Ltd. Mr. King served as a member of the board of directors of VIVUS, Inc., a pharmaceutical company, from May 2017 to December 2020, and served as interim Chief Executive Officer from December 2017 to April 2018 and interim President from April 2018 to May 2018. Previously, Mr. King served as President, Chief Executive Officer and a member of the board of directors of Alexza Pharmaceuticals, Inc., a pharmaceutical company, from June 2003 until it was acquired by Grupo Ferrer in August 2016. From October 2015 to August 2016, Mr. King also served as Chief Financial Officer and Chief Accounting Officer of Alexza Pharmaceuticals, Inc. From September 2002 to April 2003 Mr. King served as President, Chief Executive Officer and a member of the board of directors of Cognetix, Inc., a biopharmaceutical development-stage company. From January 1994 to February 2001, Mr. King held various senior executive positions at Anesta Corporation, a pharmaceutical company, including President and Chief Operating Officer from January 1995 to January 1997 and President and Chief Executive Officer from January 1997 to October 2000. Mr. King received a B.A. in chemistry from McPherson College and an M.B.A. from the University of Kansas Graduate School of Business. The determination was made that Mr. King should serve on our Board of Directors due to his extensive leadership experience in the pharmaceutical and biopharmaceutical industry, including experience with small and large development stage pharmaceutical companies, and his experience on the boards of directors of both public and private companies.

Thomas Sellig has served as the Chief Executive Officer of Adare Pharmaceuticals, Inc., a global technology-driven Contract Development and Manufacturing Organization since January 2022. From July 2019 to October 2021, Mr. Sellig served as Chief Executive Officer of LabConnect, Inc., a clinical trial laboratory services organization. Prior to LabConnect, Inc., Mr. Sellig was Chief Commercial Officer at PSKW, LLC (doing business as ConnectiveRx) from September 2018 to July 2019. From November 2017 to August 2017, Mr. Sellig was Senior Vice President of Global Sales at Patheon N.V., and continued to serve as Senior Vice President of Global Sales at Themo Fisher Scientific Inc. following its acquisition of Patheon N.V. in August 2017. Previously, he served as the Global Vice President of Sales and Client Services from 2011 to 2014, and as the Vice President of Strategic Partnering/ Alliance Management from 2007 to 2011 at Covance, the drug development business of Laboratory Corporation of America Holdings, a contract research organization. Early in his career, Mr. Sellig had a variety of sales and marketing leadership roles at Procter & Gamble Company, a multinational consumer goods company, Wyeth, LLC (formerly American Home Products), a pharmaceutical company, and Ascent Pediatrics, Inc., a drug development company. Mr. Sellig received his B.A. in Economics from Vanderbilt University and an M.B.A. from New York University. The determination was made that Mr. Sellig should serve on our Board of Directors due to his global extensive experience in the life sciences and pharmaceutical services industries.

Each of the standing committees of our Board of Directors has diverse representation. In addition, on our Board of Directors there are two directors who hold medical doctorates, two directors who holds a doctorate in scientific fields and four directors who hold a master’s degree in business administration. The table below provides certain highlights of the composition of our Board of Directors as of the date of this Proxy Statement, as reported by our directors. Each of the categories listed in the table below has the meaning set forth in The Nasdaq Stock Market LLC, or Nasdaq, Rule 5605(f).

9

Board Diversity Matrix (as of April 10, 2024)

Board Size: |

|

|

|

|

|

|

|

|

Total Number of Directors: 8 |

|

|

|

|

|

|

|

|

|

|

Female |

|

Male |

|

Non-Binary |

|

Gender |

Gender: |

|

|

|

|

|

|

|

|

Number of Directors Based on Gender Identity |

|

2 |

|

5 |

|

|

|

1 |

|

|

|

|

|

|

|

|

|

Number of Directors Who Identify in Any of the Categories Below: |

|

|

|

|

|

|

|

|

White |

|

2 |

|

5 |

|

|

|

|

Demographic Background Undisclosed |

|

|

|

|

|

|

|

1 |

Director Independence

Our Board of Directors has determined that Dr. Himes, Dr. Martell, Mr. Duty, Mr. King and Mr. Sellig, are “independent” under the applicable Securities and Exchange Commission, or the SEC, rules and the criteria established by Nasdaq. Donald Joseph, Martin Mattingly and Jay Moyes did not stand for re-election at the 2023 annual meeting of stockholders. While serving on the Board of Directors it was determined that Mr. Joseph, Dr. Mattingly and Mr. Moyes, were also “independent” under the applicable SEC rules and the criteria established by Nasdaq.

Relationships Among Directors, Executive Officers and Director Nominees

There are no family relationships among any of our directors, executive officers or director nominees.

Stockholder Communication with the Board of Directors

Stockholders who are interested in communicating directly with members of the Board of Directors, or the Board of Directors as a group, may do so by writing directly to the member(s) c/o Secretary, Achieve Life Sciences, Inc., 22722 29th Drive SE, Suite 100, Bothell, Washington 98021. The Secretary will promptly forward to the Board of Directors or the individually named directors all written communications received at the above address that the Secretary considers appropriate.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of the members of our Board of Directors, officers, and employees, and we expect our agents, representatives, consultants and contractors to conform to the standards of our Code of Business Conduct and Ethics. Our Code of Business Conduct and Ethics is posted on the “Investor Relations” section of our website, which is located at https://ir.achievelifesciences.com under “Governance Documents” in the “Governance” section of our website. We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding amendment to, or waiver from, a provision of our Code of Business Conduct and Ethics by posting such information on our website at the address and location specified above.

Our Code of Business Conduct and Ethics requires our executive officers and directors to report any conflicts of interest with our interests to our Audit Committee, and generally prohibits our executive officers and directors from conflicts of interest with our interests. Waivers of our Code of Business Conduct and Ethics with respect to an executive officer or director may only be granted by the Board of Directors or, if permitted by Nasdaq and any other applicable stock exchange’s rules, our Nominating and Governance Committee. We do not have a specific policy concerning approval of transactions with stockholders who own more than 5% of our outstanding shares.

Related-Party Transactions Policy and Procedure

Our Audit Committee is responsible for reviewing and approving all related-party transactions and conflict of interest situations involving a principal stockholder, a member of the Board of Directors or senior management. Other than as disclosed below and in “Proposal One: Election of Directors” from January 1, 2023 to the present, there have been no transactions, and there are currently no proposed transactions, in which the amount involved exceeds $120,000 to which we or any of our subsidiaries was or is to be a party and in which any director, director nominee, executive officer, holder of more than 5% of our capital stock, or any immediate family member of any of these individuals, had or will have a direct or indirect material interest.

10

Transactions with Related Persons

Other than compensation arrangements for our directors and NEOs, which are described elsewhere in this proxy statement, below we describe transactions since January 1, 2022 to which we were a party or will be a party, in which:

May 2023 Registered Direct Offering

In May 2023, we entered into a securities purchase agreement with certain purchasers, pursuant to which we sold 3,000,000 shares of common stock at a price of $5.50 per share in a registered direct offering, or the 2023 Offering. The 2023 Offering was made pursuant to our shelf registration statement on Form S-3, including the prospectus dated January 5, 2022 contained therein, or the Registration Statement, and a prospectus supplement dated May 25, 2023. The 2023 Offering raised total gross proceeds of approximately $16.5 million, and after deducting approximately $1.2 million in placement agent fees and offering expenses, we received net proceeds of approximately $15.3 million.

Pursuant to the 2023 Offering, on May 25, 2023, (a) John Bencich purchased 5,000 shares of our common stock, for an aggregate purchase price of $27,500; and (b) Contrarian Alpha, LP purchased 70,000 shares of our common stock for an aggregate purchase price of $385,000.

February 2024 Registered Direct Offering and Concurrent Private Placement

In February 2024, we entered into a securities purchase agreement with certain purchasers, pursuant to which we sold 13,086,151 shares of common stock at a price of $4.585 per share in a registered direct offering, or the 2024 Offering. The 2024 Offering was made pursuant to the Registration Statement, and a prospectus supplement dated February 28, 2024. In a concurrent private placement, or the Private Placement, we issued unregistered warrants to purchase up to 13,086,151 shares of common stock at an exercise price of $4.906 per share (provided, however, that the purchaser may elect to exercise the warrants for pre-funded warrants in lieu of shares of common stock at an exercise price of $4.906, minus $0.001, the exercise price of each pre-funded warrant). These warrants are immediately exercisable for shares of common stock or pre-funded warrants in lieu thereof, and will expire on the earlier of (i) three and one-half years following the date of issuance and (ii) 30 days following our public disclosure of the acceptance of a New Drug Application for cytisinicline by the U.S. Food and Drug Administration in a Day 74 Letter or equivalent correspondence. The 2024 Offering and Private Placement raised total gross proceeds of approximately $60.0 million, and after deducting approximately $3.8 million in placement agent fees and offering expenses, we received net proceeds of approximately $56.2 million.

Pursuant to the 2024 Offering and Private Placement, on March 4, 2024, (a) John Bencich purchased 10,000 shares of our common stock and 10,000 warrants, for an aggregate purchase price of $45,850; (b) Richard Stewart purchased 10,000 shares of our common stock and 10,000 warrants, for an aggregate purchase price of $45,850; and (c) Contrarian Alpha, LP, purchased 100,000 shares of our common stock and 100,000 warrants, for an aggregate purchase price of $458,000.

Board of Directors’ Committees

The Board of Directors has established separately designated an Audit Committee, a Compensation Committee, a Nominating and Governance Committee, and a Chemistry, Manufacturing and Controls Committee to assist it in performing its responsibilities. The Board of Directors designates the members of these committees and the committee chairs annually, based on the recommendations of the Nominating and Governance Committee in consultation with the Chief Executive Officer and the Chairperson of the Board of Directors. The Nominating and Governance Committee reviews committee assignments from time to time and considers the rotation of committee chairpersons and members with a view towards balancing the benefits derived from the diversity of experience and viewpoints of the directors. The Board of Directors has adopted written charters for each of these committees, which are available on our website at ir.achievelifesciences.com under “Corporate Governance.” The chairperson of each committee develops the agenda for that committee and determines the frequency and length of committee meetings.

Audit Committee and Audit Committee Financial Expert

The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and is currently comprised of Stuart Duty, Chairperson, Thomas King, Bridget Martell and Thomas

11

Sellig, each of whom the Board of Directors has determined satisfies the applicable SEC and Nasdaq independence requirements for audit committee members. The Board of Directors has also determined that Mr. Duty is an “audit committee financial expert,” as defined by the applicable rules of the SEC. The Audit Committee held four meetings during fiscal year 2023.

Audit Committee Responsibilities

The Audit Committee is responsible for, among other things:

Please see the sections entitled “Report of the Audit Committee” and “Proposal Two: Ratification of Appointment of Independent Registered Public Accounting Firm” for further matters related to the Audit Committee.

Compensation Committee

The Compensation Committee currently consists of Thomas King, Chairperson, Vaughn Himes and Bridget Martell, each of whom the Board of Directors has determined satisfies the applicable SEC and Nasdaq independence requirements. In addition, each member of the Compensation Committee has been determined to be a non-employee director under Rule 16b-3 as promulgated under the Exchange Act. The Compensation Committee reviews and recommends to the Board of Directors the compensation for our executive officers and our non-employee directors for their services as members of the Board of Directors. The Compensation Committee does not have any explicit authority to delegate its duties. The Compensation Committee held six meetings during fiscal year 2023.

In 2023, the Compensation Committee retained Aon’s Human Capital Solutions practice, a division of Aon plc, or Aon, a provider of compensation market intelligence to the technology and life sciences industries, to provide a report summarizing relevant benchmark data relating to industry-appropriate peers and make recommendations regarding base salary, target total cash (base salary plus target cash incentives), and terms of long-term equity incentive awards for our executives. The Compensation Committee determined that no work performed by Aon during fiscal year 2023 raised a conflict of interest.

Please see the sections entitled “Executive Compensation” and “Director Compensation” for further matters related to the Compensation Committee and director and executive officer compensation matters.

Nominating and Governance Committee

The Nominating and Governance Committee currently consists of Bridget Martell, Chairperson, Stuart Duty, and Thomas King, each of whom the Board of Directors has determined satisfies the applicable SEC and Nasdaq independence requirements.

The Nominating and Governance Committee reviews, evaluates and proposes candidates for election to our Board of Directors, and considers any nominees properly recommended by stockholders. The Nominating and Governance Committee promotes the proper constitution of our Board of Directors in order to meet its fiduciary obligations to our stockholders, and oversees the establishment of, and compliance with, appropriate governance standards. The Nominating and Governance Committee held four meetings during fiscal year 2023.

12

Chemistry, Manufacturing and Controls Committee

The Chemistry, Manufacturing and Controls Committee currently consists of Vaughn Himes, Chairperson, and Thomas Sellig, each of whom the Board of Directors has determined satisfies the applicable SEC and Nasdaq independence requirements.

The Chemistry, Manufacturing and Controls Committee identifies emerging trends in pharmaceutical regulation and manufacturing, and reviews, evaluates and proposes initiatives and reports its progress on achieving the long-term strategic goals and objectives. The Chemistry, Manufacturing and Controls Committee held three meetings during fiscal year 2023.

Board of Directors Leadership Structure

Richard Stewart has served as the Chairman of the Board since 2017 and our Executive Chairman since September 2020 and brings extensive executive leadership and experience with the development of our lead product candidate, cytisinicline. John Bencich has served as Chief Executive Officer since September 2020. Mr. Bencich is an experienced financial executive with over 20 years guiding financial and corporate strategy in the life sciences and technology industries. Our Board of Directors believes that the current Board of Directors leadership structure, coupled with a strong emphasis on the independence of the Board of Directors and the role of the lead independent director, provides effective independent oversight of management. Independent directors and management sometimes have different perspectives and roles in strategy development. Our independent directors bring experience, oversight and expertise from outside of our company. The Board of Directors also believes the current separation of the Chairman and Chief Executive Officer roles allows the Chief Executive Officer to focus his time and energy on operating and managing the Company and leverages the Chairman’s experience and perspective.

Lead Independent Director

Thomas King has served as our lead independent director since June 2023, and provides an additional measure of balance, ensures the Board of Director’s independence and enhances its ability to fulfill its management oversight responsibilities. As lead independent director, Mr. King, among other responsibilities, develops along with the Chief Executive Officer the agenda for each Board meeting, presides over regularly scheduled meetings at which only our independent directors are present, serves as a liaison between the Chief Executive Officer and the independent directors and performs such additional duties as our Board of Directors may otherwise determine and delegate.

Board of Directors’ Role in Risk Oversight

Consistent with our leadership structure, our management is charged with the day-to-day management of risks that we face or may face and provides our Board of Directors with quarterly risk assessment and mitigation strategy updates, while our Board of Directors and its committees are responsible for oversight of risk management. The Audit Committee has responsibility for oversight of financial reporting related risks, including those related to our accounting, auditing and financial reporting practices, as well as cybersecurity risks. In addition, the Audit Committee annually reviews and assesses the adequacy of our risk management policies and procedures with regard to identifying our management of financial risks, cybersecurity risks, reviews the quarterly updates on these risks that are received from management, and assesses the adequacy of management’s implementation of appropriate systems to mitigate and manage financial risks. Furthermore, under our Code of Business Conduct and Ethics, the Audit Committee is responsible for considering reports of conflicts of interest involving officers and directors. The Nominating and Governance Committee oversees corporate governance risks, including implementing procedures to ensure that the Board of Directors operates independently of management and without conflicts of interest. In addition, the Nominating and Governance Committee oversees compliance with our Code of Business Conduct and Ethics. The Compensation Committee oversees risks associated with our compensation policies, plans and practices. The Audit Committee, the Nominating and Governance Committee and the Compensation Committee each report to the Board of Directors regarding the foregoing matters, and the Board of Directors approves any changes in corporate policies, including those pertaining to risk management. The Chemistry, Manufacturing & Controls Committee oversees strategy and key risks related to manufacturing, supply chain and commercialization preparation, among other matters.

The Board of Directors has also adopted a Whistleblower Policy, which provides a means by which concerns about actual and suspected violations of laws, governmental rules or regulations; accounting, internal accounting controls or auditing matters; our Code of Business Conduct and Ethics or other policies, and other public interest matters are to be reported. We recognize that individuals may not feel comfortable reporting a matter directly to the appropriate persons at the Company and therefore the Whistleblower Policy provides a mechanism by which a person may report a matter to Nasdaq OMX Group Corporate Services, Inc., a third party retained by us. Under the policy, the Chairperson of the Audit Committee determines whether and, if so, how an investigation is to be conducted and, together with the full Audit Committee in certain instances, resolves reported violations. In all cases, a report of the outcome is to be made to the Board of Directors.

13

Risk Assessment of Compensation Programs

We have determined that our compensation policies, plans and practices are appropriately balanced and do not create risks that are reasonably likely to have a material adverse effect on our company. To make this determination, our management reviewed the compensation policies, plans and practices for our executive officers, as well as for all other employees. We assessed the following features of our compensation, plans and practices: design, payment methodology, potential payment volatility, relationship to our financial results, length of performance period, risk-mitigating features, performance measures and goals, oversight and controls, and plan features and values compared to market practices. Based on this review, we believe that our compensation policies, plans and practices do not create risks that are reasonably likely to have a material adverse effect on our company.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee during fiscal year 2023 served as one of our officers, former officers or employees nor received directly or indirectly compensation from the Company, other than in the capacity as a member of our Board of Directors and Compensation Committee. There was no direct or indirect control by the members of the Compensation Committee of the Company. No member of the Compensation Committee, directly or indirectly, is the beneficial owner of more than 10% of the Company’s equity, nor are they an executive officer, employee, director, general partner or a managing member of one or more entities that are together the beneficial owners of more than 10% of the Company’s equity. The Compensation Committee members are not aware of any business or personal relationship between (i) a member of the Compensation Committee and any person who has provided or is providing advice to the Compensation Committee; and (ii) an executive officer of the Company and any firm or other person who is employed or is employing such person to provide advice to the Compensation Committee. During fiscal year 2023, none of our executive officers served as a member of the compensation committee of any other entity, one of whose executive officers served as a member of our Board of Directors or Compensation Committee, and none of our executive officers served as a member of the Board of Directors of any other entity, one of whose executive officers served as a member of our Compensation Committee.

Director Nomination Process

Director Qualifications

Members of our Board of Directors must have broad experience and business acumen, a record of professional accomplishment in his or her field, and demonstrate honesty and integrity consistent with our values. In evaluating director nominees, the Nominating and Governance Committee considers a variety of factors, including, without limitation, the director nominee’s skills, expertise and experience, wisdom, integrity, diversity, the ability to make independent analytical inquiries, the ability to understand our business environment, the willingness to devote adequate time to Board of Directors’ duties, the interplay of the director nominee’s experience and skills with those of other directors, and the extent to which the director nominee would be a desirable addition to the Board of Directors and any committees of the Board of Directors. The Nominating and Governance Committee may also consider such other factors as it may deem are in the best interests of us and our stockholders. Additionally, in accordance with the applicable securities laws and Nasdaq requirements, a majority of the members of the Board of Directors must be “independent.” We do not have a policy regarding diversity, but the Nominating and Governance Committee does and will continue to consider each candidate’s gender, racial, ethnic and sexual identity, experiences and qualities as described above and how these identities, experiences and qualities complement the diversity of the Board of Directors.

Identification of Nominees by the Board of Directors

The Nominating and Governance Committee identifies nominees by first determining the desired skills and experience of a new nominee based on the qualifications discussed above. The Nominating and Governance Committee will solicit names for possible candidates from other directors, our senior level executives and individuals personally known to the directors, as well as third-party search firms. The Nominating and Governance Committee evaluates all possible candidates, including individuals recommended by stockholders, using the same criteria.

14

Stockholder Nominations

Our bylaws contain provisions that address the process by which a stockholder may nominate an individual to stand for election to the Board of Directors. The Nominating and Governance Committee will consider nominees properly recommended by stockholders. Stockholders wishing to submit nominations must provide timely written notice to our Corporate Secretary containing the following information:

To be timely, a Nominating Person’s notice in respect of a director nomination must be delivered to or mailed and received by our Corporate Secretary at our U.S. principal executive offices at 22722 29th Drive SE, Suite 100, Bothell, Washington 98021, not less than 90 nor more than 120 calendar days prior to the first anniversary of the previous year’s annual meeting. In the event, however, that the date of the annual meeting is more than 30 days before or more than 60 days after the anniversary date, notice must be delivered no more than 120 and not less than 90 days prior to the annual meeting or the close of business on the tenth day following the date which public disclosure of the date of such meeting is made.

Hedging and Pledging Prohibitions

As part of our Insider Trading Policy, our employees (including our executive officers) and the non-employee members of our board of directors are prohibited from or require pre-clearance approval by our Compliance Officer before: (i) engaging in transactions involving options or other derivative securities on our securities, such as puts and calls, whether on an exchange or in any other market; (ii) engaging in hedging or monetization transactions involving our securities, such as zero-cost collars and forward sale contracts; (iii) engaging in short sales of our securities, including short sales “against the box”; and (iv) using or pledging our securities as collateral in a margin account or as collateral for a loan.

Compensation Recovery Policy

In August 2023, our board of directors adopted a Compensation Recovery Policy intended to comply with applicable SEC rules and Nasdaq listing standards. The Compensation Recovery Policy is administered by our compensation committee and enables us to recover from current and former officers, and such additional employees as may be identified by the compensation committee from time to time, incentive-based compensation, as defined in the Compensation Recovery Policy, in the event of an accounting restatement resulting from material noncompliance with any financial reporting requirements under federal securities laws. For more information, see the full text of our Compensation Recovery Policy, which is filed as an exhibit to our Annual Report on Form 10-K for the year ended December 31, 2023.

15

PROPOSAL ONE:

ELECTION OF DIRECTORS

Nominees

The following persons are our 2024 director nominees, each of whom was recommended by the Nominating and Governance Committee and approved by the Board of Directors for nomination at the Annual Meeting:

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominees named above. If a nominee is unable to serve or for good cause will not serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who is designated by the present Board of Directors to fill the vacancy. Each nominee has consented to being named in this Proxy Statement and to serve if elected. We do not expect that any nominee will be unable to serve or for good cause will not serve as a director. Each director is elected annually to serve until the next annual meeting of stockholders or until a successor has been duly elected and has qualified.

Biographies of our 2024 director nominees are located above under the heading “Board of Directors – General.”

Director Compensation Overview

The charter of the Compensation Committee provides that the Compensation Committee is to recommend to the Board of Directors matters related to director compensation. The director compensation package for non-employee directors consists of annual cash compensation and stock options exercisable to purchase shares of our common stock. None of our employees who also serve as directors are entitled to receive compensation for service as a director. Therefore, Richard Stewart, John Bencich and Cindy Jacobs receive no compensation for their service as a director. Our director compensation policy for fiscal year 2023 is set forth below under the heading “Director Compensation Policy – 2023 Director Compensation.”

Director Compensation Policy

2023 Director Compensation

As part of its evaluation of compensation levels for the 2023 fiscal year, the Compensation Committee recommended and the Board of Directors approved, the retention of Aon to review compensation levels of our independent directors and committee members. Aon was instructed to benchmark and make recommendations regarding the annual retainer amounts for directors and chairpersons of the Board of Directors and the various committees, as well as the amounts and terms of initial and annual long-term equity incentive awards for directors. On recommendation by Aon in 2023, the equity compensation and cash compensation for non-employee directors in connection with their service on the Board of Directors in 2023 is as follows:

16

|

|

Chairperson |

|

|

Other Members |

|

||

Audit Committee |

|

$ |

15,000 |

|

|

$ |

7,500 |

|

Compensation Committee |

|

$ |

10,000 |

|

|

$ |

5,000 |

|

Nominating and Governance Committee |

|

$ |

7,500 |

|

|

$ |

3,500 |

|

Chemistry, Manufacturing and Controls Committee |

|

$ |

12,500 |

|

|

$ |

6,000 |

|

Director Compensation Paid for 2023

The following table summarizes all compensation paid or awarded to non-employee directors who served during 2023 as compensation for board service during the 2023 fiscal year. Messrs. Duty, King and Sellig were appointed to our Board of Directors in March 2023 and Donald Joseph, Martin Mattingly and Jay Moyes did not stand for re-election at the 2023 annual meeting of stockholders.

|

|

Fees Earned or |

|

|

Option Awards |

|

|

Total |

|

|||

Name |

|

($) |

|

|

($)(1)(2) |

|

|

($) |

|

|||

Stuart Duty |

|

|

40,778 |

|

|

|

229,820 |

|

|

|

270,598 |

|

Vaughn Himes |

|

|

55,319 |

|

|

|

140,496 |

|

|

|

195,815 |

|

Donald Joseph(3) |

|

|

34,889 |

|

|

— |

|

|

|

34,889 |

|

|

Thomas B. King |

|

|

51,531 |

|

|

|

229,820 |

|

|

|

281,351 |

|

Bridget Martell |

|

|

58,255 |

|

|

|

140,496 |

|

|

|

198,751 |

|

Martin Mattingly(3) |

|

|

26,602 |

|

|

— |

|

|

|

26,602 |

|

|

Jay Moyes(3) |

|

|

25,512 |

|

|

— |

|

|

|

25,512 |

|

|

Thomas Sellig |

|

|

39,929 |

|

|

|

229,820 |

|

|

|

269,749 |

|

The Board of Directors unanimously recommends that stockholders vote “FOR all” nominees FOR THE BOARD OF DIRECTORS.

17

REPORT OF THE AUDIT COMMITTEE

In connection with the consolidated financial statements for the fiscal year ended December 31, 2023, the Audit Committee has:

Based on the Audit Committee’s review of the audited consolidated financial statements and its discussions with management and PwC, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements for the 2023 fiscal year be included in our Annual Report on Form 10-K filed with the SEC.

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

Stuart Duty, Chairperson

Thomas B. King

Bridget Martell

Thomas Sellig

The information contained in the report above shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, except to the extent specifically incorporated by reference in such filing.

18

PROPOSAL TWO:

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed PricewaterhouseCoopers LLP, or PwC, as our independent registered public accounting firm for the fiscal year ending December 31, 2024. PwC audited our financial statements for the fiscal years ended December 31, 2023 and 2022. A representative of PwC will be present at the Annual Meeting, will be given the opportunity to make a statement, if he or she desires, and will be available to respond to appropriate questions.

Proxies solicited by management for which no specific direction is included will be voted “FOR” the ratification of the appointment of PwC as our independent registered public accounting firm for the fiscal year ending December 31, 2024.

Fees Billed by Independent Registered Public Accounting Firm

The following is a summary of the fees billed by PwC for the fiscal years ended December 31, 2023 and December 31, 2022: Amounts are presented in USD.

Fee Category |

|

Fiscal |

|

|

|

Fiscal |

|

|

||

Audit Fees |

|

$ |

194,435 |

|

(2) |

|

$ |

176,784 |

|

(2) |

Audit-Related Fees |

|

$ |

81,655 |

|

|

|

$ |

60,846 |

|

|

Tax Fees |

|

|

— |

|

|

|

|

— |

|

|

All Other Fees |

|

|

— |

|

|

|

|

— |

|

|

Total Fees |

|

$ |

276,090 |

|

|

|

$ |

237,630 |

|

|

Audit Fees. Consists of fees billed for professional services rendered for the audit of our consolidated financial statements and review of the interim consolidated financial statements included in quarterly reports on Form 10-Q that are filed with the SEC.

Audit-Related Fees. Consists of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements, including accounting consultations and fees related to registration of securities.

Policy on Audit Committee Pre-Approval of Audit Services and Permissible Non-Audit Services

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services performed by our independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. For audit services, our independent registered public accounting firm typically provides audit service detail in advance of the second quarter meeting of the Audit Committee, which outlines the scope of the audit and related audit fees. If agreed to by the Audit Committee, an engagement letter is formally accepted by the Audit Committee.

For non-audit services, our senior management will submit from time to time to the Audit Committee for approval non-audit services that it recommends the Audit Committee engage our independent registered public accounting firm to provide for the fiscal year. Our senior management and our independent registered public accounting firm will each confirm to the Audit Committee that each non-audit service is permissible under all applicable legal requirements. A budget, estimating non-audit service spending for the fiscal year, will be provided to the Audit Committee along with the request. The Audit Committee must approve both permissible non-audit services and the budget for such services. The Audit Committee will be informed routinely as to the non-audit services actually provided by our independent registered public accounting firm pursuant to this pre-approval process.

19

For the 2022 and 2023 fiscal years, the Audit Committee approved all of the services provided by PwC described above.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS OUR independent registered public accounting firm FOR THE YEAR ENDING DECEMBER 31, 2024. |

20

EXECUTIVE OFFICERS

The following table provides information regarding our current executive officers as of April 10, 2024.

Name |

|

Age |

|

Position With the Company |

John Bencich |

|

47 |

|

Chief Executive Officer |

Richard Stewart |

|

65 |

|

Executive Chairman |

Cindy Jacobs |

|

66 |

|

President and Chief Medical Officer |

Jerry Wan |

|

42 |

|

Principal Accounting Officer |

Following is the biography of Jerry Wan. The biographies of Mr. Bencich, Mr. Stewart and Dr. Jacobs are located above under the heading “Board of Directors—General.”

Jerry Wan has served as our Principal Accounting Officer since September 2020 and served as our Senior Director, Accounting Operations since June 2018. He previously served as our Director, Accounting Operations from August 2017 to June 2018 and as the Director, Accounting Operations of OncoGenex Pharmaceuticals, Inc. from July 2014 to August 2017. From July 2012 to July 2014, Mr. Wan served as OncoGenex’s Senior Manager, Finance and Accounting and, from October 2011 to July 2012, as its Manager, Financial Reporting and Analysis. Prior to joining OncoGenex, Mr. Wan served as Manager, Management Reporting at Gateway Casinos and Entertainment Limited from 2010 to 2011. From 2006 to 2010, Mr. Wan was an employee of PricewaterhouseCoopers LLP, an international professional services firm, where he last served as Manager, Audit and Assurance Group. Mr. Wan received his Bachelor of Commerce in Accounting from The University of British Columbia and a Chartered Accountant Designation from the Canadian Institute of Chartered Accountants.

21

EXECUTIVE COMPENSATION

During fiscal year 2023, our named executive officers and their respective positions were as follows: John Bencich, Chief Executive Officer; Richard Stewart, Executive Chairman; and Cindy Jacobs, Ph.D., M.D., President and Chief Medical Officer.

Mr. Bencich, Dr. Jacobs and Mr. Stewart are referred to as our named executive officers for purposes of this Proxy Statement.

Summary Compensation Table

The following table sets forth information regarding the compensation of our Named Executive Officers for each of the fiscal years ended December 31, 2023 and 2022. The components of the compensation reported in the Summary Compensation Table are described below.

Name and |

|

Year |

|

Salary |

|

|

Stock Awards |

|

|

Option Awards |

|

|

Non-Equity |

|

|

Total |

|

|||||

John Bencich, |

|

2023 |

|

|

530,000 |

|

|

|

490,000 |

|

|

|

426,207 |

|

|

|

251,750 |

|

|

|

1,697,957 |

|

Chief Executive Officer |

|

2022 |

|

|

510,000 |

|

|

|

413,000 |

|

|

|

358,670 |

|

|

|

223,125 |

|

|

|

1,504,795 |

|

Richard Stewart, |

|

2023 |

|

|

450,000 |

|

(4) |

|

367,500 |

|

|

|

319,655 |

|

|

|

213,750 |

|

|

|

1,350,905 |

|

Executive Chairman |

|

2022 |

|

|

400,000 |

|

|

|

371,700 |

|

|

|

322,803 |

|

|

|

175,000 |

|

|

|

1,269,503 |

|

Cindy Jacobs, |

|

2023 |

|

|

473,000 |

|

|

|

294,000 |

|

|

|

255,724 |

|

|

|

179,740 |

|

|

|

1,202,464 |

|

President and Chief Medical Officer |

|

2022 |

|

|

455,000 |

|

|

|

268,450 |

|

|

|

233,135 |

|

|

|

159,250 |

|

|

|

1,115,835 |

|

Annual Base Salary

Base salaries for executive officers are reviewed annually in connection with our annual performance review process, and adjusted from time to time to realign salaries with market levels after taking into account individual responsibilities, performance, experience and other factors. Our Compensation Committee reviews competitive market data prepared by Aon. Base salaries are targeted to the 50th percentile range of comparable peer companies in aggregate. Salary increases are recommended to, and approved at the discretion of, the Board of Directors.

2023 Equity Awards

Equity awards are granted to executive officers at the discretion of the Compensation Committee. Our Compensation Committee reviews competitive market data prepared by Aon in connection with its grant of long-term equity incentive awards to the named executive officers at the market 50th to 75th percentile which is a higher target than our cash compensation to provide economic value as we are a clinical development-stage specialty pharmaceutical company and have not generated revenue. A blended approach of options and Performance-Based Restricted Stock Unit, or PSUs, were awarded to attract and retain highly skilled employees and provide long term incentive and performance-based goals which we believe are aligned with providing stockholder value.

In January 2023, the Compensation Committee granted options to purchase 100,000 shares of common stock to John Bencich, options to purchase 75,000 shares of common stock to Richard Stewart, and options to purchase 60,000 shares of common stock to Cindy Jacobs. The stock options have an exercise price of $4.90 per share, which was the closing price of our stock on the date of grant, and vested as to one-third of the total on January 25, 2024, and thereafter vest in equal monthly installments over 24 months. At the same time, the Compensation Committee also granted 100,000 performance-based restricted stock units, or PSUs, to John

22

Bencich, 75,000 PSUs to Richard Stewart and 60,000 PSUs to Cindy Jacobs. The PSUs vest as to 50% of the total amount on the achievement of the filing of a New Drug Application, or NDA, for cytisinicline with the U.S. Food and Drug Administration, or FDA, by a certain time, and 50% upon FDA acceptance of the NDA within 60 days of submission; or 100% upon either marketing approval of cytisinicline by the FDA or acquisition of the Company occurring by a certain time. The Compensation Committee selected these goals for the PSUs because the NDA submission is our next pivotal stage for the advancement of cytisinicline, and to reflect our commitment to move cytisinicline to market.

2023 Bonuses

Annual bonuses for our executive officers are based on the achievement of corporate performance objectives, which in 2023 included the achievement of clinical development goals, financial milestones and stretch goals to accelerate the cytisincline development program. In January 2024, our Compensation Committee determined that approximately 95% of our 2023 corporate performance objectives were achieved and determined that 95% of each executive officer’s target bonus should be awarded based on the advancement of our cytisinicline program through the positive topline data of Phase 3 ORCA-3 and ORCA-V1 clinical trials, the completion of three NDA-supportive clinical studies evaluating QT interval prolongation, steady-state pharmacokinetics in smokers, and pharmacokinetics parameters in subjects with renal impairment, and furthering CMC objectives.

With respect to the payment of these bonuses, John Bencich’s target bonus was equal to 50% of his annual base salary of $530,000 and he was awarded $251,750, Richard Stewart’s target bonus was equal to 50% of his annual base salary of $450,000 (increased from $400,000, effective July 1, 2023) and he was awarded $213,750, and Cindy Jacobs’ target bonus was equal to 40% of her annual base salary of $473,000 and she was awarded $179,740.

23

Outstanding Equity Awards at Fiscal Year-End

The following table provides information regarding the outstanding equity awards held by the Named Executive Officers as of December 31, 2023.

|

|

OPTION AWARDS |

|

|

STOCK AWARDS |

|

||||||||||||||||||||||||||

Name |

|

Number of |

|

|

Number of |

|

|

Option |

|

|

Option |

|

|

Number of |

|

|

Market Value |

|

|

Number of |

|

|

Market Value |

|

||||||||

John Bencich, |

|

|

18 |

|

|

|

— |

|

|

|

6,974.00 |

|

|

08/12/24 |

|

(1) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Chief Executive |

|

|

11 |

|

|

|

— |

|

|

|

4,092.00 |

|

|

05/19/25 |

|

(2) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Officer |

|

|

1,370 |

|

|

|

— |

|

|

|

578.00 |

|

|

08/01/27 |

|

(3) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

1,250 |

|

|

|

— |

|

|

|

67.40 |

|

|

07/26/28 |

|

(4) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

2,500 |

|

|

|

— |

|

|

|

51.20 |

|

|

09/20/28 |

|

(5) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

1,500 |

|

|

|

— |

|

|

|

28.40 |

|

|

01/29/29 |

|

(6) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

500 |

|

|

|

— |

|

|

|

28.40 |

|

|

01/29/29 |

|

(7) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

9,792 |

|

|

|

208 |

|

|

|

11.20 |

|

|

01/28/30 |

|

(8) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

20,000 |

|

|

|

— |

|

|

|

10.36 |

|

|

11/16/30 |

|

(9) |

|